黄金正在经历历史性的一年:

年初至今价格上涨了 +42.17%,有望创下自 1979 年以来的最大年度涨幅。

美元指数下跌了-10.2%,这是自 1973 年以来同期最剧烈的跌幅。

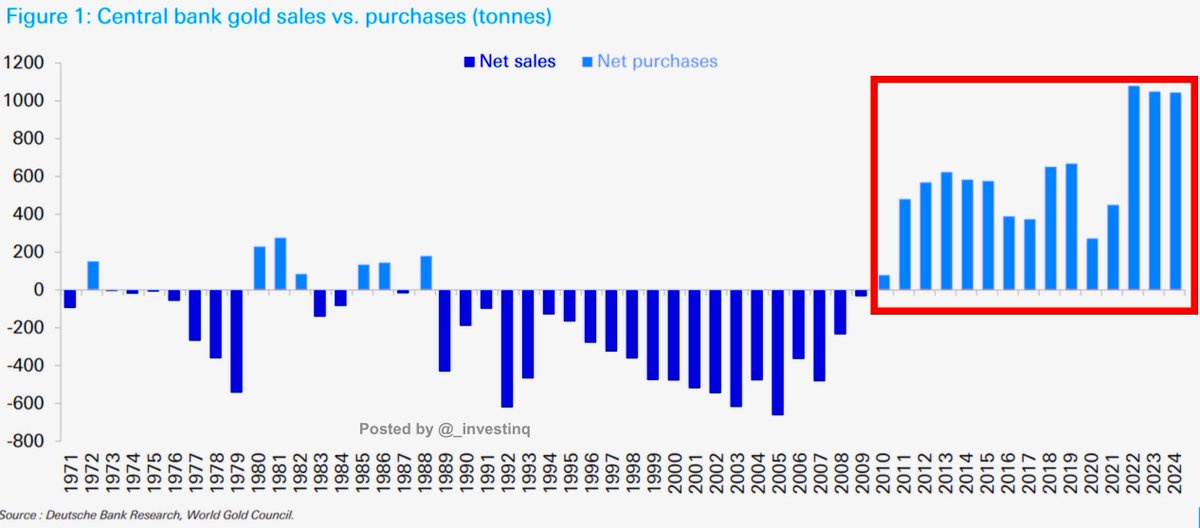

中央银行是主要推动力。图表显示它们从几十年的净卖家转变为创纪录的净买家。

自 2010 年以来,净购买量激增,2022-2024 年标志着现代历史上最强劲的购买狂潮。

这与更广泛的去美元化趋势一致。美元在中央银行储备中的份额已从 2015 年的 58% 降至今天的约 43%。

黄金的份额翻了一番,在不到十年的时间里从约 9% 攀升至近 19%。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。