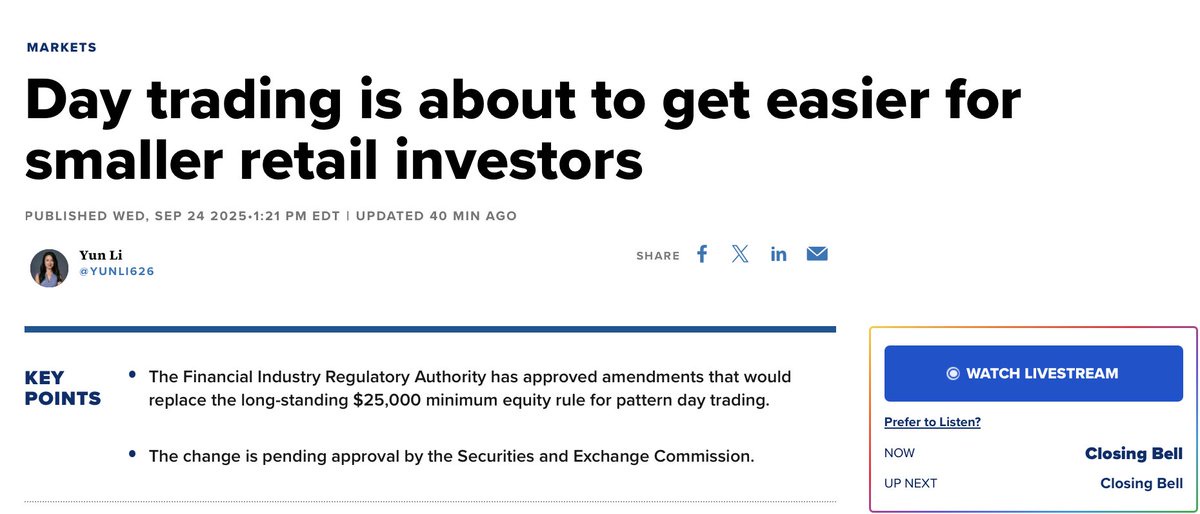

监管机构正在废除零售交易中最令人讨厌的规则之一:2.5 万美元的日内交易规则。自 2001 年以来,如果你想在五天内进行四次或更多次的日内交易,你必须在账户中保持至少 2.5 万美元的资金。

这条规则是在互联网泡沫破裂后出台的,当时监管机构认为小交易者在追逐互联网股票时自毁。美国金融业监管局(FINRA)刚刚投票决定用日内保证金框架取代它,基本上,你的购买力现在将取决于你当天所持仓位的保证金要求,而不是一些任意的股权门槛。它仍然需要美国证券交易委员会(SEC)的批准,但 2.5 万美元的门槛似乎即将被废除。

做市商和经纪商会喜欢这一点。更多的交易量,更多的价差,更多的期权流动,对他们来说是免费的钱。但普通零售交易者呢?他们即将陷入一个耗尽他们账户的跑步机。一次糟糕的交易,一次糟糕的成交,没有 2.5 万美元的缓冲,他们将面临追加保证金通知。

这实际上是在火上浇油。它推动小账户过度交易,追逐杠杆,并以艰难的方式学习日内波动的无情。那些带着盈利离开的人不会是零售交易者,而是那些做市的公司。相信我,庄家总是赢家。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。