A US government shutdown on October 1 is looking more likely by the day.

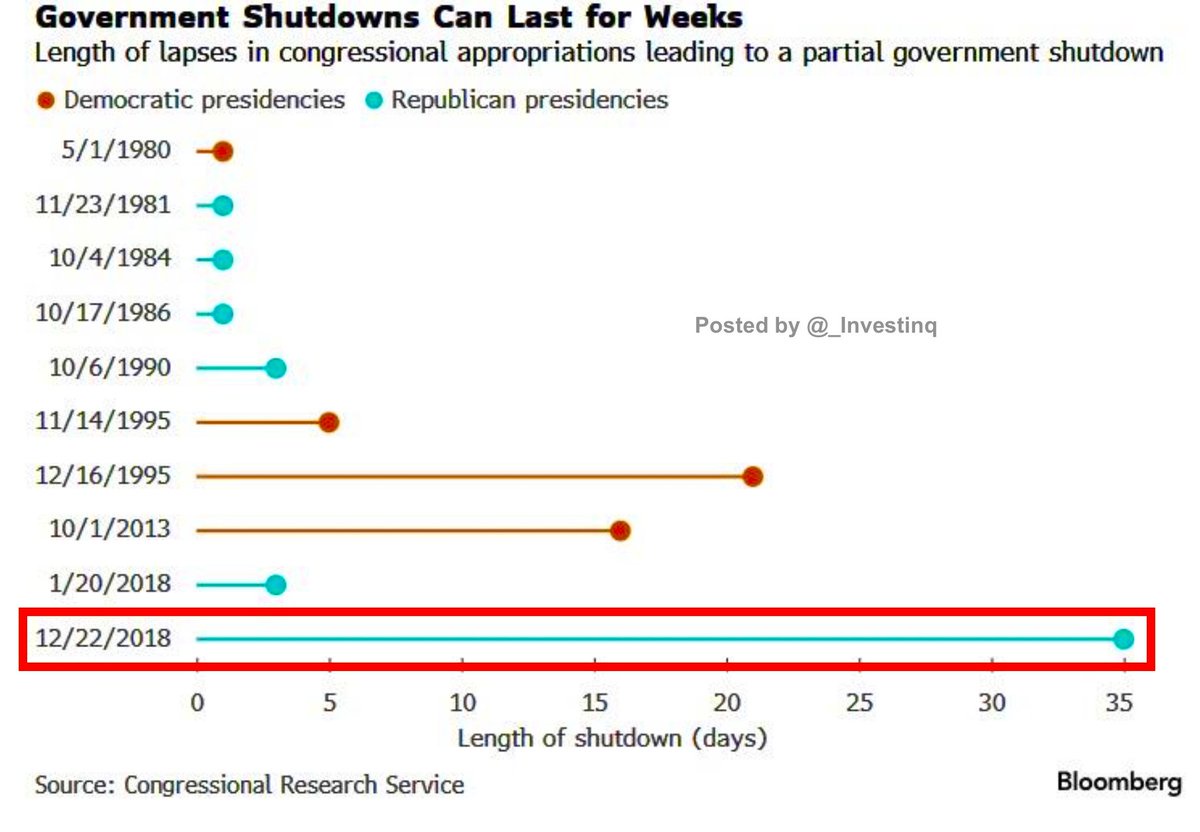

Shutdowns occur when Congress doesn’t pass new spending bills on time. Federal agencies usually have playbooks to manage these lapses, but this time the administration is revising those plans, adding another layer of uncertainty compared to past episodes.History shows shutdowns can drag on. The 2013 shutdown lasted 16 days. The record was 35 days in late 2018. Goldman warns that this one could be severe because none of the 12 appropriations bills have been passed.If a shutdown hits, roughly 40% of federal employees would be furloughed while 60% would be forced to work without pay. Essential services like the military, Medicare, and Social Security would continue, but parks, museums, and many agencies would shut down.For markets, the biggest risk may not be the lost activity but the missing data. A shutdown would delay NFP and CPI reports, leaving the Fed without key inputs ahead of its October 28–29 meeting. At the same time, Sept 30 brings quarterly options expiration, which removes a major “collar” hedge that has supported equities. Add a shutdown on top, and volatility risk rises sharply.The real question: does this turn into another short disruption like 2013, or a prolonged standoff like 2018?Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.