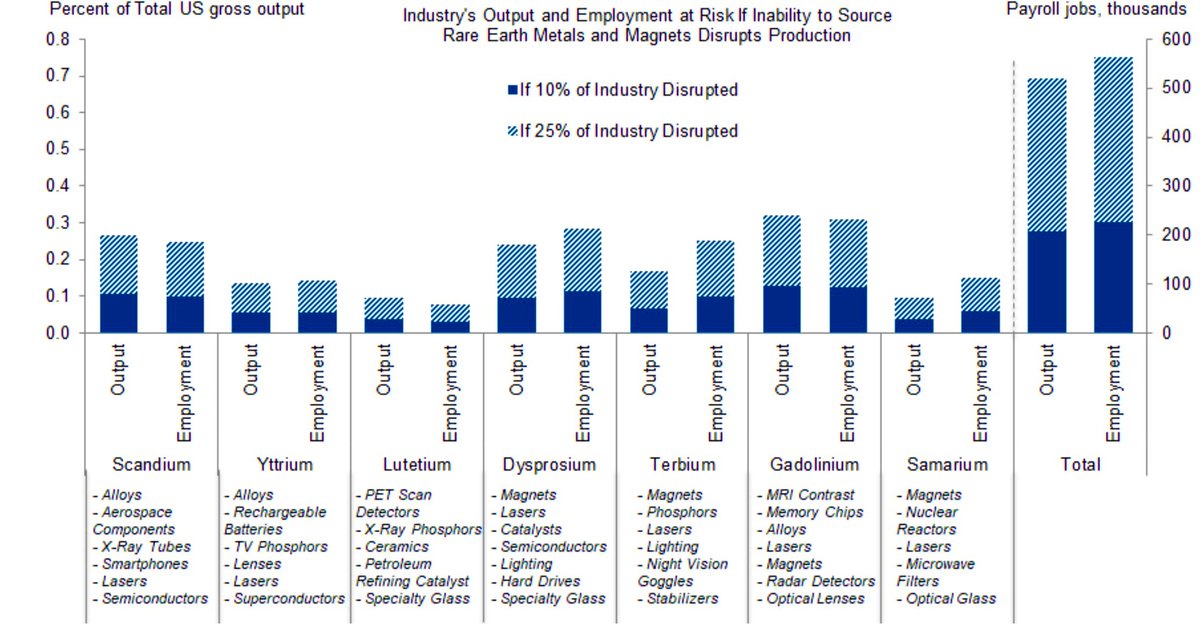

这张图表展示了美国经济对稀土金属的依赖程度以及这种依赖带来的风险。它衡量了如果这些金属供应中断,美国工业和就业可能受到的影响。蓝色实线柱表示 10% 的相关产业受干扰时的后果,条纹柱则显示 25% 产业受影响时的冲击。

每种金属在科技和制造业中都扮演着重要角色。钪用于飞机零件和半导体;钇用于制造可充电电池和激光器;镥用于医疗扫描仪和特种玻璃;镝、铽和钐是电动汽车、风力涡轮机和高科技设备中强力磁铁的关键材料;钆则用于核磁共振机和计算机存储芯片。这些金属支撑着众多现代产业的运转。

图表显示即使少量短缺也会造成严重问题。若供应中断 10%,可能影响美国总产出和某些行业就业的 0.2%;若中断 25%,影响可能达到 0.6%,相当于数十万工作岗位和数百亿美元的生产损失。在清洁能源、半导体和国防等关键领域,这可能造成重大停滞。

问题在于大多数稀土金属仍来自中国。如果贸易紧张加剧或出口受限,美国从电动汽车到先进医疗设备等产业都将面临困境。这就是为什么保障这些供应链已成为重要议题。

结论很简单:虽然多数人不会关注稀土金属,但它们对科技和经济未来至关重要。如果美国不尽快建立更安全、本土化的供应来源,即使小规模中断也可能引发重大经济与国家安全问题。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。