Posts

Posts Likes Received

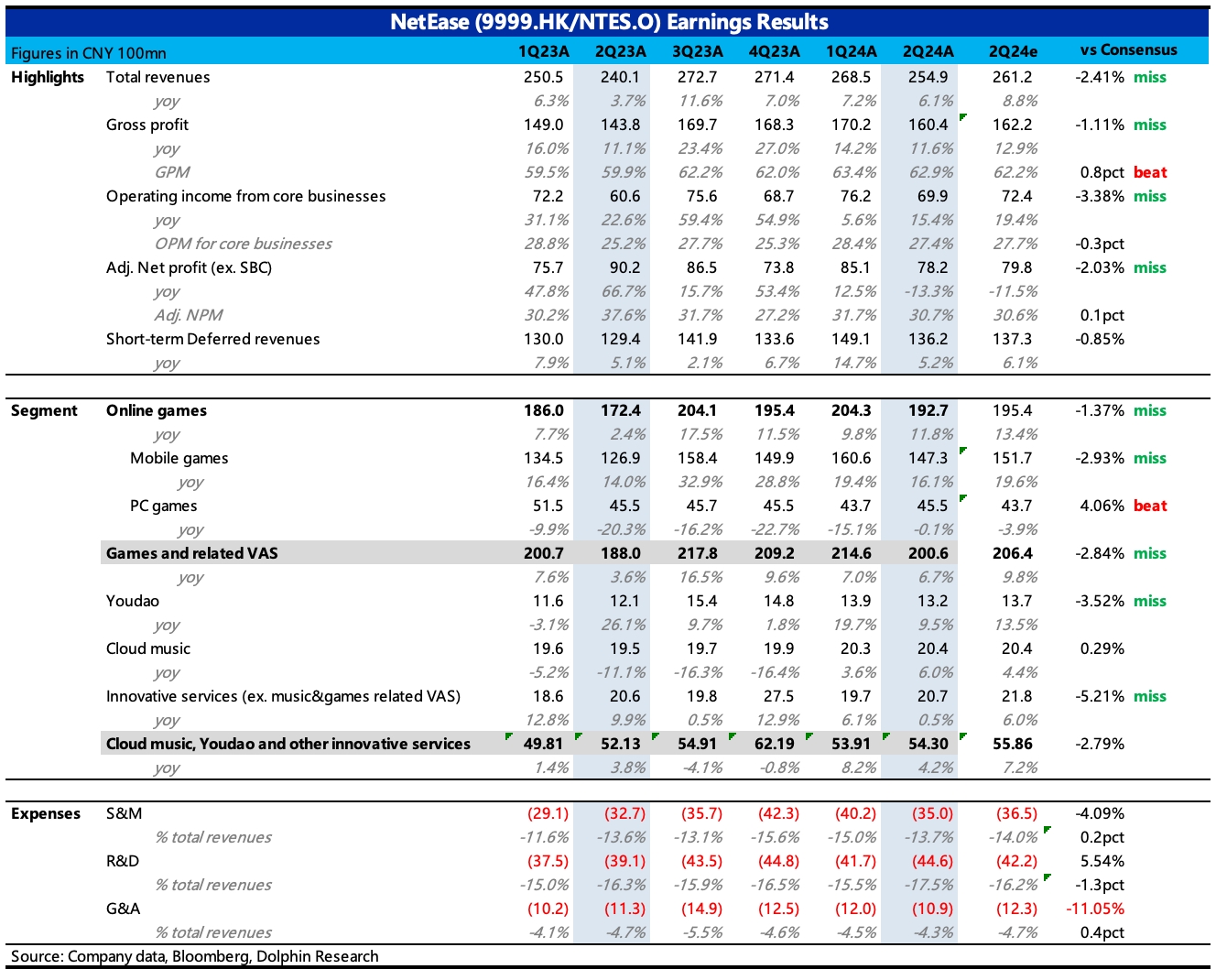

Likes Received$NTES-S(09999.HK) first take:The second quarter delivered another unsatisfactory performance, with both revenue and profits missing expectations to varying degrees.

Although game revenue is generally disclosed by third-party platforms, the gaming industry performed poorly in the second quarter. NetEase's flagship games, "Eggy Party" and "Justice Online," saw a decline in popularity, and the "Fantasy Westward Journey" incident had a short-term impact on user activity. As a result, the market had already adjusted its expectations downward, but some institutions may not have adjusted enough, with the main discrepancy in expectations lying in mobile games.

However, based on the latest game revenue trends, "Justice Online" showed signs of recovery in July. Although "Naraka: Bladepoint" did not exceed expectations after its launch, it still performed relatively well within the industry. During the earnings call, attention should be paid to management's description of the current state of core games and their guidance for Q3. While "Naraka: Bladepoint" will contribute incremental revenue in Q3, the high base from last year's unexpectedly strong performance of "Justice Online" means growth pressure remains significant.

Meanwhile, regarding additional insights from the earnings report, Dolphin Research noted that NetEase appears to be expanding its R&D team against the trend. The SBC (share-based compensation) expenses for R&D increased by 52% YoY in Q2, offsetting the slight outperformance in gross margin and keeping the operating profit margin in line with expectations. Management's explanation for this—possibly related to the return of "World of Warcraft"—should be closely watched.

Another noteworthy point is that NetEase's Non-GAAP net profit fell by 13% YoY, which looks alarming. However, this includes the impact of foreign exchange losses and declines in investment income. Dolphin Research typically focuses on core operating profit under GAAP, which grew by 15% YoY in Q2, a relatively normal performance.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.