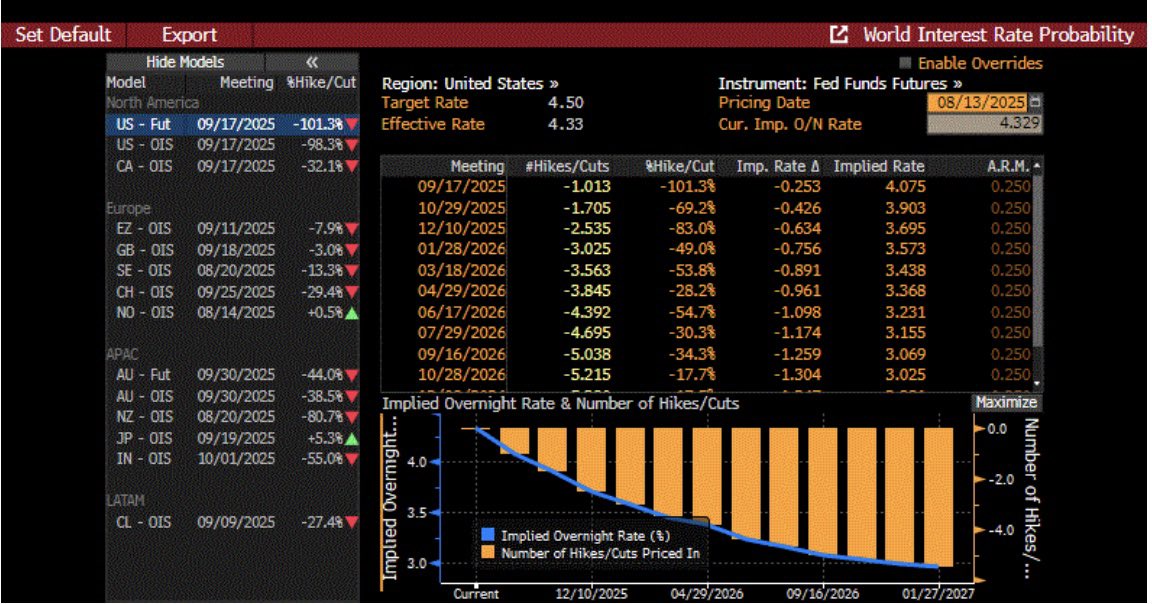

Market now anticipating 1.7 rate cuts in Sept and Oct, and 2.5 rate cuts by year-end. We expect a 50bp cut in Sept, which could trigger more equity gains, despite the S&P already ahead by +10% YTD. At 6,455, the S&P 500 is now trading at 23.5x forward 4-qtr rolling earnings of $275. The implied S&P 500 E/P yield is now 4.26% (1/23.5x) or +3bp vs the 10yrTY of 4.23%. The normal S&P earnings yield spread over 10yrTY over the past 60 years has been +100bp. Market clearly expecting 10yrTY to fall as short term rates come down.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.