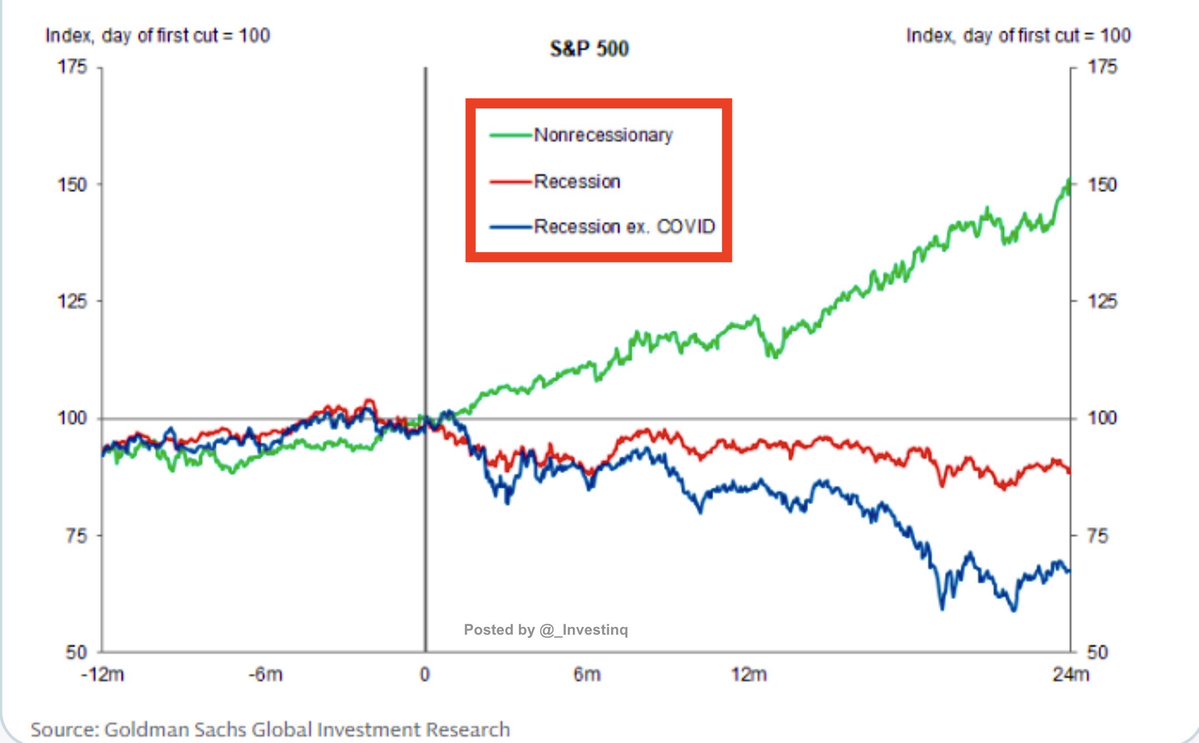

降息并非一视同仁。

高盛的数据显示,当美联储在经济衰退之外降息时,股市通常会上涨,非衰退性降息历史上在两年内将标普 500 指数推高了 50% 以上。

但如果降息发生在经济衰退期间,情况就会反转。股市表现不佳,指数平均下跌 20-30%。

结论很简单:不仅仅是降息的问题,而是背景的问题。

平静水域中的降息提振市场。风暴中的降息则不会。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。