Posts

Posts Likes Received

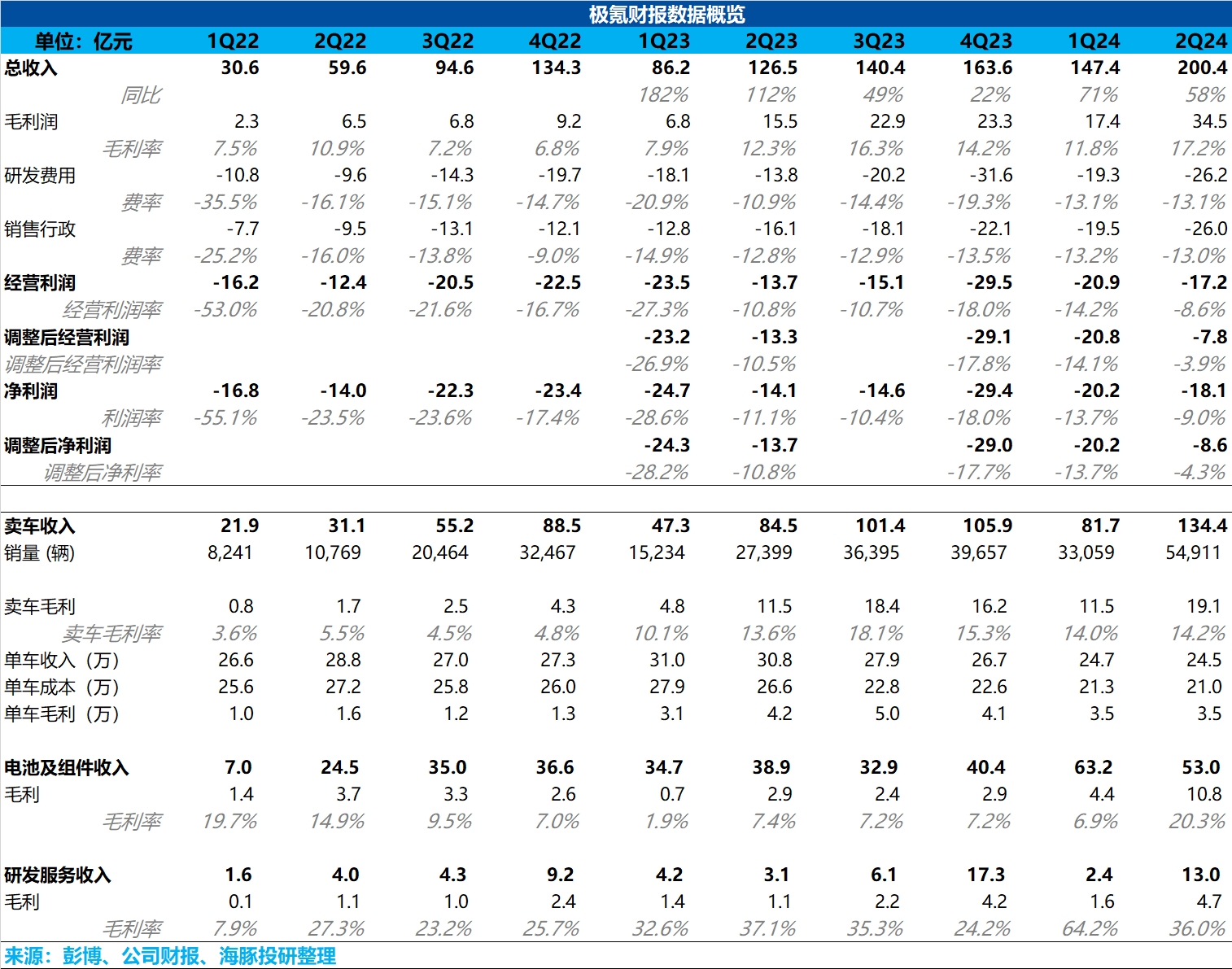

Likes Received$ZEEKR Intelligent Tech(ZK.US) first take:From the Q2 performance, what we at Dolphin Research are most concerned about is ZEEKR's core car manufacturing business. In terms of gross margin performance, the car manufacturing business basically met market expectations.

In Q2, the proportion of the highest-priced ZEEKR 009 model in the product mix declined, dropping from 4.3% in Q1 to 2.7% in Q2, dragging down the average selling price. However, the proportion of ZEEKR 001 (priced at 269,000-329,000 yuan) increased from 46.7% in Q1 to 71.3% in Q2, partially offsetting the impact of the decline in ZEEKR 009's share. As a result, the average selling price this quarter dropped by 2,000 yuan to 245,000 yuan.

The gross margin for car sales this quarter increased slightly by 0.2% quarter-over-quarter, mainly due to a reduction in per-unit costs, driven by a 66% quarter-over-quarter rebound in sales volume, which lowered per-unit depreciation costs and released some scale effects. From the expense side, although operating expenses this quarter increased significantly compared to the previous quarter (up by 1.35 billion yuan quarter-over-quarter), this was mainly due to the recognition of 944 million yuan in SBC expenses related to the IPO, compared to only 3 million yuan in the previous quarter. Actual operating expenses increased by about 410 million yuan quarter-over-quarter, which is still manageable, mainly due to growth in R&D headcount and overseas expansion of sales channels.

After adjusting for the impact of SBC, the loss narrowed significantly this quarter, primarily due to the quarter-over-quarter improvement in ZEEKR's gross margin. The main reason for this improvement was the increase in gross margin for ZEEKR's battery and components business (from 6.9% last quarter to 20.3% this quarter), possibly due to a higher proportion of battery pack sales overseas. However, since this business is mainly related-party transactions and the sustainability of the gross margin is uncertain, the long-term revenue still depends on whether Geely's new energy vehicles can succeed and whether ZEEKR's sales can break through. Ultimately, the value must be realized through the automotive business. Currently, Dolphin Research's focus on ZEEKR remains on its automotive operations, so this quarter's performance can only be considered as basically meeting expectations.

However, considering the current stock price, Dolphin Research conservatively estimates ZEEKR's 2024 sales at 180,000-200,000 units (taking into account the impact of European tariffs on exports, with no excessive expectations for overseas sales). The corresponding 2024 P/S multiple is only 0.6-0.7x, indicating that the valuation remains very low. The narrowing loss this quarter (mainly driven by the battery and components business, with uncertain sustainability) and the increase in cash and cash equivalents (mainly due to IPO proceeds) are indeed positive, but the long-term upside for the stock price still depends on expectations for the core automotive business.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.