How Dollar Cost Averaging Creates Millionaires.

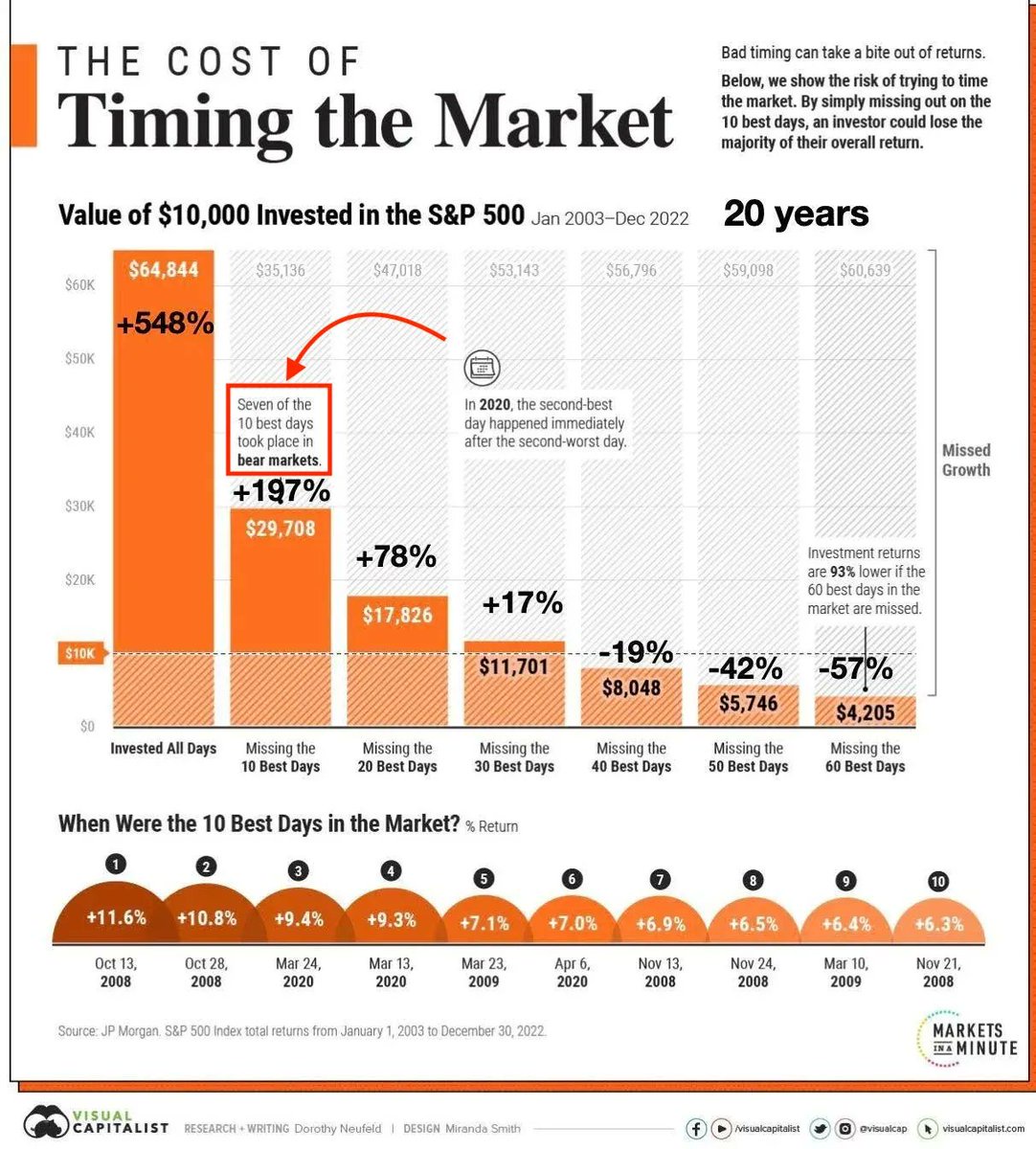

It’s become a mantra for a reason, it’s grounded in years of data, research, and (most importantly) real life success stories.Today, I’m going to dive into why staying invested matters so much and how Dollar-Cost Averaging (DCA) can give everyday investors a powerful edge.You might have felt the urge to sell everything when the markets get rocky, maybe after a steep drop in the S&P 500, a crisis in global markets, or some fresh round of doom and gloom headlines.After all, nobody wants to watch their portfolio shrink.But over the long term, market rebounds have historically been rapid and strong. Statistics from the Schwab Center for Financial Research show that from 2001 to 2020, if you missed the 10 best market days, your total return would be cut nearly in half compared to someone who stayed fully invested.Think about that. Missing just ten days, out of thousands, could separate you from achieving the goals you’ve set for your portfolio.Why does this matter so much? The best days often appear in the midst of the worst downturns. You don’t know when those best days are going to strike, and if you’re sitting on the sidelines, you could miss out on those explosive gains. That’s why consistent participation, rather than market timing, matters most:Post-2008 Recession Rebound: After the massive collapse of 2008, most people were terrified. Yet, by early 2009, those who remained in the market saw a formidable rally that lasted for more than a decade.Covid-19 Crash of March 2020: The market plummeted in record time, but rebounded just as fiercely. The S&P 500 reached new all-time highs within months.These examples illustrate a pattern of downturns and rebounds.Historically, the market has trended upward over longer time horizons despite short term volatility. That doesn’t mean it’s a smooth ride every year, but the direction has consistently moved higher over decades.Dollar-Cost Averaging is quite simple: You invest a fixed amount of money at regular intervals, regardless of where prices stand. Some people do it weekly, bi-weekly, or monthly—however it fits your budget. This strategy helps take the guesswork out of investing.When the market is high, you’re buying fewer shares for your set investment. When the market is down, you’re buying more shares at a discount. Over time, your average cost per share levels out:Reduces Emotional Bias: When you’re investing a set amount on a schedule, the panic button looks less tempting. You focus on the long-term process.Smooths Out Volatility: Rather than putting a lump sum in at a potentially unfavorable time, DCA spreads out your risk. Over