只是一个友好的提醒,PPI 数据将于明天东部时间上午 8:30 公布。我预计 PPI 数据将再次表现强劲。对于 8 月份,我预计环比增长 0.3%,年率将维持在 3.3% 左右。

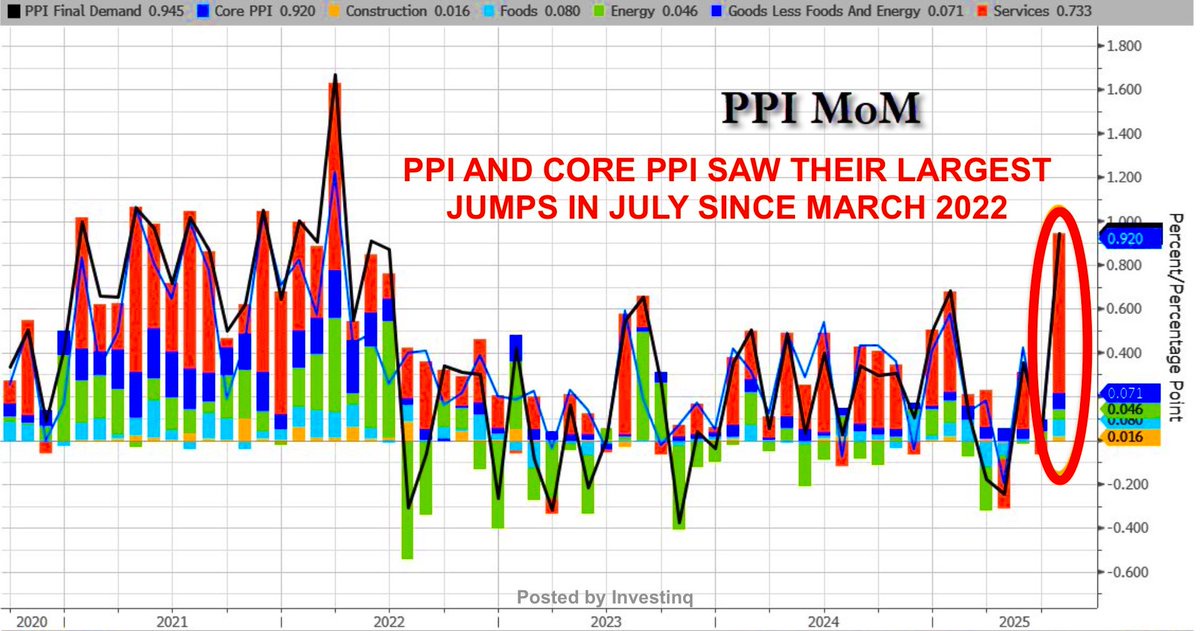

PPI 追踪生产商为其商品和服务获得的价格,基本上是商品到达你我手中之前的 “出厂” 价格。当这些成本上升时,通常会在稍后的 CPI 中体现出来,CPI 衡量的是消费者在结账时实际支付的价格。上个月我们已经看到了压力在积累。7 月份,生产者价格飙升 0.9%,这是三年来最大的月度涨幅,推动 PPI 同比上涨 3.3%。这比经济学家预期的四倍还要多。更大的问题是顽固的通胀。关税不断推高投入成本,虽然公司可以暂时承担这些成本,但它们正在慢慢将这些成本转嫁给消费者。由于关税是分阶段实施的,其影响不是一次性冲击,而是随着时间的推移逐渐显现,使价格持续承压。再加上核心通胀已经比美联储 2% 的目标高出几个百分点,这就是为什么我认为 PPI 不会很快降温的原因。明天我将对此进行详细报道,请确保开启通知,以免错过更新。来源:StockMarket.News

本文版权归属原作者/机构所有。

当前内容仅代表作者观点,与本平台立场无关。内容仅供投资者参考,亦不构成任何投资建议。如对本平台提供的内容服务有任何疑问或建议,请联系我们。