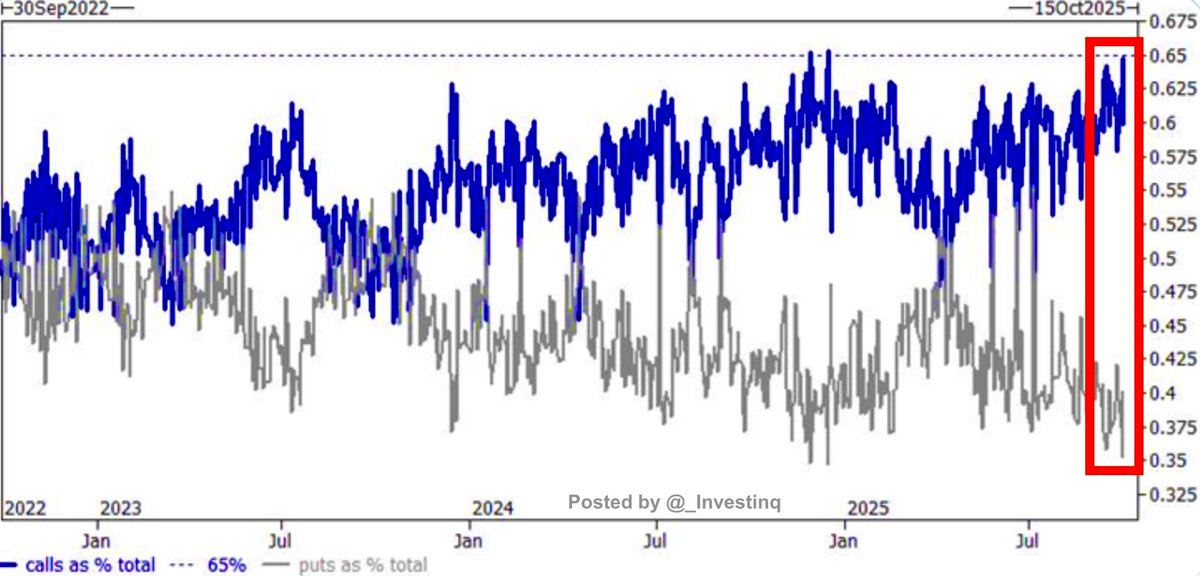

您所看到的图表显示了期权市场变得多么不平衡。周三,看涨期权占所有交易期权的 65%。这几乎是历史最高水平,基本上告诉我们交易员正在押注股票将继续上涨。大多数人不是在规避风险,而是在追逐上涨。

为什么会这样?像这样的大动作通常伴随着兴奋的浪潮。当交易员看到势头,尤其是短期势头时,他们通常不想错过。看涨期权让他们以低成本控制大量股票,因此如果市场继续上涨,回报看起来会非常巨大。换句话说,这是将害怕错过转化为交易策略。

但这也有双刃剑。当看涨期权购买激增时,市场可能会变得脆弱。看涨期权是杠杆合约,因此如果上涨停滞,所有这些押注都可能突然变得糟糕。出售看涨期权的交易商通常通过买卖股票来对冲风险。如果价格开始下滑,他们可能会抛售股票以保持平衡,这可能导致下跌更剧烈、更快。这意味着推动股票上涨的同样能量也可能使反转变得痛苦。

这种行为也反映了心理。当看涨期权如此主导时,这更多是关于投机而非谨慎投资。人群关注的是快速获利,而不是保护。这可能会形成一个循环,上涨会自我维持一段时间,但安全网很薄。如果有任何坏消息或失望情绪出现,平仓可能会非常剧烈,因为几乎没有人持有看跌期权或下行保险。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。