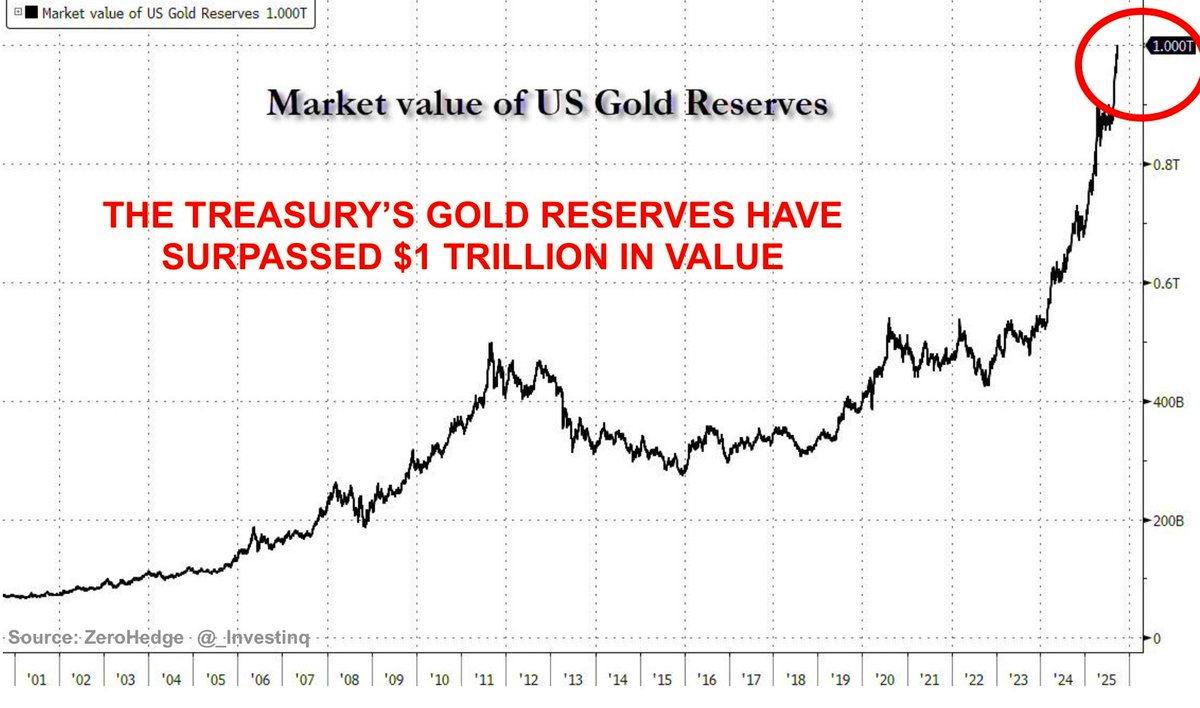

Gold has gone on a crazy run this year, up about 45% and that surge just pushed the U.S. Treasury’s gold stash past the $1 trillion mark for the first time ever.

The wild part? On paper, the government still lists that hoard at only $11 billion, since it hasn’t updated the official book value in decades. That gap is what’s fueling a debate in Washington: should Treasury Secretary Bessent “revalue” gold to its actual market price?If he did, it would be like the government suddenly discovering an extra $990 billion in its wallet. Other countries like Germany and Italy have done this with their reserves, but the U.S. is unique because the Treasury itself holds the gold, not the Fed. The Fed only has certificates linked to the Treasury’s bars. By marking it to market, the Treasury could hand the Fed new certificates, and in return, its account at the Fed (TGA) would fill up with nearly a trillion fresh dollars.That wouldn’t technically be “QE,” since the Fed wouldn’t be buying Treasuries in the market, but it would feel almost the same. The government would suddenly have a ton of new spending power without issuing more bonds or raising taxes. Gold, bitcoin, and other hard assets would likely rip even higher as traders digest what amounts to stealth monetary easing.The risks, though are real. Pumping that much money into the Treasury’s account could flood markets with cash, boost stocks and risk assets, and stoke inflation. It would also blur the lines between fiscal policy (Congress’s job) and monetary policy (the Fed’s job), something that could make investors nervous about U.S. discipline. And legally, there are still unanswered questions about whether Treasury can even do this without Congress.Do you think the Treasury should actually pull the trigger on this, or would it be a dangerous move?Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.