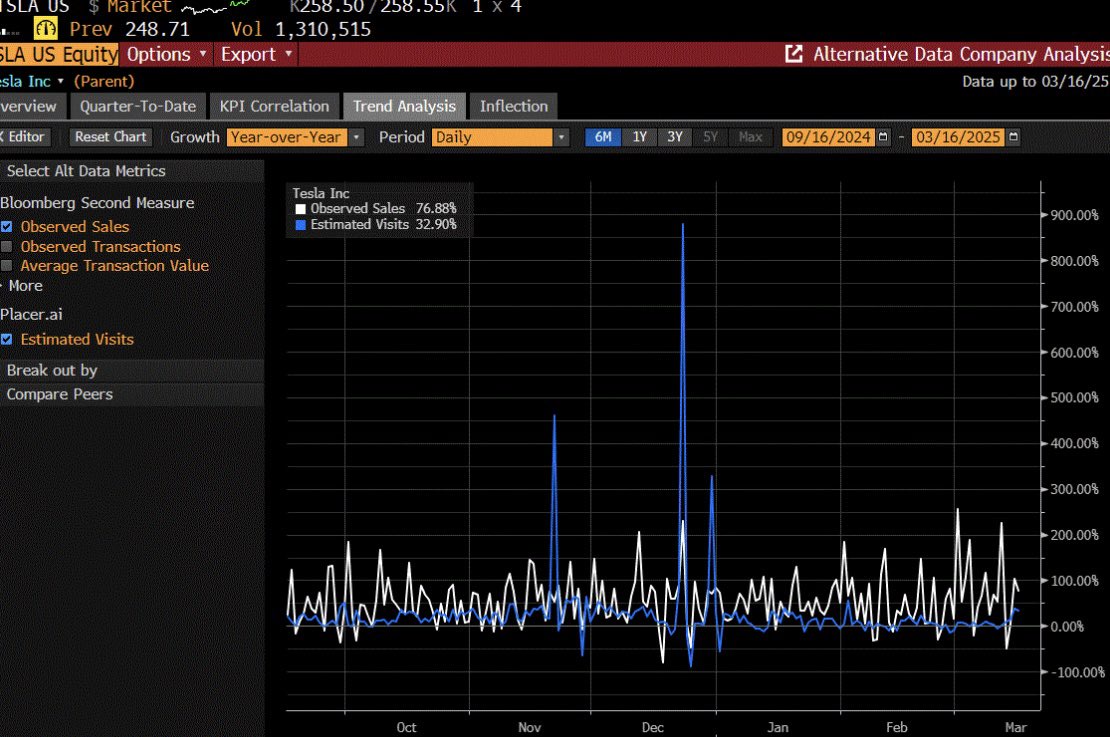

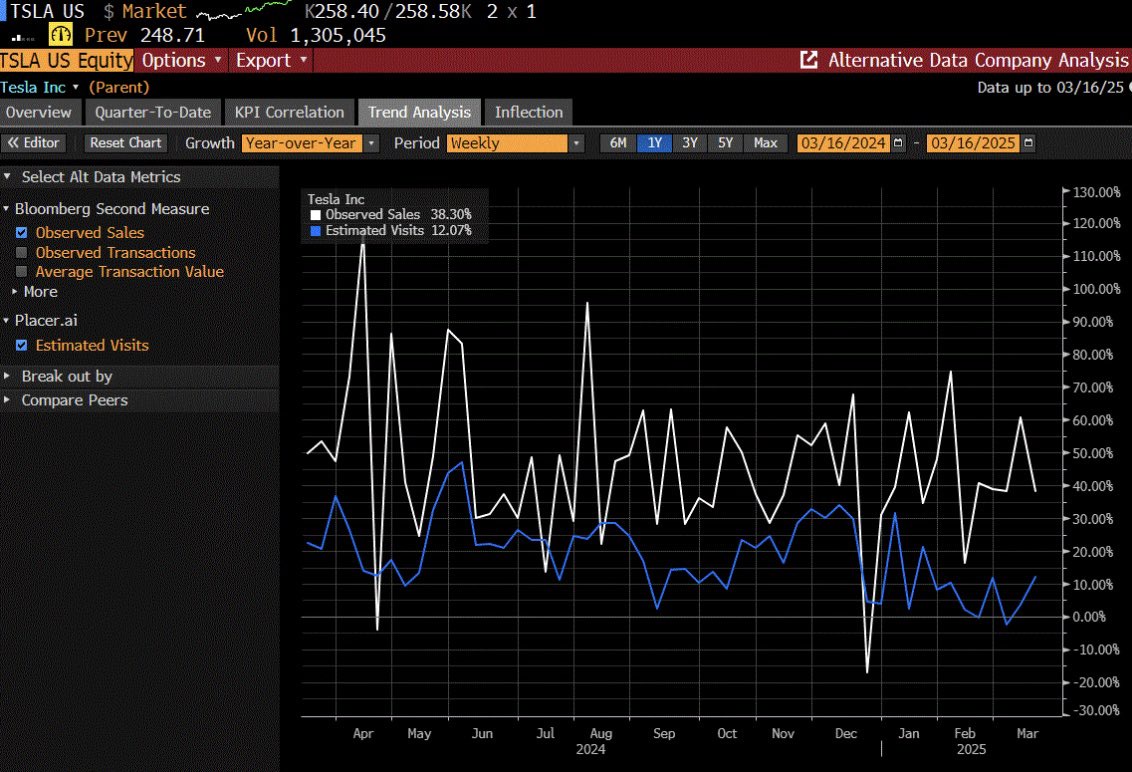

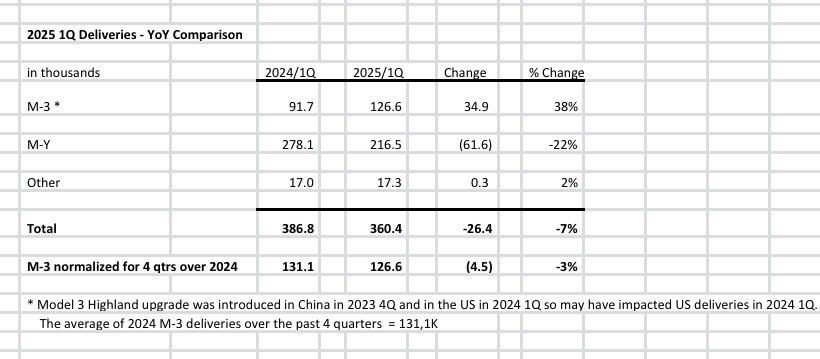

$Tesla(TSLA.US) +10.5% today (vs NDX +2.2%) as investors starting to realize the decline in 1Q deliv estimates (from 459K on 1/1 to 400K today) are more due to lack of inventory of new refreshed Model Y than Elon’s political rhetoric and DOGE actions. From third party credit card data, we see that orders and specifically deposits don’t seem to be impacted by Tesla’s bad PR. Also, 1Q Model 3 delivs have so far been stable YoY.

With the refreshed Model Y supply shortage now easing, we should see a corresponding increase in TSLA 2Q deliv estimates over the next few weeks. We also believe tonight’s Chinese weekly insured registrations could top last week’s YTD high of 15.3K. That said, it would be naive for us to argue that Elon Musk’s political rhetoric and actions have no impact on TSLA demand. Democrats are 2.5x as likely to buy an EV as Republicans, and when Elon backs a conservative political cause (e.g. endorses AfD party candidate in Germany) it’s going to impact TSLA demand given that Dems way overindex EV purchases.The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.