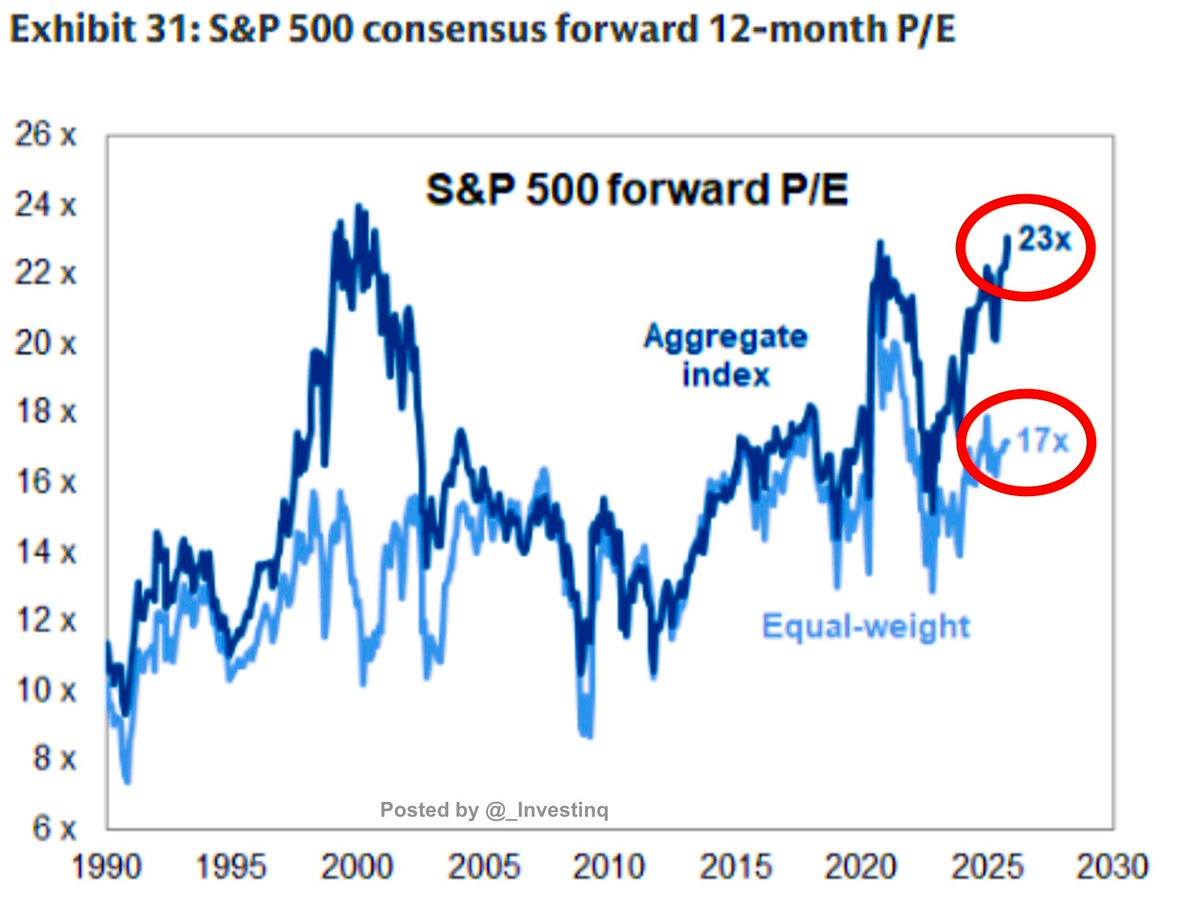

标普 500 综合指数目前的前瞻市盈率为 23 倍。

这意味着如果你今天买入该指数,你为每 1 美元的预期盈利支付 23 美元,这一估值主要由大型科技股推动。与此同时,等权重指数的市盈率仅为 17 倍。在这里,标普 500 中的每只股票权重相同,因此排除了最大公司的主导地位。这一差距显示了市场变得多么集中:大型股推高了综合市盈率,而 “普通股票” 看起来更接近长期历史水平。所以真正的问题是:大型科技股的溢价是否可持续,还是市场需要降温?来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。