Total Assets

Total Assets Amazon

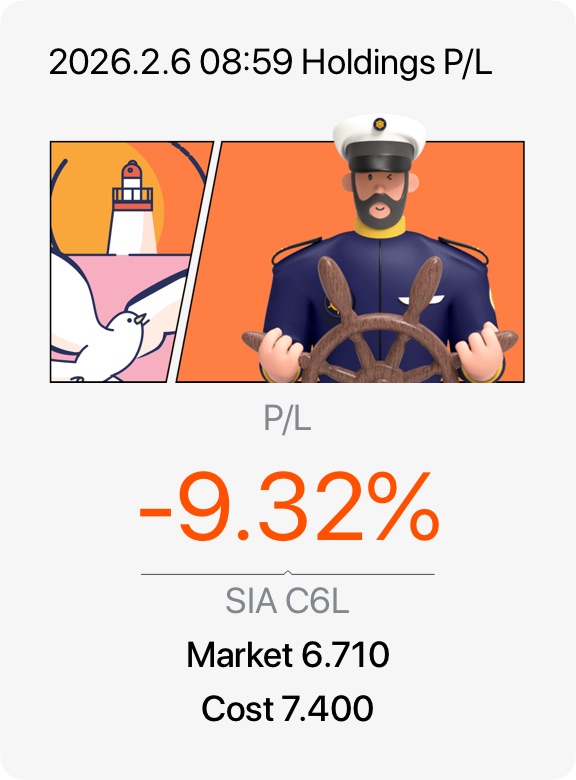

Amazon$SIA(C6L.SG)Im cautiously positive as there is dare strategic expansions that support growth such as new non-stop flights (e.g., Riyadh relaunch) and trials with green jet fuel, hinting at growth.

However, profitability remains under pressure from external factors (costs, competitive yields, and Air India-related losses), adding uncertainty to fundamental valuation and stock performance. This m means investors need to balance SIA’s growth and dividend appeal against industry cyclicality and earnings volatility. So mainly hold? @Bridge Buzz SG

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.