$Microsoft(MSFT.US) $Meta Platforms(META.US) $Amazon(AMZN.US) $Alphabet(GOOGL.US) $NVIDIA(NVDA.US)

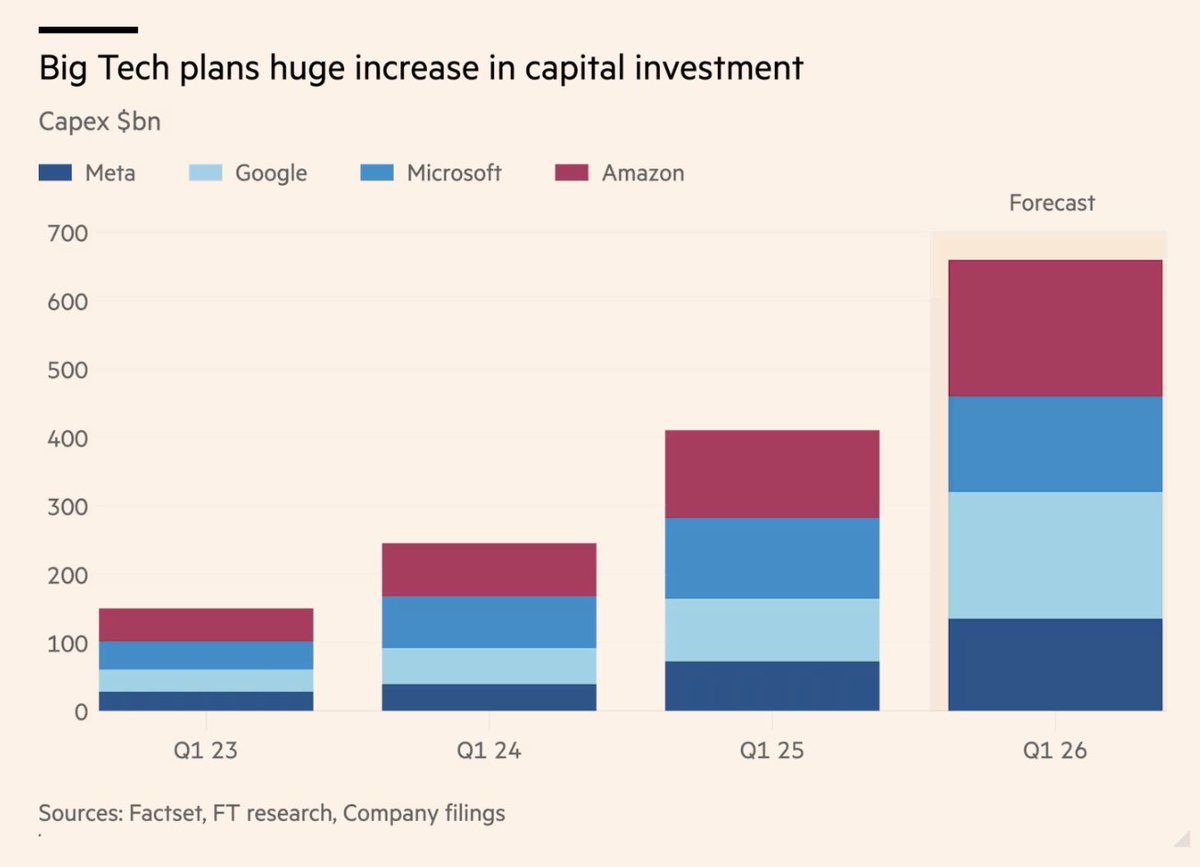

The story is CapEx. That's it. That's all that matters.Now that big tech earnings are done, it's quite obvious that the AI buildout will continue throughout 2026. Around $650B will be spent from Microsoft, Meta, Amazon, and Google this year. The same reason all of those stocks are down is the same reason to be excited around GDP growth: capex will fuel GDP but it will also result in decreased or even negative FCF for many of the big tech companies.The winners? Obviously $NVIDIA(NVDA.US) $AMD(AMD.US) $Broadcom(AVGO.US) $Taiwan Semiconductor(TSM.US) and all the other players in the semiconductor ecosystem as the biggest companies in the world continue to spend on the most important tech buildout in history.However, the companies spending the money should not be losers here. The fact that the street took $Amazon(AMZN.US) down on $200B of capex is laughable. Yes, in the short term it will affect their numbers, but Jassy is guiding for 24% AWS growth, a reacceleration! The capex is obviously justified given the opportunity to capitalize on the greatest era for cloud compute we have ever seen and the most important era given how much compute is needed for the foundation models to continue expanding and being implemented across thousands of companies. $Meta Platforms(META.US) roundtripping on earnings is even funnier given their capex is leading to 33% TOPLINE growth. The Mag 7 are on sale and although they are spending heavy, it does not seem like reckless spending which should be bullish for all of these names going into the end of the year.Source: amit

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.