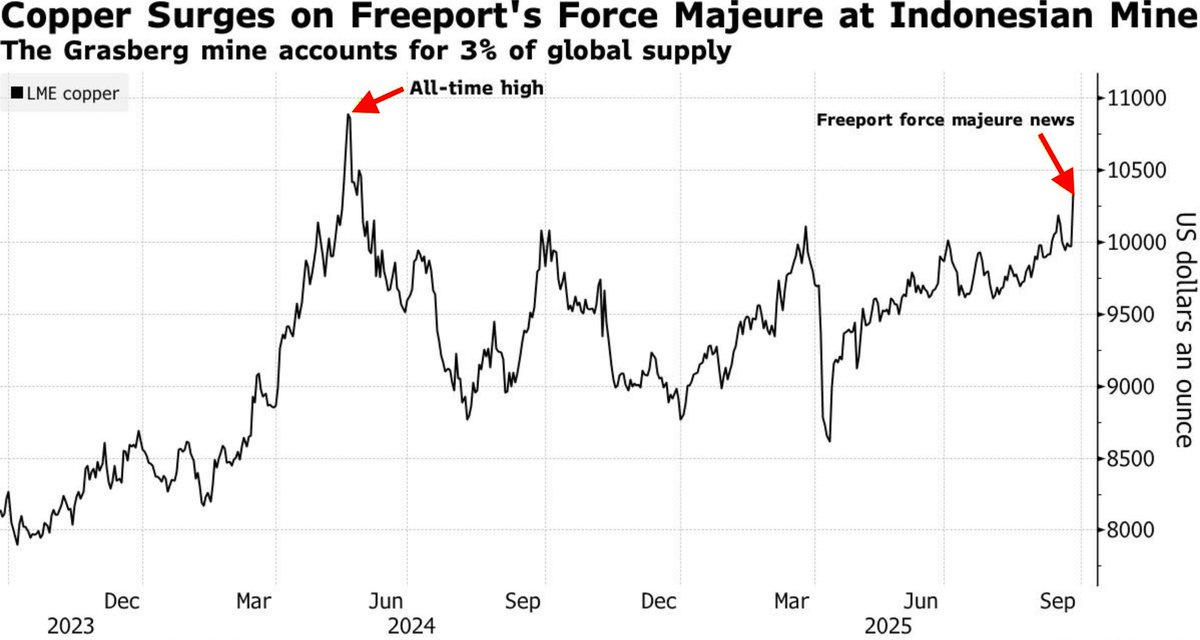

In case you missed this last week, a huge mudslide hit the Grasberg copper mine in Indonesia, the second-largest in the world. On September 8, over 800,000 tons of mud ripped through the Block Cave section, killing two workers and leaving five more missing.

Freeport-McMoRan had to shut everything down, and the company doesn’t expect to get back to normal production until 2027. Grasberg usually accounts for about 3-4% of global copper output, so the hit to supply is significant.Copper prices spiked right after the news but have since come down from the highs. Even with that pullback, the long-term effects are clear. Freeport expects copper sales to fall by more than a third in 2026, with production in late 2025 close to zero. Analysts say almost 600,000 tons of copper will be lost through the end of next year, a shortfall big enough to rival the yearly output of the world’s third-largest mine. Forecasts now show global copper deficits ballooning to 350,000 tons in 2026 and more than 500,000 tons in 2027, compared to a tiny gap this year.Bank of America has already raised its copper outlook, now calling for $5.13 per pound in 2026 and $6.12 in 2027, with a possible peak of $6.80 by the end of that year. Demand is still running hot, especially from China’s renewable energy push and AI-related infrastructure, while stockpiles on the London Metal Exchange remain extremely low. Even if prices eased off in the short term, the supply shock and ongoing demand mean copper could stay tight for years. Do you think this disruption sets copper up for a long bull run, or will supply eventually catch up?Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.