Nvda earnings preview: are we about to see another substantial surge?

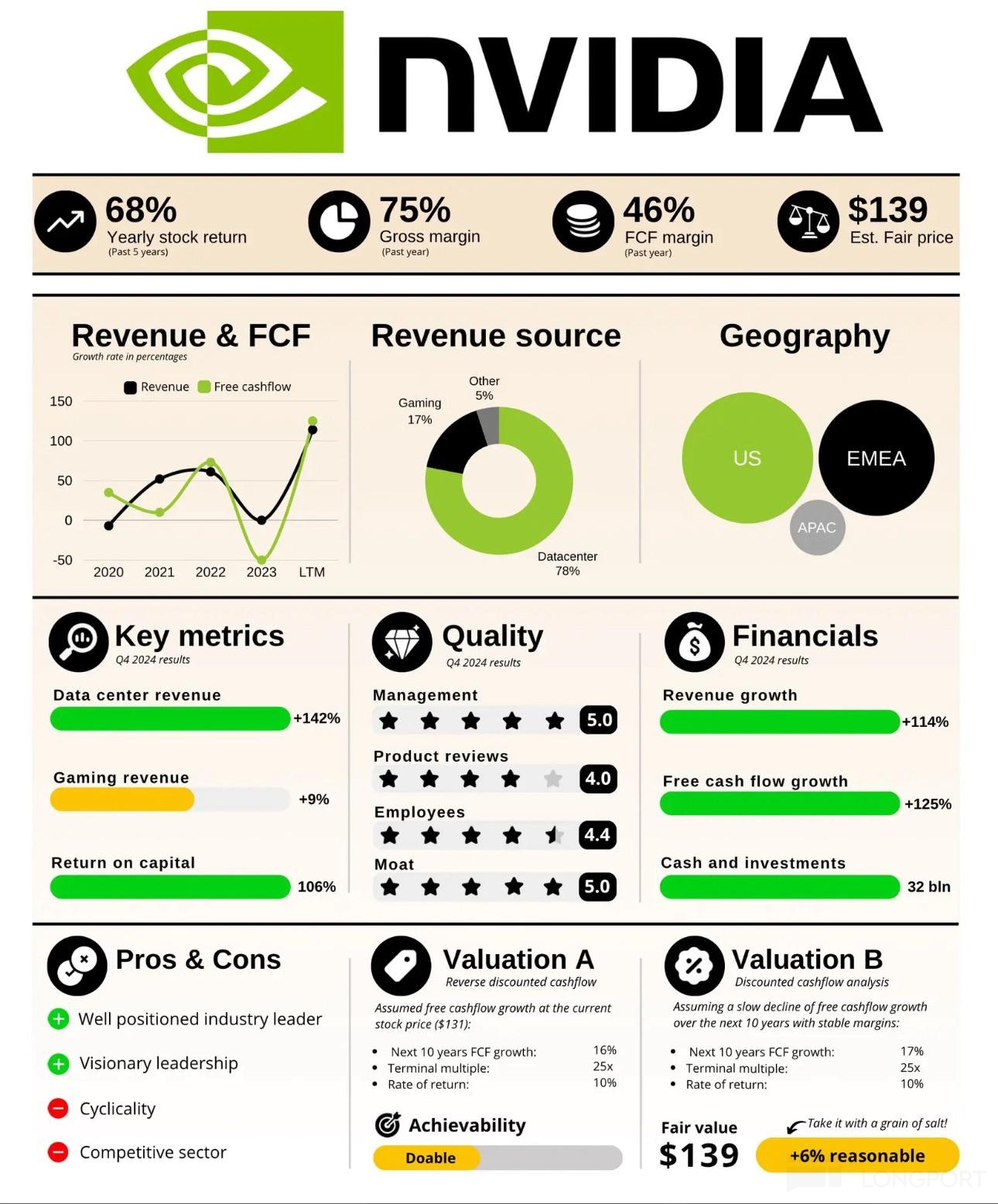

NVDA’s Q1 2026 earnings are coming after market close on May 28th. The consensus is for about $43B revenue (up 65% YoY), EPS around $0.82-$0.89, and gross margin close to 71%. Last earnings, NVDA popped over 3% right away, and it’s been strong ever since.

I’m feeling bullish for a few reasons: Blackwell’s new architecture brought in $11B last quarter, which is insane, and with Computex plus all the AI buzz, demand looks even stronger. I’ve also heard chatter (even on Tiger) that a lot of Chinese clients are trying to get orders in before any tariff changes, which could be a sneaky boost for revenue this time. Technically, we might see a golden cross soon, and even though we’ve been moving sideways around $130-132, things still look positive.

Of course, the risks are there: expectations are super high, so just meeting the numbers might not be enough, and any Blackwell production issues or export restrictions could cause trouble. The options market is expecting a pretty big move too (implied straddle is at 8.5%).

Overall, data center demand is still wild, Blackwell is ramping faster than expected, and between the AI wave and potential tariff front-loading, I’m holding my shares. Analyst targets on Tiger and elsewhere average around $163, so there could be more upside. How’s everyone feeling about the China demand and Blackwell timeline? Anyone else holding through earnings? $NVIDIA(NVDA.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.