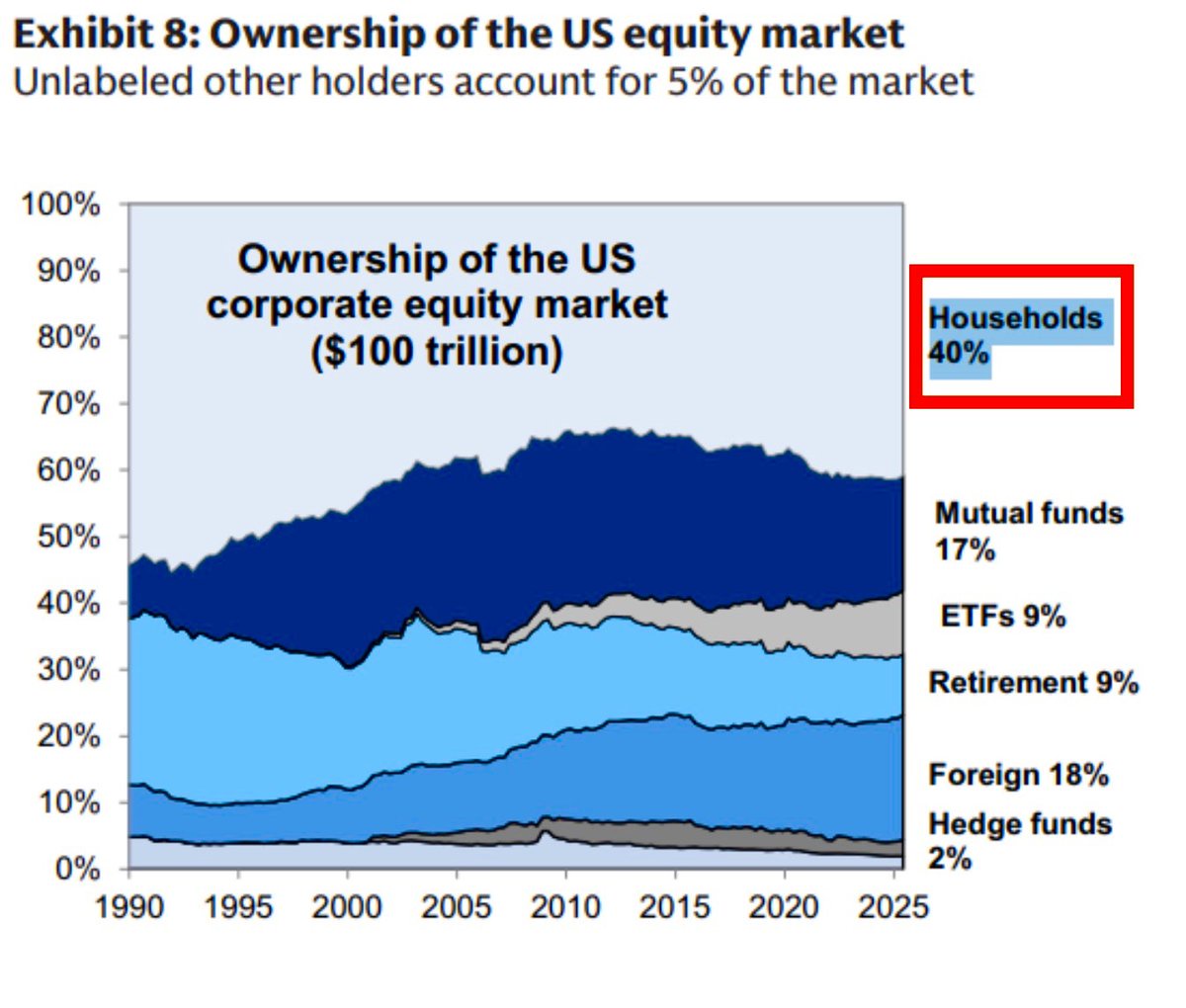

Households now own 40% of the entire U.S. stock market more than mutual funds, pensions, and ETFs combined.

Almost 90% of that sits in the hands of the wealthiest 10%, which means a small group of investors now has more influence over market direction than ever before. When that much buying power is concentrated at the top, selloffs get shallower and dips get bought faster.It’s one of the biggest reasons this melt-up hasn’t cracked yetSource: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.