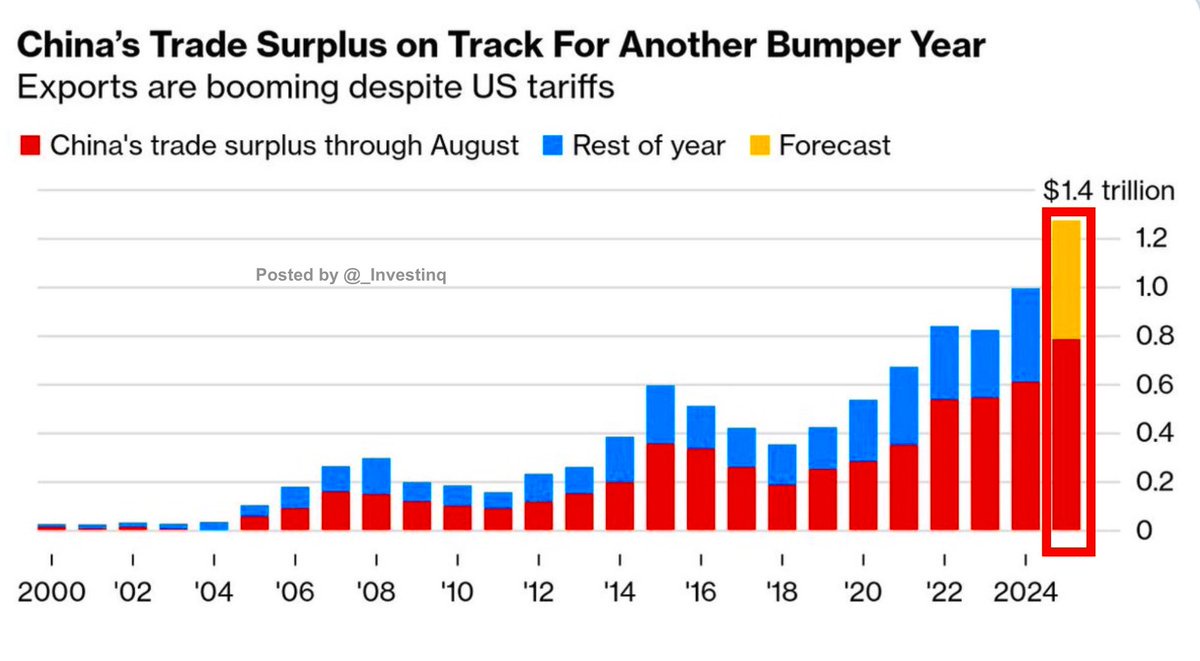

中国的出口机器再次打破纪录。尽管美国实施了数月的严厉关税,北京今年的贸易顺差仍有望达到 1.2 万亿美元。对美国的出口可能在减少,但中国制造商已转向其他市场。

8 月对印度的销售额创下历史新高,对非洲的出口预计将创下年度纪录,东南亚的采购量也超过了疫情期间的水平。这一激增引发了反弹。从墨西哥到印度尼西亚等国家都对从汽车到服装的廉价中国商品泛滥发出警告,一些国家正在考虑自行加征关税。然而,许多政府仍犹豫是否升级措施,尤其是那些已与华盛顿处于紧张谈判中的国家。对中国来说,策略很明确:如果美国消费者受限,就寻找其他市场。较低的价格、疲软的人民币以及通过其他国家转运商品等巧妙方法,使工厂保持运转。其结果是海外出口蓬勃发展,尽管中国国内面临利润疲软和持续的通缩。更大的问题是世界能容忍多久。将低成本商品推向全球市场支持了中国增长,但可能掏空其他地方的产业。目前,很少有人希望引发第二场贸易战,但如果过剩持续,压力将不断累积。来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。