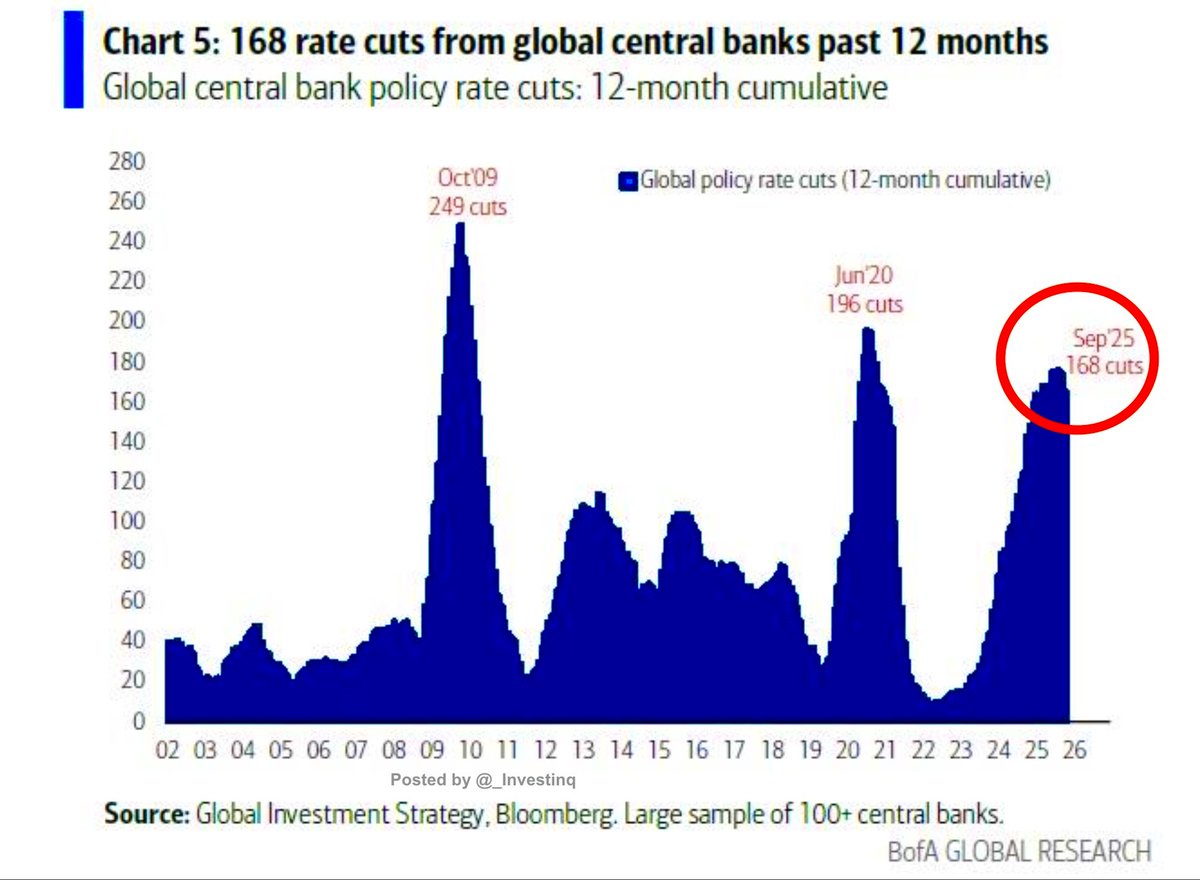

Global central banks have cut rates 168 times in the past 12 months.

This is the third-largest wave of cuts in history, behind only the Global Financial Crisis in 2009 (249 cuts) and COVID in 2020 (196 cuts).Rate cuts are meant to stimulate growth, but they also weaken currencies and fuel demand for hard assets.It’s no coincidence that while 168 cuts were delivered, the US dollar posted its worst year since the 1970s and gold surged to record highs.When rate cuts pile up like this, it’s a clear signal: the global economy is under real stress.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.