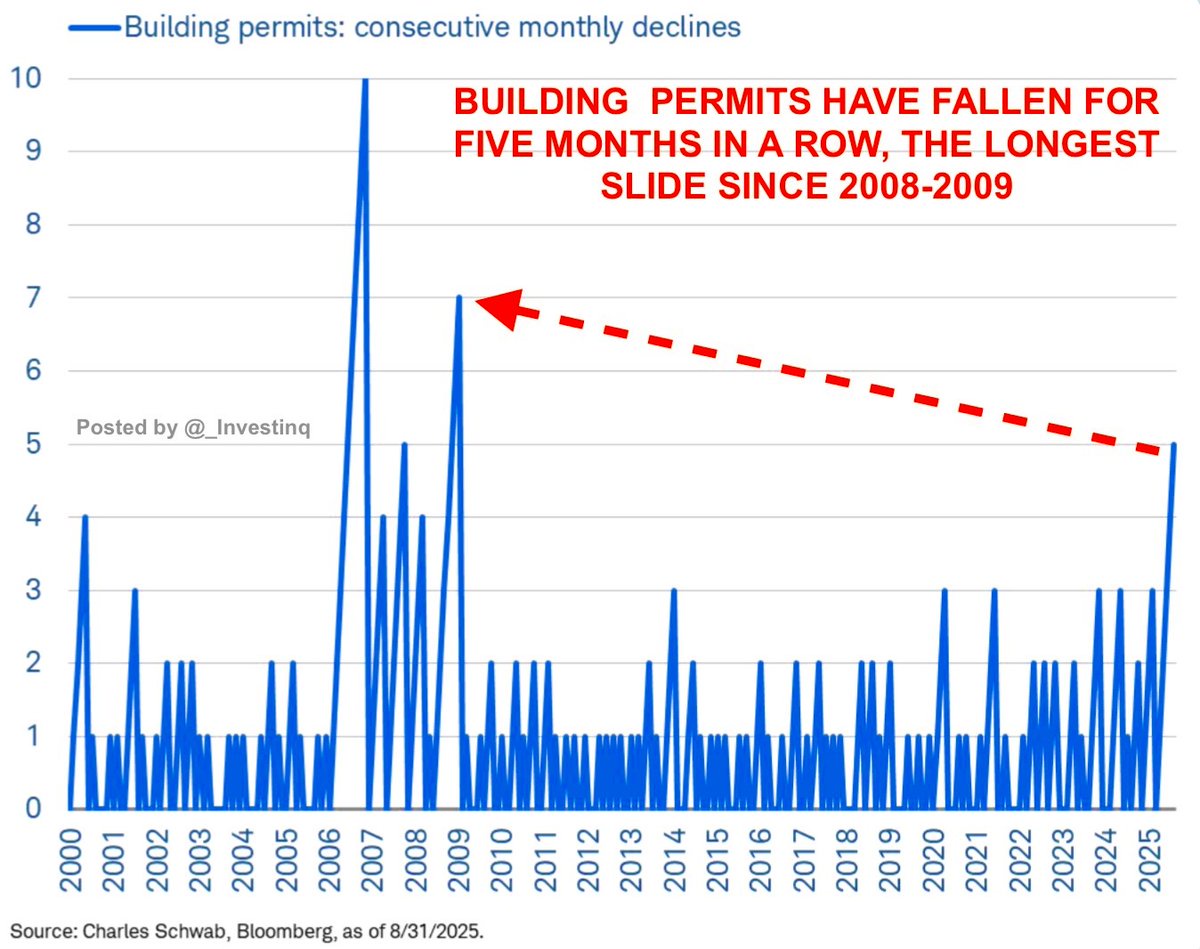

8 月新屋开工率下降 8.5% 至年化 131 万套,营建许可下降 3.7% 至 131 万份。营建许可已连续五个月下滑,使建筑活动回落至 2008-2009 年金融危机以来最低水平。表面看竣工数据表现良好,增长 8.4% 至 161 万套。但竣工量仅反映已开工项目,在建房屋数量持续萎缩——独栋住宅在建量降至 61.1 万套,创 2021 年初以来新低,表明开发商正集中收尾既有项目而暂缓新项目开工。

独栋住宅开工量下降 7% 至 89 万套,为一年多来最低;多户住宅开工量骤降 11% 至 40.3 万套,创 5 月以来新低。营建许可呈现相同趋势:独栋住宅许可 85.6 万份,多户住宅 40.3 万份。作为美国住房市场传统引擎的南部地区,8 月开工量暴跌 21%,尽管西部和东北部小幅增长,仍拖累全国数据走低。此轮放缓出现之际,抵押贷款利率已跌至近三年低点——上周抵押贷款申请量激增近 30%。通常这是积极信号,但住房可负担性仍严重承压:房价居高不下,当前利率与多数业主锁定的历史最低利率间巨大差距,导致二手房供应持续僵化。开发商深知若不大幅降价,市场无法消化更多新房供应,故选择收缩战线。

趋势影响已然明朗:供应管道正快速萎缩。作为未来建设最纯粹指标的营建许可持续逐月下滑,开发商加速完成存量项目却不愿启动新工程,独栋与多户住宅建设同时失速。历史经验预示后续发展:在 2000 年代中期房地产泡沫和 1970 年代滞胀时期,当许可崩溃而竣工暂时坚挺后,开工量终将随之下行。随着可负担性恶化,建筑业将遭遇重挫。8 月报告已拉响警报:南部建筑活动突然停滞,多户住宅增长动能断裂,独栋开工量降至年度最低。即便抵押贷款利率下降刺激贷款需求,供应端基本面仍在恶化——这绝非市场反弹开端,而是动能快速流失的征兆。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。