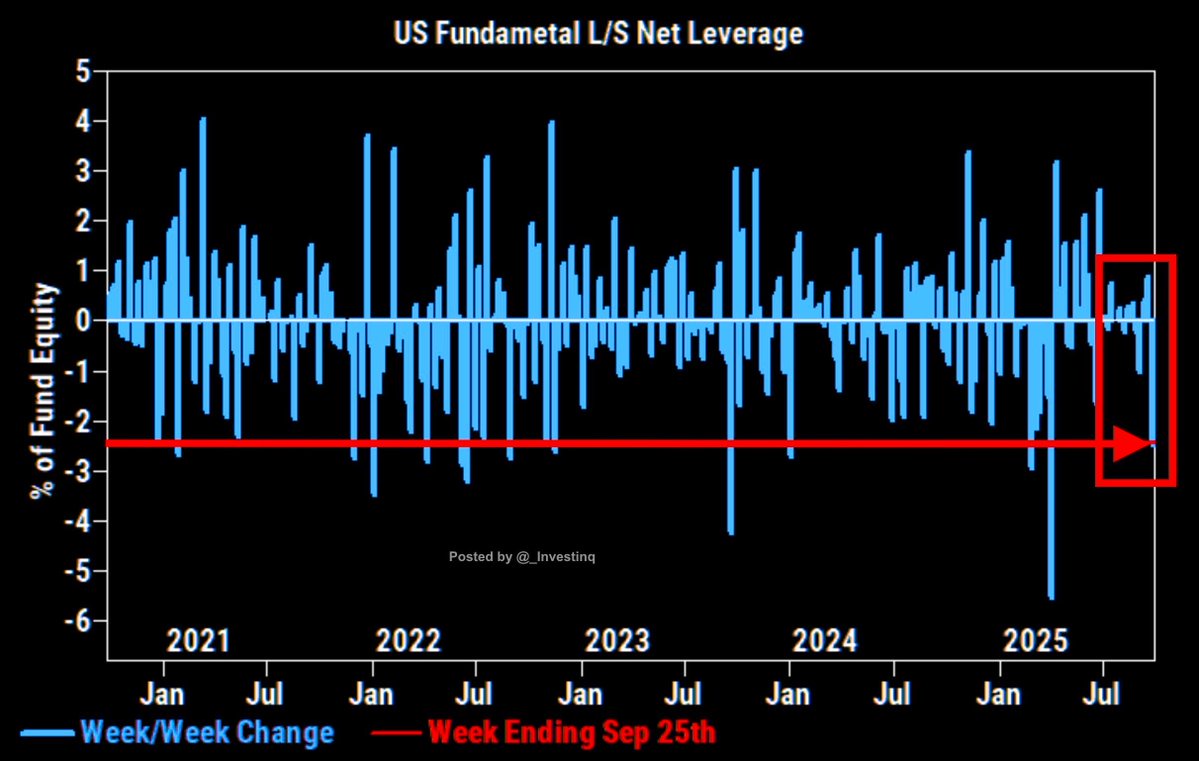

美国基本面多空(L/S)净杠杆率上周下降了 2.5 个百分点至 50.7%。

根据高盛的数据,这是自解放日以来最大的单周降幅,使杠杆率处于过去 3 年的第 28 百分位。

“净杠杆率” 是什么意思?它基本上是指对冲基金用借来的资金进行投注的金额。数字越高意味着基金承担的风险越大,而数字越低则意味着它们更谨慎。

这一突然下降表明基金正在快速减少敞口。从好的方面来看,这降低了系统性风险,减少了强制清算的可能性,并为市场稳定后留下了购买的资金。

但也有另一面。较低的杠杆率也意味着基金正在从市场撤退,这可能会降低流动性并表明信心减弱。如果股票大幅反弹,基金可能会错过上涨机会。

基金显然正在进入防御模式。我认为它们正在为 10 月做准备,历史上这是市场波动最大的月份之一。但如果历史可以作为参考,这种仓位重置可能为第四季度的反弹奠定基础,届时季节性因素将变得更加有利。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。