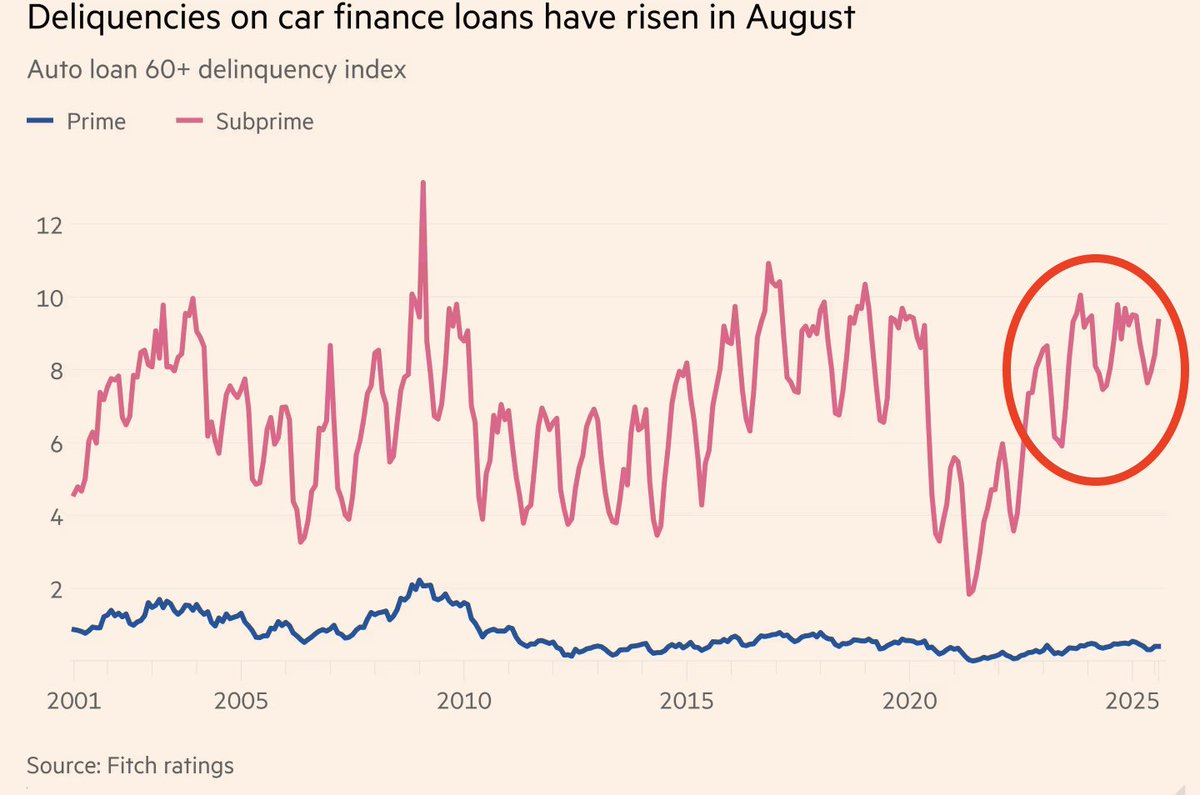

Tricolor, one of the biggest subprime auto lenders, collapsed in September. The company focused on low-income and Hispanic families, offering loans with sky-high interest rates. By August, delinquencies jumped to 9.3%, the highest since 2008.

At the same time, Tricolor faced accusations of fraud for pledging the same cars to multiple lenders. Once that came out, the company fell apart. More than 100,000 customers are now at risk of losing their vehicles, and for many, that means losing their ability to work.The bigger question is: where was JPMorgan Chase? This wasn’t a small lender hidden in the shadows. JPMorgan was one of Tricolor’s largest backers and also underwrote its debt. A bank this big has the resources to see what’s going on. It has teams of analysts, risk officers, and legal experts. Yet it kept pouring money in. Did it really miss the warning signs or did it choose to look the other way?Subprime auto loans come with huge returns, often over 22%. That’s why JPMorgan and others got involved. They knew the risks but saw the profits. During the boom, they earned money by lending directly and by packaging the loans into securities sold to investors. Once signs of trouble appeared, JPMorgan likely hedged its exposure or shifted its position to reduce losses. This collapse didn’t happen in isolation. Just before Tricolor failed, First Brands Group, a large auto parts supplier, filed for bankruptcy. Back to back blows shook confidence in credit markets. Now JPMorgan, Fifth Third, and other banks could face hundreds of millions in losses. Investors have already started backing away from asset-backed securities tied to subprime loans.These failures are hitting the hardest on low-income and Hispanic families who are already under tremendous pressure. At the center of it all is JPMorgan Chase. They financed it, they underwrote it, they profited. So why isn’t anyone asking the obvious question, why isn’t JPMorgan being investigated for this?Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.