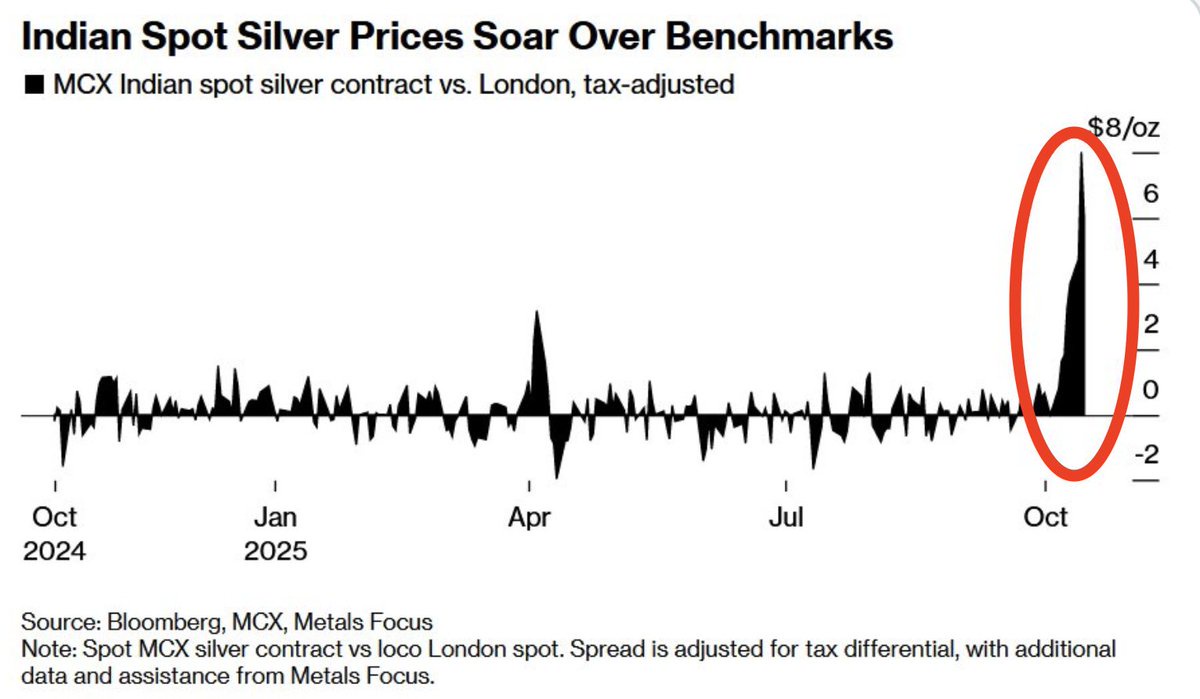

India’s biggest refinery ran out of silver for the first time ever as demand exploded. What started as a festive buying spree during Diwali quickly turned into a full-blown global crisis. With gold prices at record highs, millions of Indian buyers turned to silver as the cheaper alternative only to drain national inventories within days. Dealers across the country said they were literally out of stock, and prices on India’s MCX exchange shot up to $8 above London’s benchmark, the biggest premium in history.

The shock rippled across the world. In London, the hub of global silver trading, liquidity vanished almost overnight. Lease rates, the cost of borrowing physical silver spiked from under 1% to 39%, levels unseen since Warren Buffett’s 1998 squeeze. Traders were so desperate to meet delivery contracts that they began chartering cargo planes to fly silver bars from New York to London.Behind the chaos was a deeper problem: a market running on fumes. Global silver supply has lagged behind demand for five straight years, creating a cumulative deficit of nearly 700 million ounces. Most silver isn’t mined directly but comes as a byproduct of other metals, meaning supply can’t ramp up easily even when prices soar. Meanwhile, demand from the solar industry has exploded, each solar panel needs silver, and installations have jumped into the hundreds of gigawatts per year.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.