In our pre-mkt summary for Subscribers: Traders awaiting fresh catalysts to sustain the rally that erased the S&P 500’s YTD losses amid a US-China trade truce, continued deceleration in inflation, and a resurgence in technology shares.

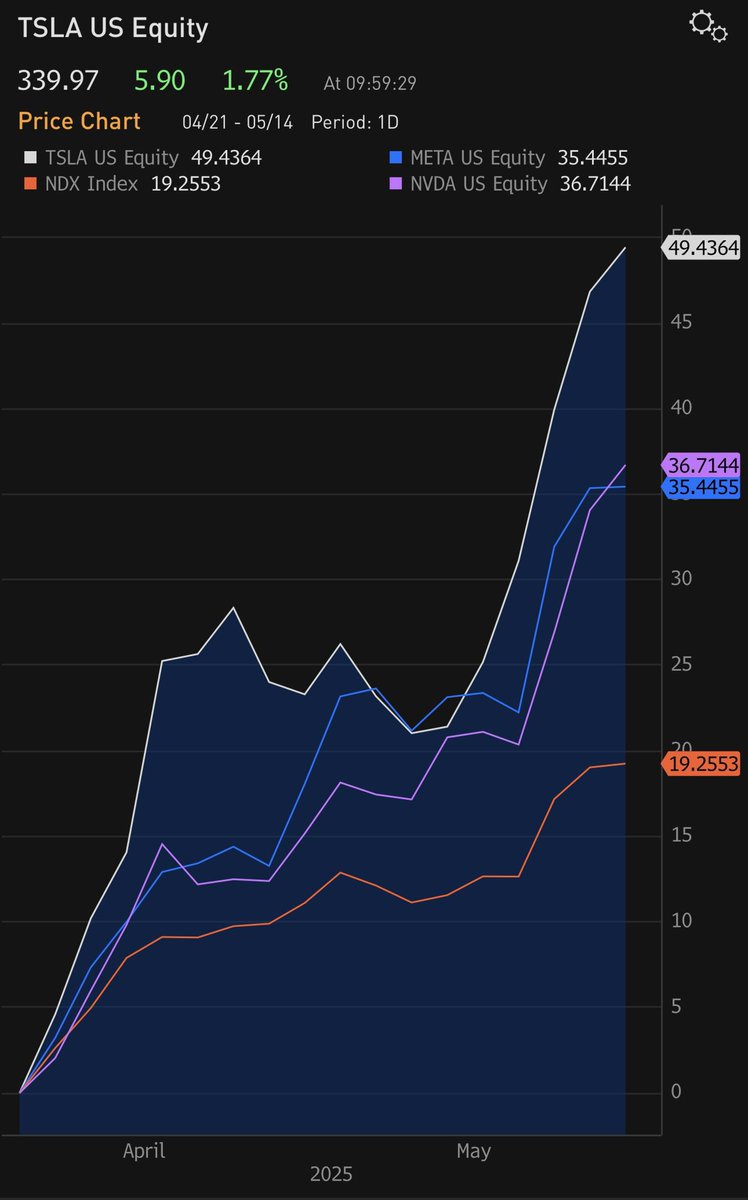

We remain skeptical of TSLA’s +49% move since dismal 1Q earnings (vs NDX +19%, $NVIDIA(NVDA.US) +37%, META +35%) as we still see asymmetrical risk associated with the Austin June robotaxi event. We remain concerned the new more affordable Tesla launch in 2H may involve stripped down Model Y trims (lower prices funded by lower costs, no new form factor, no new TAM) that cannibalize existing higher-priced Tesla M-Y trims. We continue to believe TSLA 2Q and FY’25 deliveries could be down -10% YoY and -8% YoY respectively, vs WS 2Q deliv ests of -5% and FY’25 deliv ests of -3% respectively. We still like TSLA stock long-term, but would wait for a more compelling entry point to add to positions.The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.