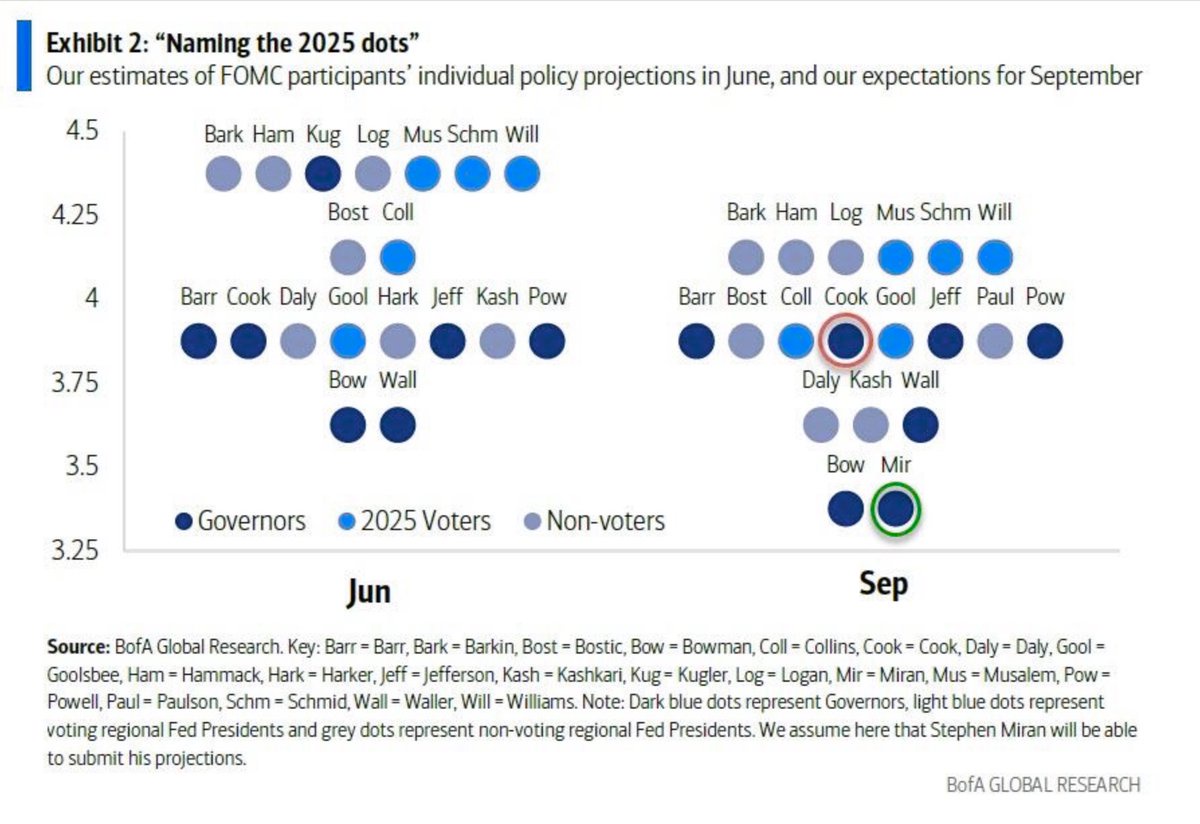

The chart you’re looking at is basically a “naming the dots” exercise, Bank of America trying to match Fed officials to the anonymous projections in the dot plot. For anyone who doesn’t follow this stuff, the dot plot is how the Fed shows where each policymaker thinks interest rates should be at. Back in June, this told a simple story: consensus. Almost everyone was huddled in the 3.75–4.0% range for 2025. That meant the Fed looked unusually aligned, policy staying restrictive enough to keep inflation in check, but with a little easing from the peak. Rarely do you see the dots that tight.

By September, it all blew apart. The dots are scattered everywhere. Some want sharp cuts into the 3.25–3.5% range, worried about slowing growth. Others want to sit tight around 4.0% and wait things out. And a few have dots higher, north of 4.25%, signaling they’re not done fighting inflation. What was once neat and tidy has become one of the most fractured outlooks in years.On top of that, you’ve got a new wildcard: Stephen Miran, just confirmed and already in the mix. His record leans more hawkish, and his vote could easily shift the balance in such a divided room.Meanwhile, markets aren’t showing the same confusion. Futures are pricing a 96% chance of a 25bps cut, almost acting like it’s guaranteed. Compare that to the scatter inside the Fed and the disconnect couldn’t be more obvious. Markets are unified. The Fed is anything but. That’s what makes this moment so tense. Investors are treating a cut as baseline, but inside the Fed, there’s no clear path. Some are ready to cut hard, others still open to hikes. What looked like unity in June has turned into a fractured committee staring down one of its most unpredictable calls yet.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.