掉期市场预测美联储在明天的会议上将短期利率下调 25 个基点的概率为 100%。截至 2025 年 3 月 31 日的年度,美国劳工统计局(BLS)创纪录地下调了 91.1 万的非农就业数据修正值,这意味着截至 2025 年 3 月 31 日的年度每月就业增长仅为 7 万,而此前的估计为每月增长 14.6 万,加上 8 月份疲软的 2.2 万就业增长,促使多位知名经济学家呼吁在明天的会议上降息 50 个基点。相比利率决定本身,季度点阵图和美联储主席鲍威尔的新闻发布会可能会提供更多关于美联储想法的见解。鉴于美国就业增长突然疲软,以及如果美联储在推动最大就业和稳定价格的双重使命中在就业方面出错,后果将更加严重,我们预计杰伊·鲍威尔将比以往的美联储新闻发布会更加鸽派。

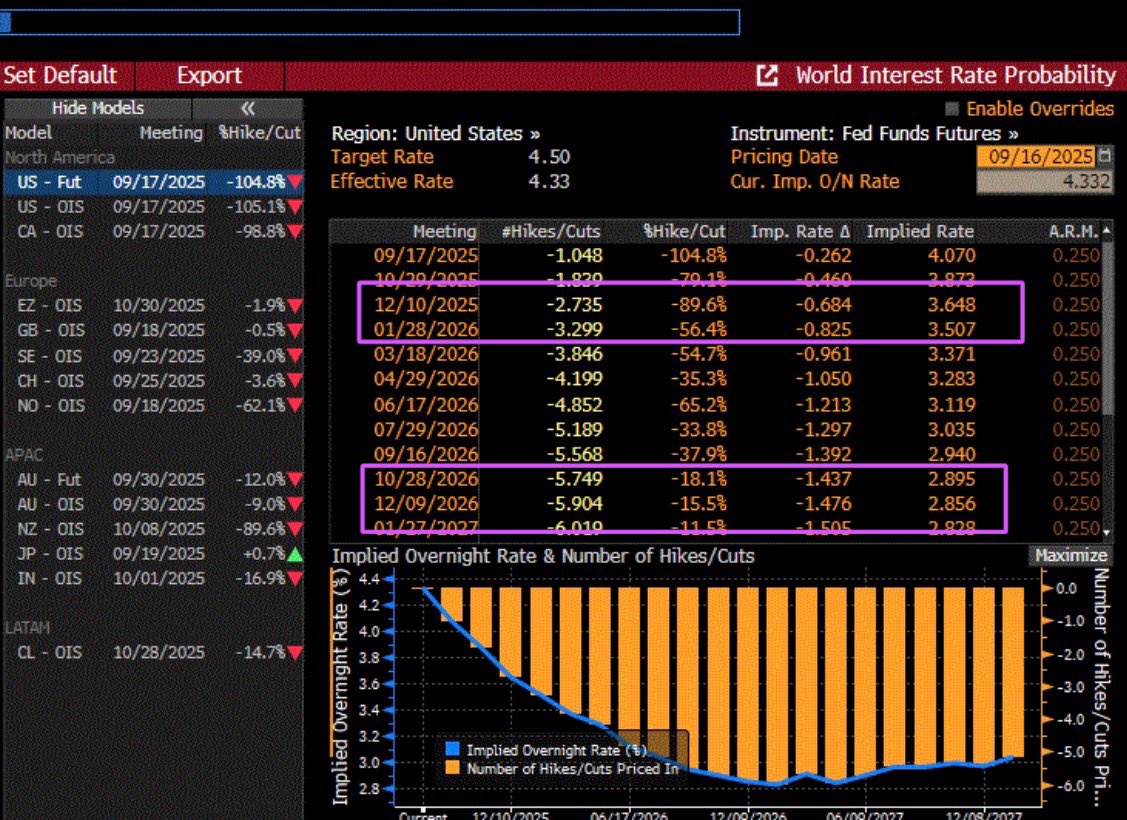

当前 10 年期国债收益率为 4.02%,而标普 500 指数 2026 年的盈利收益率为 4.6%(基于标普 500 每股收益 300 美元,2026 年市盈率为 21.8 倍),股票相对于无风险债券提供了 60 个基点的溢价(历史溢价为 100-125 个基点)。假设到 2026 年底美联储降息 150 个基点(相当于 2026 年底联邦基金利率为 2.9%),股票相对于短期国债的溢价将达到 170 个基点。我们可以认为,在没有经济衰退的情况下,尽管标普 500 指数今年上涨了 12%,但股票看起来仍然便宜。

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。