Posts

Posts Likes Received

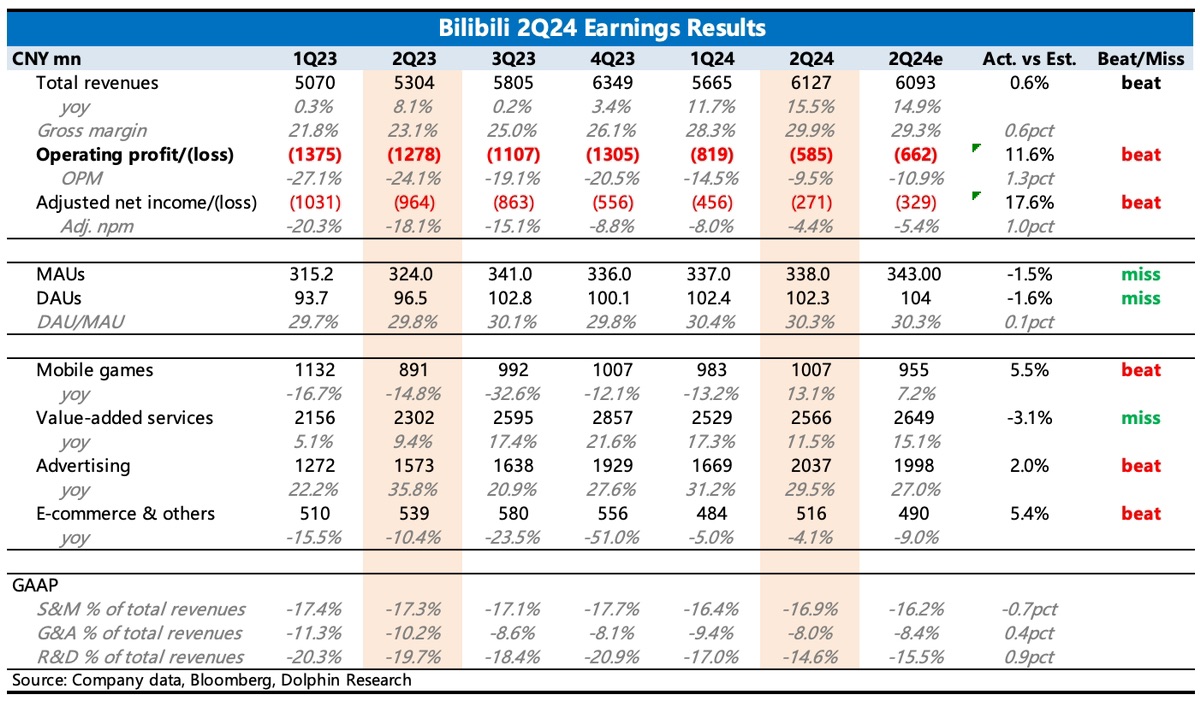

Likes Received$Bilibili(BILI.US)first take:The Q2 earnings slightly exceeded expectations, with only the value-added service revenue slightly below expectations. However, the most surprising aspect was the profitability. On one hand, the increased proportion of gaming and advertising revenue boosted the overall gross margin. On the other hand, the company continued to lay off employees, especially after strategically abandoning in-house R&D, leading to a reduction in R&D personnel salaries. Ultimately, the non-GAAP net profit margin narrowed to a loss of 4.4%. With the release of "Three Kingdoms Tactics" and the high investment in summer game advertising, Bilibili's turnaround to profitability in Q3 is almost certain.

Although the short-term performance is good, the current valuation is not low compared to other Chinese concept stocks. It is necessary to look at the medium-to-long-term revenue growth trend and the potential for margin improvement. After all, Q2 and Q3 benefited from the dual buffs of exclusive game distribution and game advertising. Under macroeconomic pressure, the sustainability of growth entering Q4 is uncertain. At the same time, influenced by Xiaohongshu and Douyin, Bilibili's user growth continues to slow, which may also weaken medium-to-long-term revenue growth. This point can be further observed in the management's guidance and strategic goals during the earnings call.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.