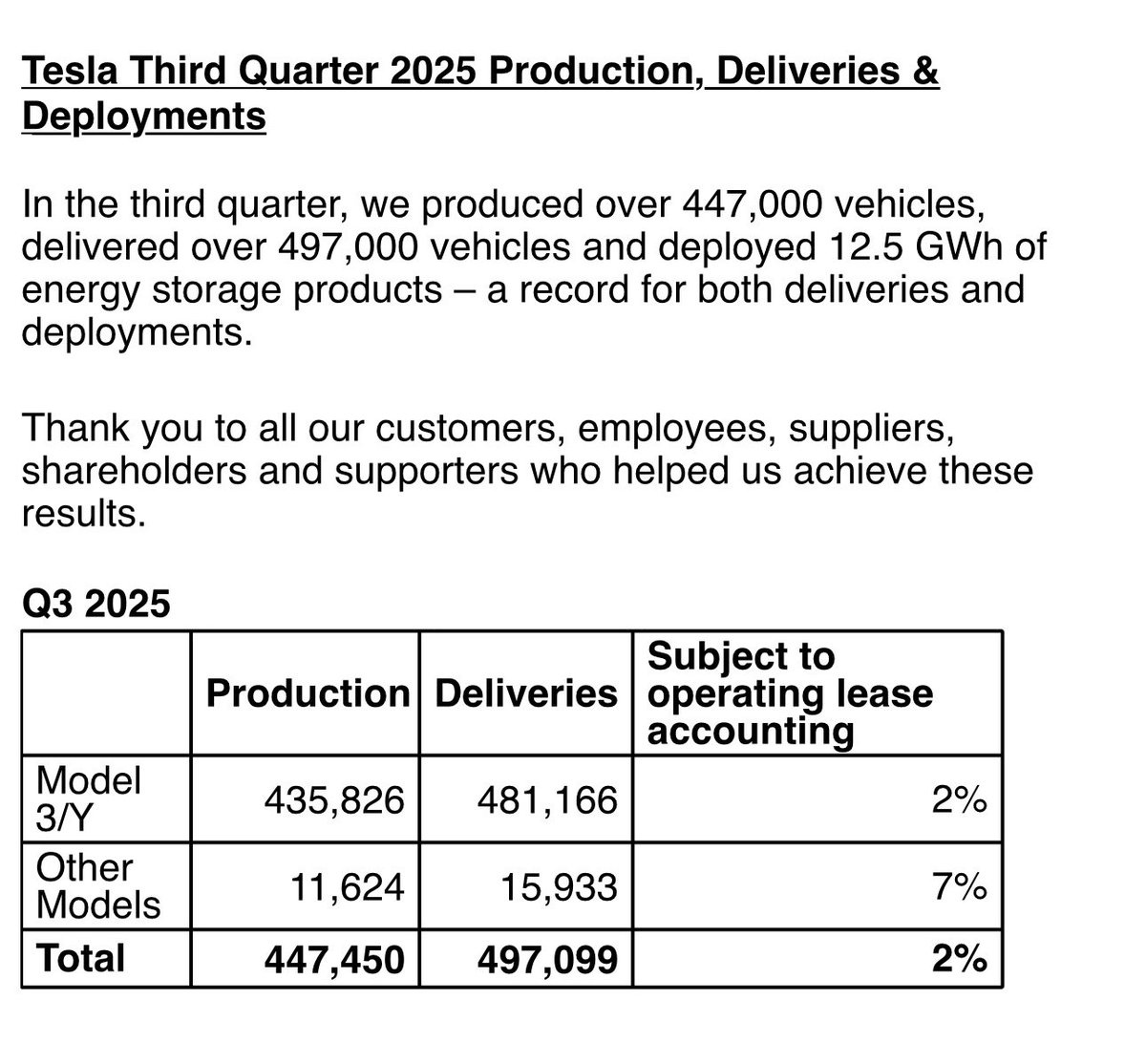

$Tesla(TSLA.US) reported record 3Q deliveries of 497K +7.4% YoY, as customers pulled forward EV purchases in front of the 9/30 expiration of the $7,500 EV credit. This easily beat 3Q WS consensus of 443K and our estimate of 470K.

Through 3Q, year-to-date TSLA deliveries were -6% YoY. We expect 4Q TSLA deliveries to slide -13%, and FY’25 TSLA deliveries to total 1.65M -8% YoY. After the initial likely pop today (+3% pre-mkt), we expect $Tesla(TSLA.US) stock to retreat between now and 3Q earnings on 10/22 as investors conclude the delivery beat was largely pull forward from 4Q deliveries to get in front of the $7,500 EV credit expiration.The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.