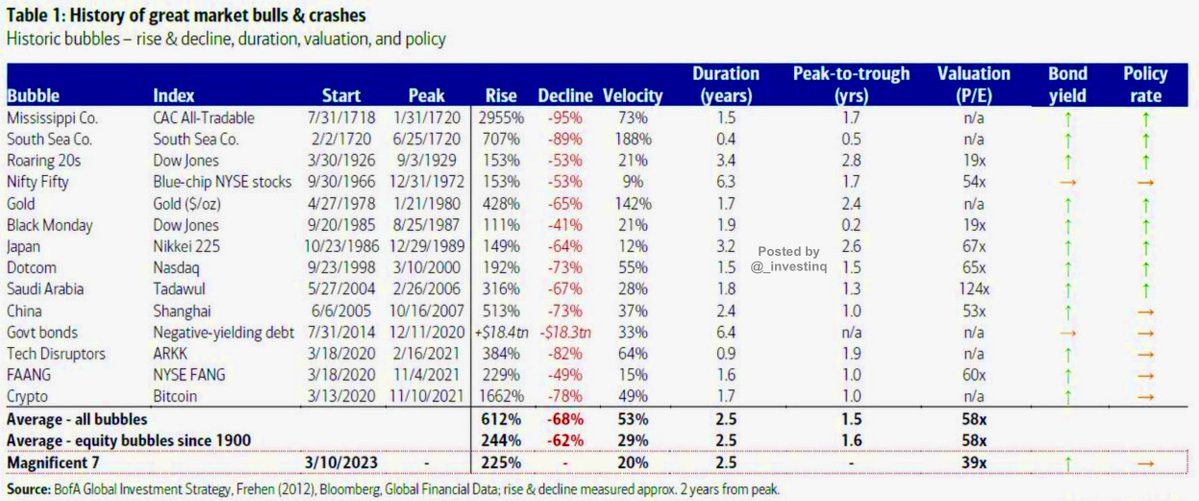

This is one of the reasons I think markets still have more room to run. Bubbles do not usually stop when prices look expensive or momentum feels stretched. They often keep going until conditions reach extreme levels. Since 1900, the average bubble has gained 244 percent from trough to peak, with valuations near 58 times earnings and markets trading about 30 percent above the 200-day moving average. The fallout has been harsh with losses averaging 62 percent in less than two years. The Mississippi Company rose nearly 30,000 percent before crashing 95 percent. Dotcom gained 192 percent before falling 73 percent. Crypto surged 1,600 percent before losing 78 percent The pattern has been consistent.

The Magnificent 7 look like the modern version of this cycle. Since March 2023, they have rallied 223 percent and grown to 34 percent of the S&P 500’s total value. Their average PE ratio is 39, which is elevated but still below the 58 seen in past peaks. Technically they trade about 20 percent above the 200-day moving average. That is extended but still short of the 29 percent overshoot that has defined earlier bubbles. This leaves room for the rally to continue. The weaknesses are becoming clear. Earnings growth is slowing, forward estimates have flattened, and valuations remain high. Apple and Microsoft are near 29 times earnings, Amazon at 37, Meta at 28, Nvidia at 40, and Tesla at 180. Analysts are lowering price targets. Policy also remains restrictive with bond yields rising. These conditions have often appeared near the end of past cyclesEven so, the Magnificent 7 are supported by more than speculation. They dominate global technology, generate massive cash flows, and benefit from long-term forces like artificial intelligence, cloud, and digital infrastructure. History shows bubbles rarely stop just because valuations look rich. They usually push further until markets reach extremes, and we are not at that stage yet. The Magnificent 7 rally shows the signs of a late bubble. Gains have been outsized, valuations are expensive, momentum is stretched, and concentration risk ties the broader market to a handful of stocks but it has not reached the fever pitch that marked earlier collapses. That is why I think markets still have room to run. When the turn finally comes, the reversal will be quick and harsh, just as it has been before.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.