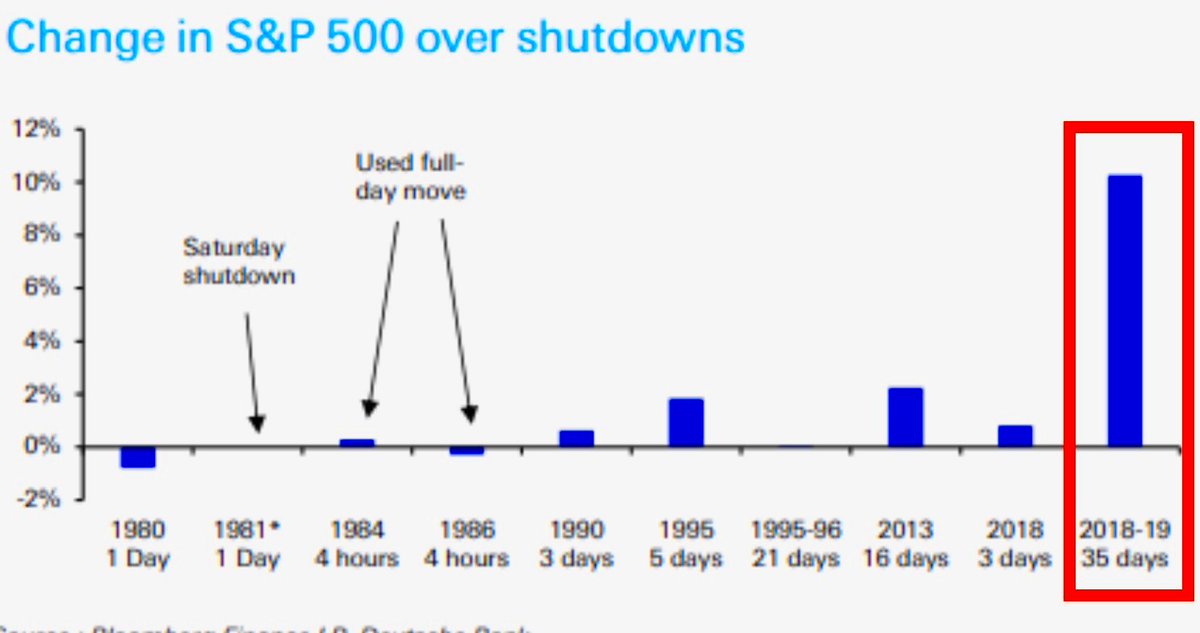

Historically, shutdowns have not been the market killer many fear. The last 6 shutdowns all saw the S&P 500 rise from start to finish. Even the 35-day freeze in 2018–19 saw the index surge nearly 10%.

Yes, Powell’s dovish pivot helped then but the bigger takeaway is clear: markets shrugged off the shutdown and rallied. Why? Because markets hate uncertainty, but they also know every shutdown will eventually be resolved. Stocks are always priced forward, discounting today’s drama in anticipation of tomorrow’s solution.That’s why shutdowns tend to create more noise than real damage. The real risk this time isn’t the shutdown itself, it’s the delay of key economic data like the jobs report. Without that data, investors are flying blind on the Fed’s most-watched indicators.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.