Posts

Posts Likes Received

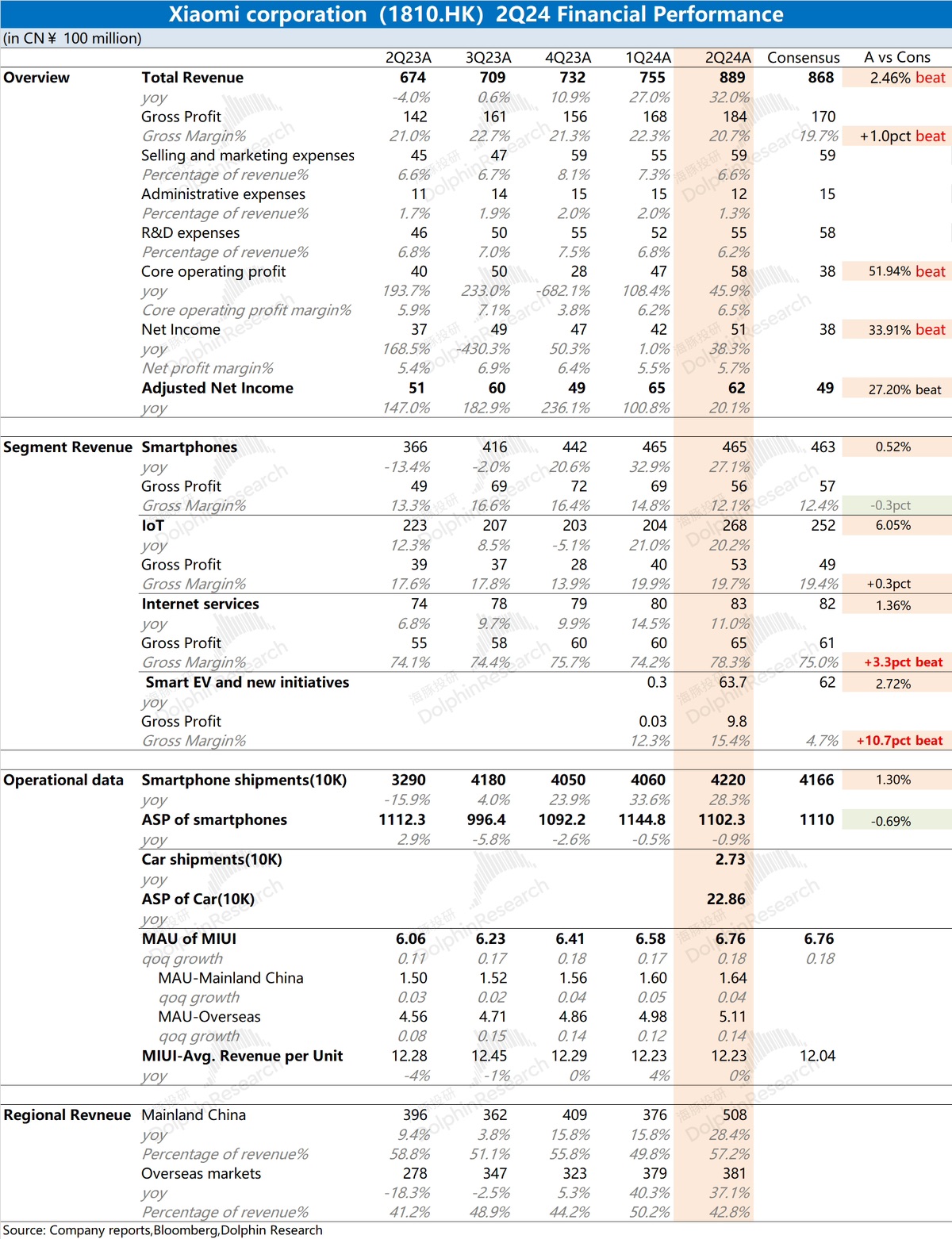

Likes Received$XIAOMI-W(01810.HK)first take:The company's revenue and profit performance this quarter were both good. Starting this quarter, the company officially disclosed data for its automotive business, divided into two parts: smartphone x AIoT and automotive business. The company's revenue slightly exceeded market expectations, mainly driven by continued growth in the IoT business.

Xiaomi's profit performance this quarter was significantly better than expected, primarily due to the impressive gross margins of its internet services and automotive businesses. The gross margin of the company's internet services continued to rise to 78.3%, boosting overall profitability. Meanwhile, the gross margin of the automotive business reached 15.4%, far exceeding the market expectation of 5%.

Overall, Xiaomi's performance is steadily improving, and the automotive business, which was a market concern, did not become a drag on the company. With further improvements in production capacity, the profitability of the company's businesses is expected to continue to improve.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.