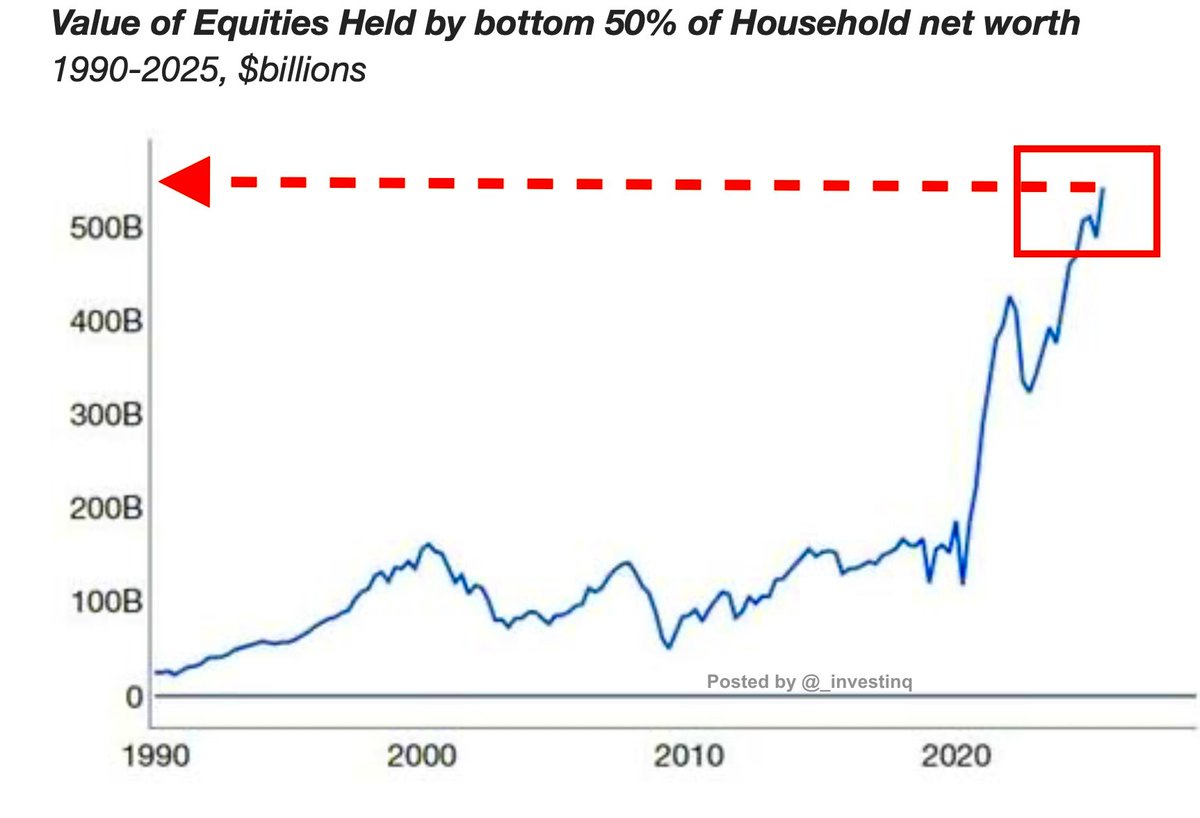

The bottom 50% of U.S. households have historically had little exposure to stocks.

For decades, the top 10% controlled nearly all equity wealth and they still do, holding about 85–90% today.What has changed is that the bottom half now hold over $500 billion in equities, the most on record. That’s a +542% surge since 2020, fueled by stimulus, rising wages, and the retail trading boom. It doesn’t overturn wealth concentration, but it does mean more households than ever before have a stake in markets.This creates new vulnerabilities. The bottom 50% often lack the buffers that wealthier investors rely on: diversified portfolios, liquid savings, or multiple income streams. If equities stumble, the impact on consumption, debt repayment, and household confidence could be sharper.So while the top 10% still dominate, the record exposure for the bottom half is both progress and a warning: more Americans are finally at the table, but they are also far more exposed to Wall Street’s swings.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.