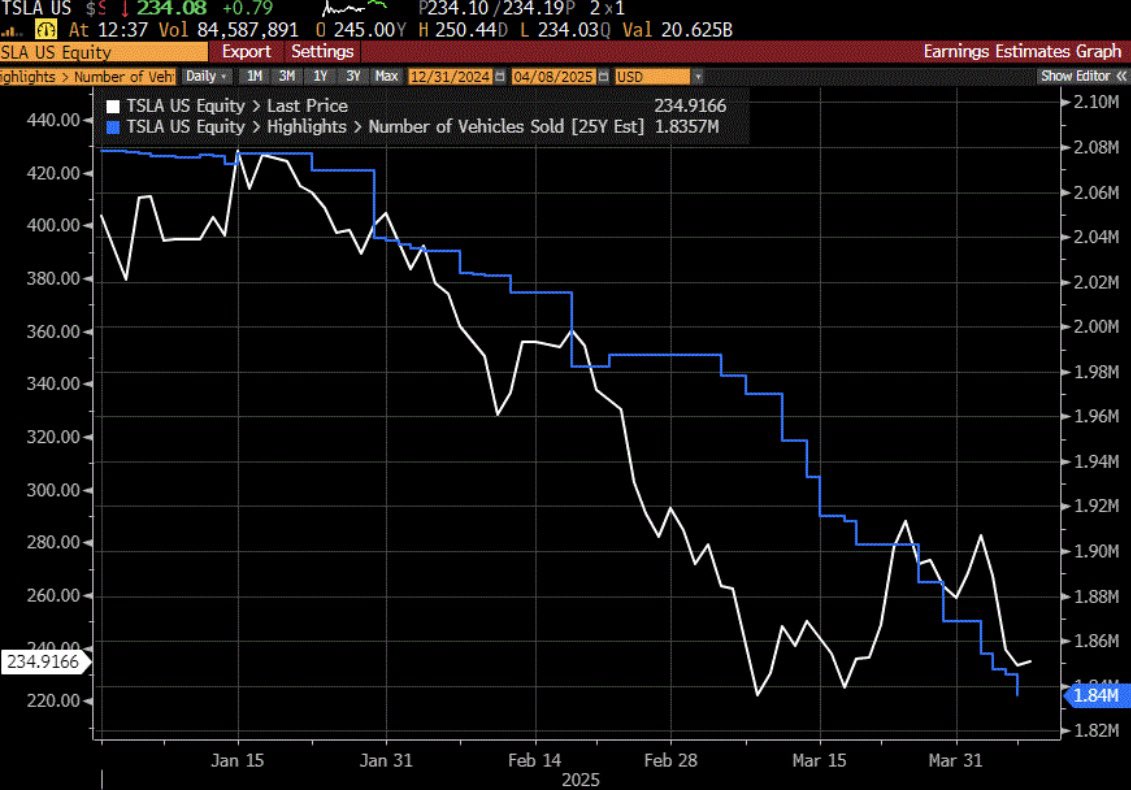

Many $Tesla(TSLA.US) investors don’t want to hear this, but TSLA FY’25 deliveries are still likely the most important metric driving TSLA’s stock through year-end. FY’25 delivery estimates have come straight down YTD and are now just +3% YoY vs +16% YoY at the beginning of the year, which is the main cause of $Tesla(TSLA.US) underperformance this year (TSLA -42%, NDX -16%). IMHO, the Austin autonomous ride-hailing test market in 3Q will likely be a non-event, since Elon’s “one toe in the water” go-slow strategy likely means that TSLA drivers will assist initially, which makes this supervised autonomy rather than unsupervised.

The other TSLA 2025 catalyst that can either help or hurt is the more affordable TSLA EV to be priced below $30K after the $7,500 EV credit. If the new vehicle is a new form factor (e.g. hatchback) that expands TSLA TAM to the compact segment (12-15% of global volume), similar to how Model Y expanded TSLA TAM to the CUV segment in 2020-21, then the TSLA volume and EPS impacts could be significant and lead to higher FY’25 deliv and earnings estimates. If on the other hand the new vehicle is just a lower-cost and lower-priced M-3 or M-Y vehicle, we’ll likely get a repeat of 2023-24 after TSLA cut prices funded by cutting costs, with little or no incremental volume.The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.