我同意 @bradsferguson 的观点,$特斯拉(TSLA.US)应该用其 370 亿美元的过剩现金回购股票,而不是让这些现金继续积累。那些认为特斯拉应该将现金再投资于机器人出租车、人形机器人等内部项目的人也是正确的,但这与我们讨论的问题无关,因为我们讨论的是在满足所有内部投资后,如何处理特斯拉的过剩现金。金融理论告诉我们,公司对过剩现金只有五种处理方式:偿还债务、支付股息、回购股票、进行收购或让现金积累(参见威廉·普里斯特的《自由现金流与股东收益》,可在亚马逊购买)。机构显然更倾向于特斯拉选择后者。

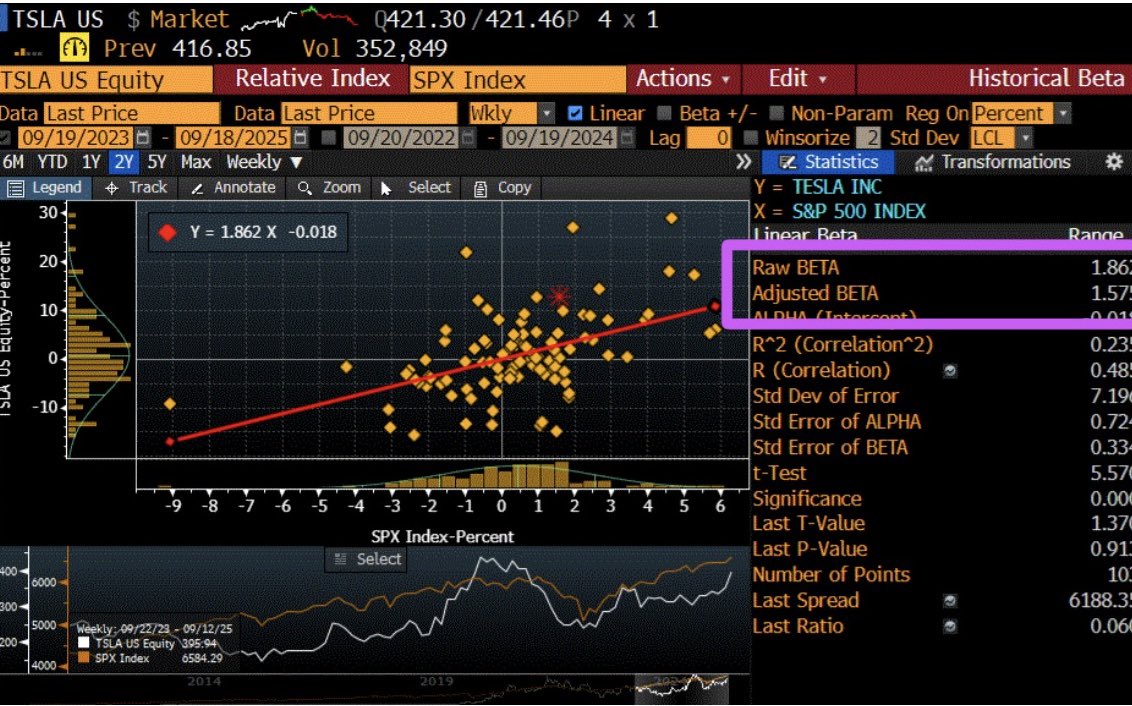

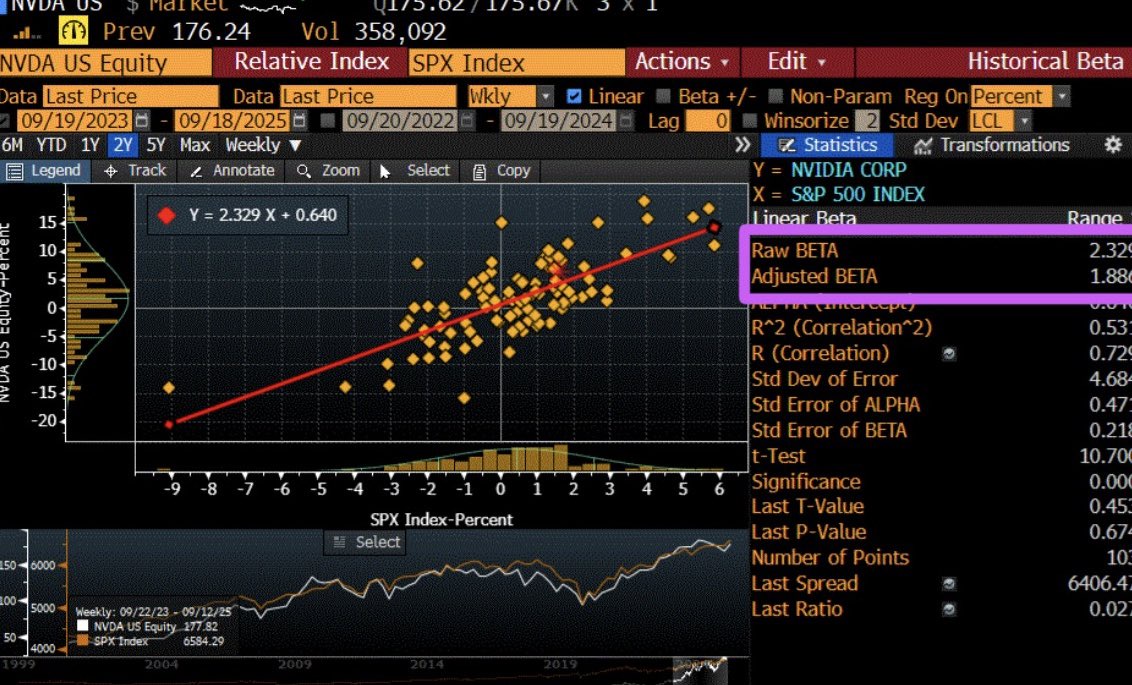

