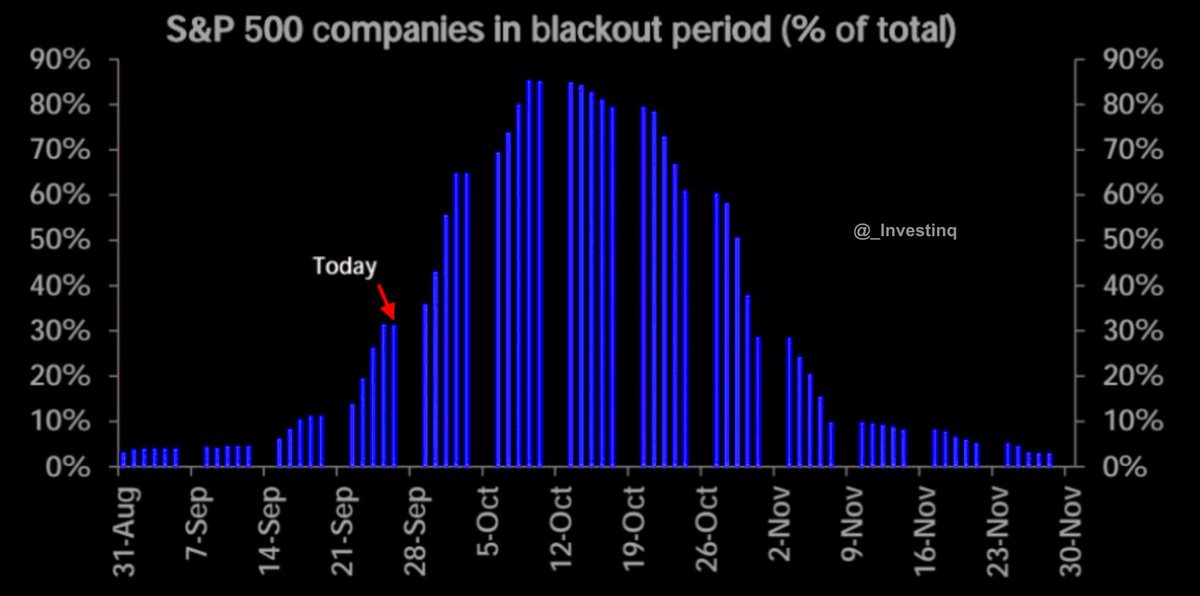

我们正式进入股票回购静默期。

截至今日,标普 500 指数中约三分之一的公司已被限制回购股票。这一数字将迅速攀升,到 10 月中旬将达到 80-85% 的峰值。

这很重要,因为回购是股票需求的最大来源之一。当静默期窗口关闭时,这种需求将消失,而此时市场正面临财报季、宏观风险和波动性加剧。

换句话说,当市场最需要流动性时,股票的最大买家即将退场。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。