Posts

Posts Likes Received

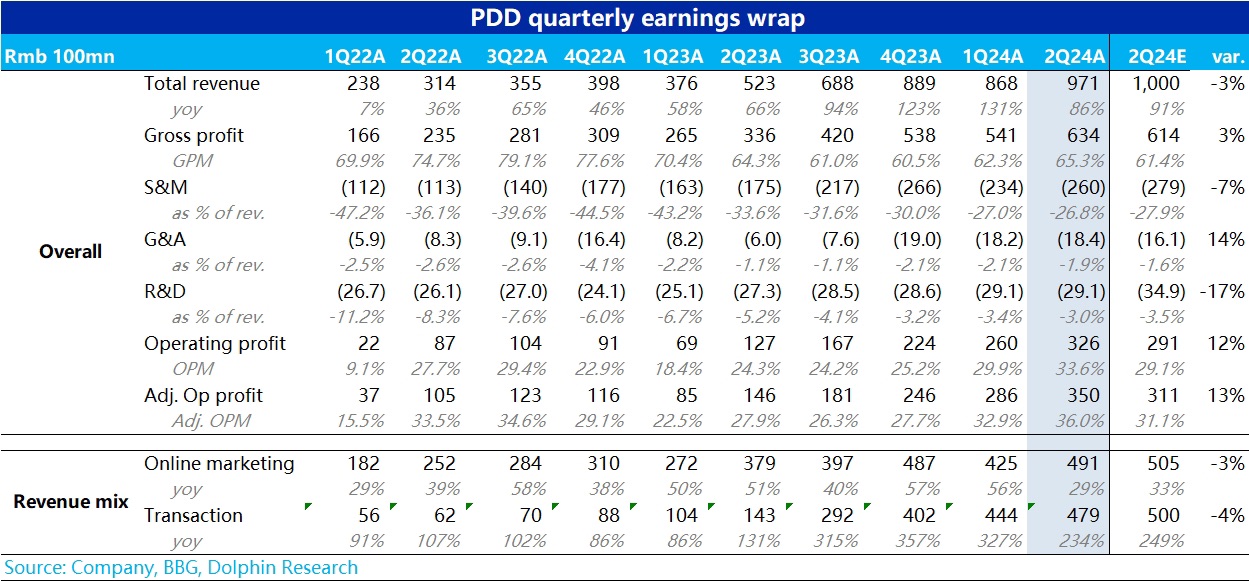

Likes ReceivedDamn, $PDD(PDD.US) is screwed! Chinese stocks are collectively collapsing! How can 86% revenue growth and 156% operating profit growth still be called a miss? Actually, looking at the big numbers is useless. The key for Pinduoduo lies in the core support for its valuation—the growth rate of domestic advertising revenue, which plummeted from 56% last quarter to 29% this quarter, likely falling short of buyers' minimum expectation of 30%+.

Additionally, transaction-based commission income wasn’t as optimistic as the market expected.

What exceeded expectations this time was operating profit, mainly because the slowdown in marketing expenses was significant, with the corresponding expense ratio at just 26.8%, lower than the market’s expected 28%.

But with revenue slowing down too quickly, the better-than-expected profits seem insignificant. After all, the market’s biggest concerns right now are:

a. With online consumption so weak in Q2, how much alpha does Pinduoduo really have left?

b. With the entire industry targeting Pinduoduo’s low-price strategy in 2024, how long can Pinduoduo stay ahead?

c. With GMV growth slowing down, how much room is left for Pinduoduo to aggressively monetize?

These three questions are like ticking time bombs, and the market fears they could explode at any moment. Q2’s performance feels like the other shoe finally dropping.

Given Pinduoduo’s usual volatility, the market’s reaction to such performance could easily lead to a 10-20% drop.

After the panic, Pinduoduo’s valuation logic may need a complete rethink: growth or value? How much potential is left in overseas business, and what’s the profitability like? Will there be buybacks, and how much? Once these questions are clarified, Pinduoduo’s valuation floor will become clear.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.