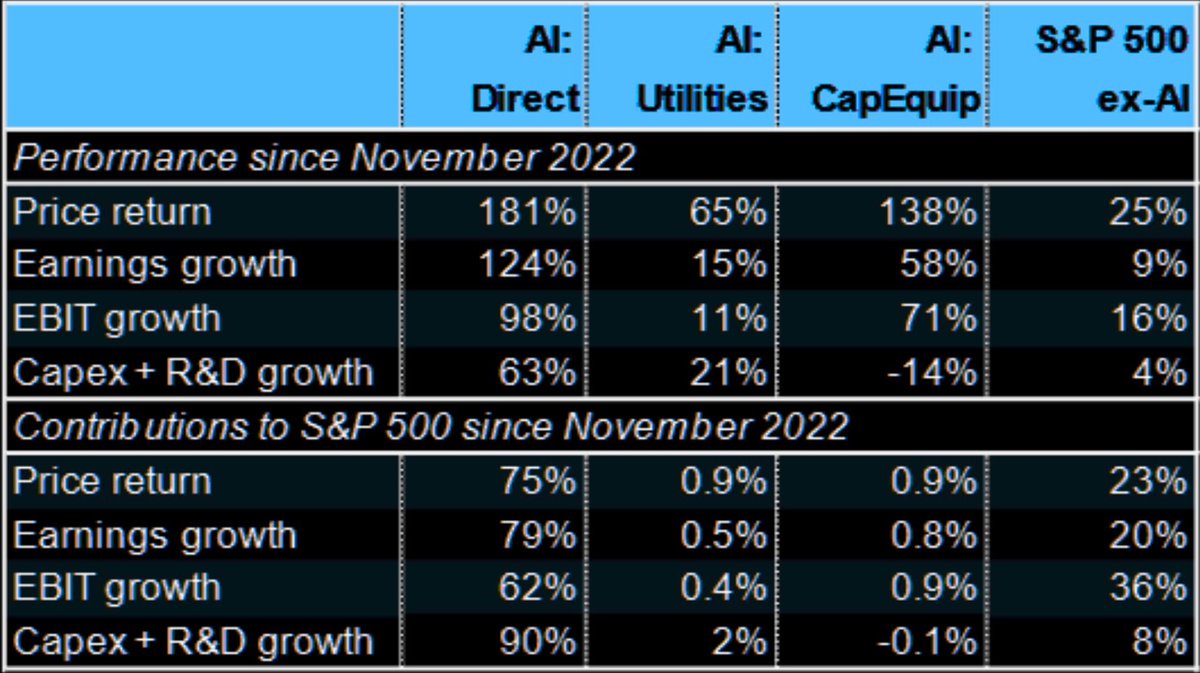

自 2022 年底以来,AI 股票一直是标普 500 指数上涨的主要推动力。与 AI 最直接相关的公司股价惊人地上涨了 181%,再加上 AI 相关的公用事业和设备,它们解释了该指数的大部分涨幅。简而言之,现在这几个板块约占整体回报的 75%,近 80% 的盈利增长,以及几乎所有的投资支出增加。如果没有 AI,市场的其他部分看起来要弱得多,价格仅上涨 25%,盈利增长也很小。

差异巨大。直接涉足 AI 的公司利润翻了一倍多,并大力投资新项目,而许多非 AI 公司几乎没有增长。即使在研发方面,专注于 AI 的公司投入了大量资金,而其他行业则削减了开支。企业显然将 AI 视为未来增长的来源。

对于投资者来说,这改变了游戏规则。分散投资于标普 500 指数不再像过去那样提供保护,因为现在很大程度上取决于少数几家 AI 领军企业。如果它们遇到困难,整个指数都会受到影响。与此同时,芯片制造商和云服务提供商等支持性行业表现良好,但对市场的推动力远不及 AI。

更大的故事是经济本身正在向 AI 转型。公司正在增加支出并围绕 AI 制定战略。供应链、并购甚至初创企业都受到这股浪潮的影响。对于市场的其他部分来说,信息很明确:要么找到融入 AI 的方法,要么面临落后的风险。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。