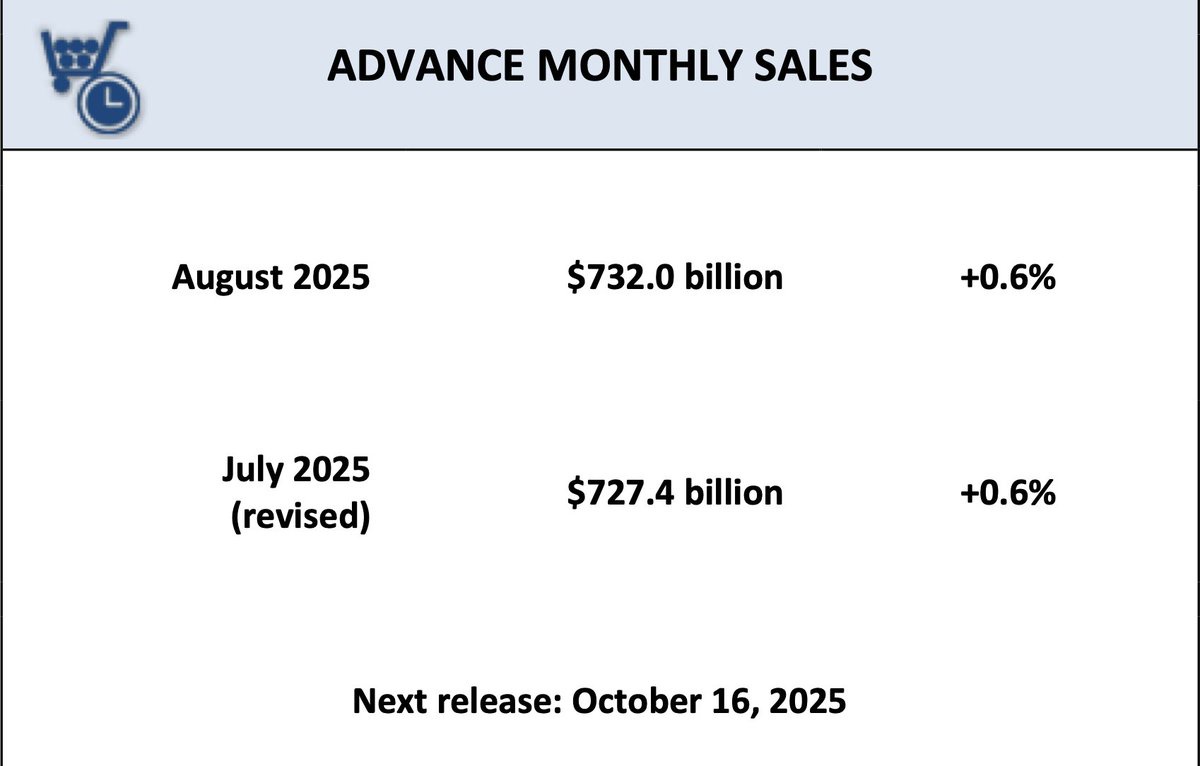

8 月零售销售总额为 7320 亿美元,环比 7 月增长 0.6%,同比增长 5%。乍看是健康增长,但这些数据未经通胀调整。计入价格变化后,实际增幅小得多——月率仅约 0.3%,年率约 2.5%。换言之,大部分增长来自物价上涨而非销量增加。表面强势集中在少数领域:如线上零售商年增超 10%,餐厅酒吧涨 6.5%。消费者仍在为便利和体验买单,但这些品类撑起大局的同时,零售业整体仍陷停滞。

报告其余部分尽显疲态:加油站 8 月降 3.2% 且同比下跌;家具家装下滑,建材园艺同比跌超 2%;百货商店 8 月降 2.7% 且低于去年水平——这些与房地产强相关的品类,反映出高利率和楼市冻结的压力。即便增长的领域也仅勉强跑赢通胀:电子产品涨 0.3%,食品饮料店 8 月微升 0.3%(年率 3.2%),健康个护店微跌 0.1%。百货商店持续结构性衰退,这不仅关乎零售业,更意味着失业、商场萧条和地方经济连锁反应。

剔除汽车、汽油、餐饮服务和建材的对照组(用于 GDP 消费计算)8 月升 0.7%,年增 5.4%。经通胀调整后实际收益微薄。核心矛盾在于失衡:美国人花钱更多但买得更少。外出就餐和网购的挥霍,被住房相关支出和耐用品的削减所抵消。信用卡余额创新高,储蓄率近历史低点,支出结构恶化伴随金额上升。标题写着增长,细节却揭示脆弱性。

来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。