time, historically, DCA has shown robust results for investors who stick with it.Academic and industry research alike supports staying in the market and employing strategies like DCA.A study by Vanguard found that while a lump sum investment can sometimes outperform DCA during bull markets, the emotional resilience and consistency offered by DCA helps many investors stay the course.In the long run, what matters most is that you keep investing rather than trying to time your entries and exits.Furthermore, a J.P. Morgan Asset Management study underscored how missing the market’s best days dramatically reduces total returns.Over a 20 year period, sitting on cash during these key days makes the difference between a healthy retirement fund and an underperforming one. Put simply, participating in the market is essential to capturing the big moves.Having said that, it is not that simple.One of the biggest mistakes new (and even seasoned) investors make is letting emotions drive decision-making. Fear leads us to sell when markets are falling, and FOMO (Fear of Missing Out) leads us to buy in a frenzy when markets are euphoric.DCA and a steady commitment to staying invested are the antidotes to these emotional swings.Key mindset shifts to consider:Think in Years, Not Days: Market corrections happen and can be scary, but they are normal events.Focus on Fundamentals: Whether you’re buying index funds or individual stocks, always know what you’re investing in.Ignore the Noise: Financial headlines can sway your mood. Keep your eyes on your long-term objectives.Diversify: DCA doesn’t replace diversification. Spread your investments across different asset classes, sectors, and regions to reduce risk.Keep an Emergency Fund: This helps ensure you won’t have to liquidate your long-term positions during a market dip for unexpected expenses.Review, But Don’t Obsess: Check in on your portfolio periodically, but avoid minute-by-minute price tracking.Market volatility is a feature, not a bug.The upside potential of stocks has historically rewarded those who remain cool headed during storms and continue to invest regularly. Time in the market, combined with the discipline of Dollar-Cost Averaging, often outperforms the stress, and questionable success of attempting to time the market’s every dip and spike.Still, if the data teaches us anything, it’s that staying invested and systematically contributing over time is the surest path to success for the average investor. By harnessing the power of DCA and avoiding the pitfalls of fear based selling, you set yourself up for those critical rebound days and achieve the best potential for long term growth.TomThe copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.