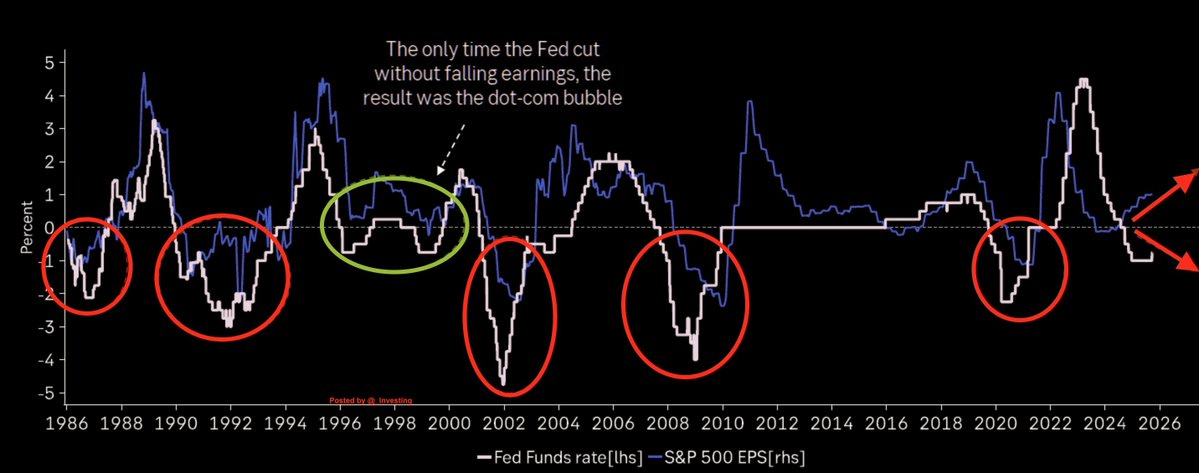

在过去四十年中,以两位数盈利开启降息周期的情况仅发生过一次。上一次以互联网泡沫告终。上世纪 90 年代末,尽管公司利润仍在快速增长,美联储仍下调了利率。这种额外的宽松资金推动股价进一步上涨,并创造了市场历史上最大的泡沫之一。几年后当利润最终放缓时,降息无法阻止随之而来的崩盘。这表明当经济和盈利仍然强劲时放松政策的风险。目前的情况看起来与那时非常相似。尽管企业利润仍在快速增长且股市创下历史新高,美联储已开始降息。通常,降息发生在利润下降或经济陷入衰退时。这就是为什么许多分析师表示当前情况非同寻常。降息非但没有在经济需要时提供支持,反而可能给已经昂贵的市场火上浇油,使泡沫更容易形成。

另一个需要记住的是,美联储通常会等到明确看到问题才降息。它通常会等到失业率开始显著上升或就业市场疲软。目前失业率为 4.3%,按历史标准仍处于低位,尽管美联储预计到年底将升至 4.5%。主席杰罗姆·鲍威尔将此举称为 “风险管理降息”,意味着美联储试图在情况恶化前采取行动,而非在疲软显现后。这使得这一决定更加突出,因为它打破了美联储通常等待问题明显的模式。

如果没有衰退且盈利保持强劲,市场通常在降息周期开始时表现良好。但当降息发生在估值高企且利润仍在上升时,历史表明这可能播下不稳定的种子。一旦利润最终降温,更宽松的政策可能不足以防止大幅下跌。互联网时代证明了在错误环境下放松政策可能创造短期乐观情绪,但会导致长期痛苦。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。