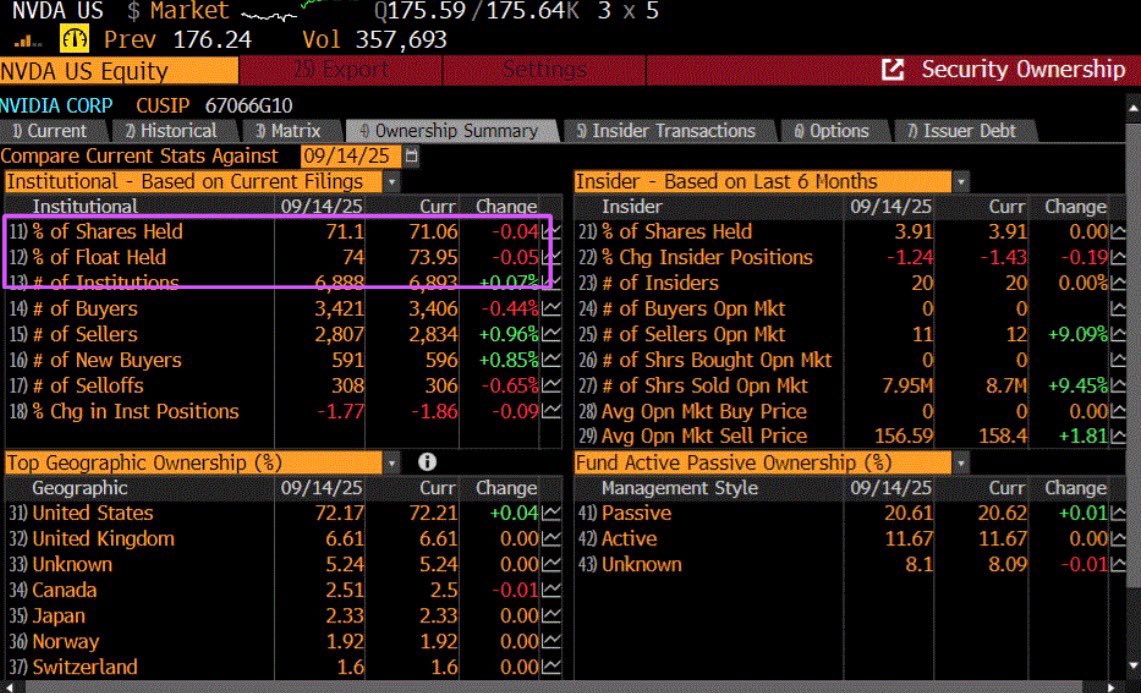

我与布拉德的不同之处在于:机构对特斯拉持股不足的主要原因在于,对他们来说,相对于他们对内在价值的估计,特斯拉的股价看起来太贵了。没有一家市值巨大的公司,其未来现金流以适当的风险调整资本成本折现后的现值,会接近明年盈利的 240 倍(英伟达的远期市盈率为 39 倍)。估值是特斯拉持股不足的原因,而不是因为其高波动性。特斯拉相对于标普 500 的贝塔值为 1.6 倍,低于$英伟达(NVDA.US)的 1.9 倍,但英伟达是标普 500 成分股中机构持股比例最高的股票之一(英伟达 71%,特斯拉 50%)。过高的波动性并不是机构回避特斯拉的原因,而是特斯拉的估值。

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。