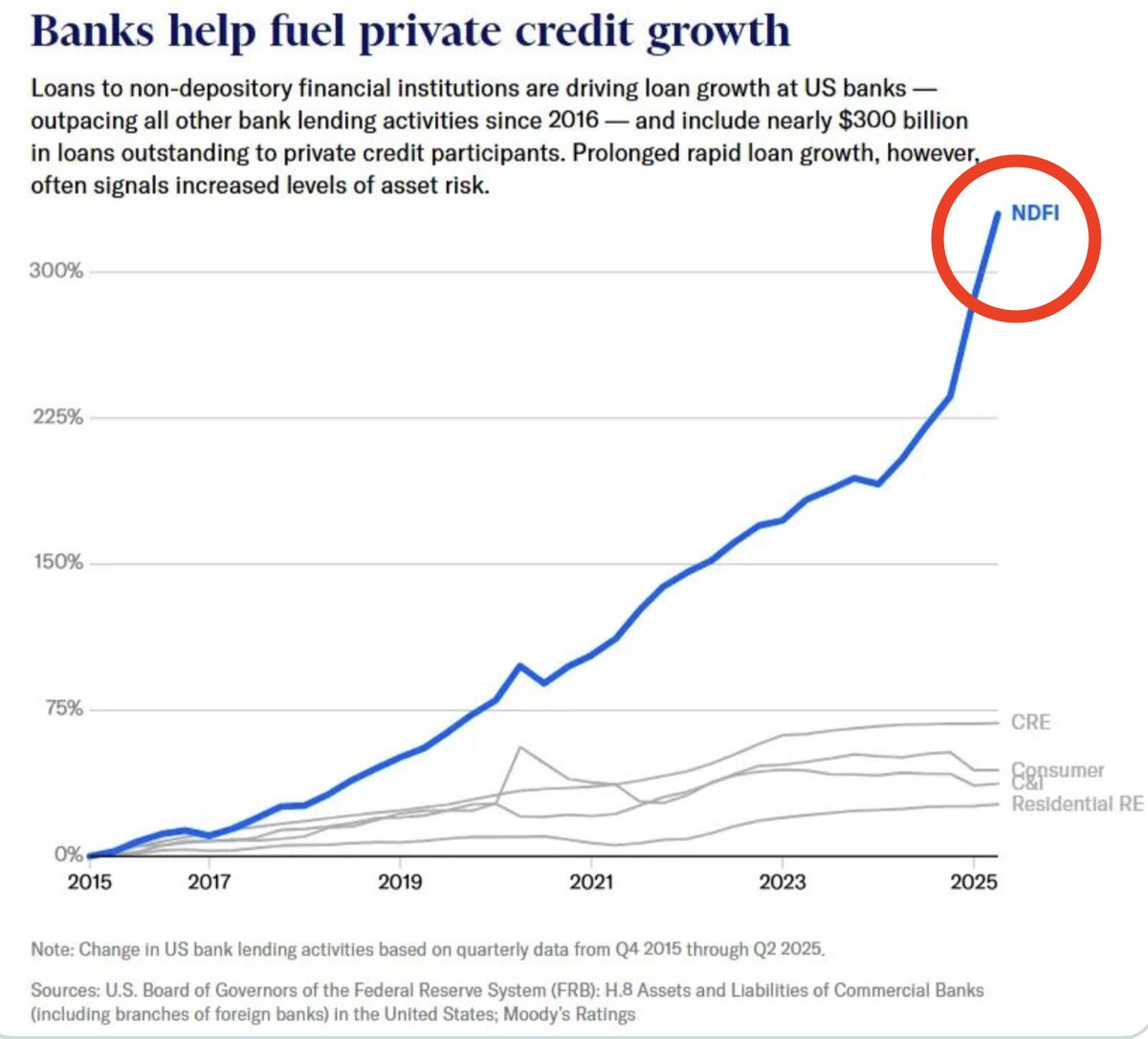

这张图表展示了银行贷款如何悄然重塑信贷世界。自 2015 年以来,对非存款金融机构(NDFIs,主要是私募股权和私人信贷基金)的贷款飙升了近 300%,而其他所有类别的贷款几乎停滞不前。消费贷款、商业地产贷款、住宅贷款全部持平。增长几乎完全集中在一个方向:银行向贷款机构放贷。

2008 年金融危机后,监管机构对传统银行收紧了监管。根据《巴塞尔协议 III》和《多德 - 弗兰克法案》的规定,杠杆贷款和中端市场信贷等贷款类型变得资本密集,银行开始退出这些领域。私人信贷基金填补了这一空白,从 2000 年代初的利基市场发展到 2025 年约 3 万亿美元的规模。

但银行没有反击,而是找到了新角度。他们意识到,通过为私人信贷基金提供融资,比直接向企业放贷更有利可图。这种方式更干净、成本更低,且完全符合监管要求。向一家大型、有抵押的基金放贷,远比管理数百笔高风险小额贷款简单。这些基金还拥有大量股权缓冲,商业发展公司(BDCs)的资本储备约为 36%,因此银行无需持有过多资本就能获得稳定回报。

这种关系对各方都有利。私人信贷基金获得廉价循环信贷额度,可以更激进地放贷。银行从低维护成本的大额贷款中获得稳定利息和费用。由私募股权支持的借款人无需经历银行信贷缓慢且合规繁琐的流程,能更快获得资金。至少现在,皆大欢喜。

问题在于,这种贷款模式让两个世界深度交织。银行以为外包出去的风险并未消失,只是转移了。如果私人信贷借款人开始违约,这些基金将在银行同样承压时动用银行授信额度。这是一个等待错误条件触发的反馈循环。

私人信贷从未经历过重大衰退。整个行业建立在低利率和流动性宽松的时代。如果经济急剧放缓,银行可能发现,他们以为更安全的渠道反而让他们暴露风险。监管机构正努力跟进,收集更多数据并密切监控 NDFI 贷款,但增长速度快于监管。

这张图表真正展示的是危机后银行业的新面貌。银行不再是主角,而是幕后的制片人。这种方式聪明、有利可图且符合监管,但也意味着银行和私人信贷现在属于同一生态系统。一方跌倒,另一方也会跟着倒下。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。