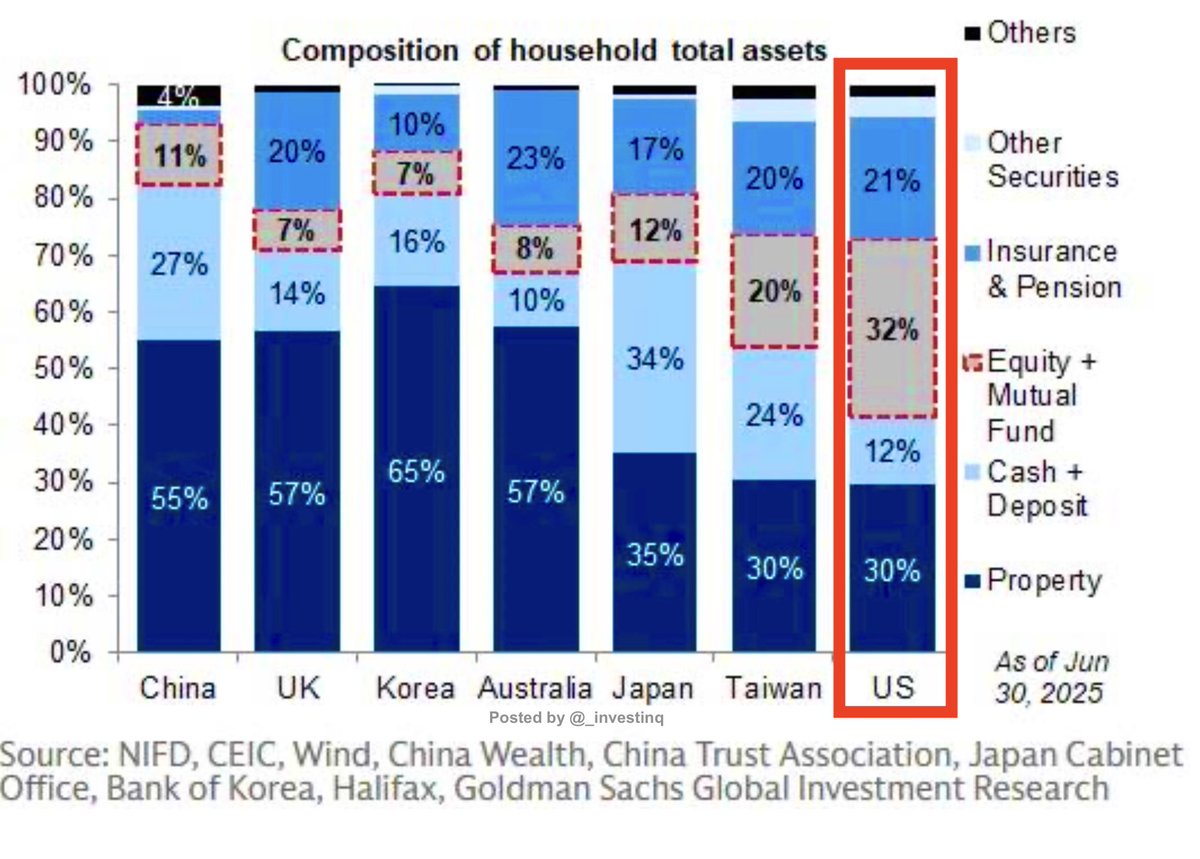

Household wealth looks very different across the world:

In China, 65% of household assets are in property, with just 11% in stocks.By contrast, the U.S. has only 30% in property but allocates 21% to equities and a massive 32% to pensions/insurance.Japan and Taiwan lean heavily on cash deposits (34% and 24%, respectively), showing a preference for safety over growth.Meanwhile, Korea has the most property-heavy households globally at 65%.The U.S. stands out as the most diversified, while Asia remains dominated by property and cash.A tale of two worlds: housing-driven wealth in Asia vs. market-driven wealth in the West.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.