Micron QFeb25

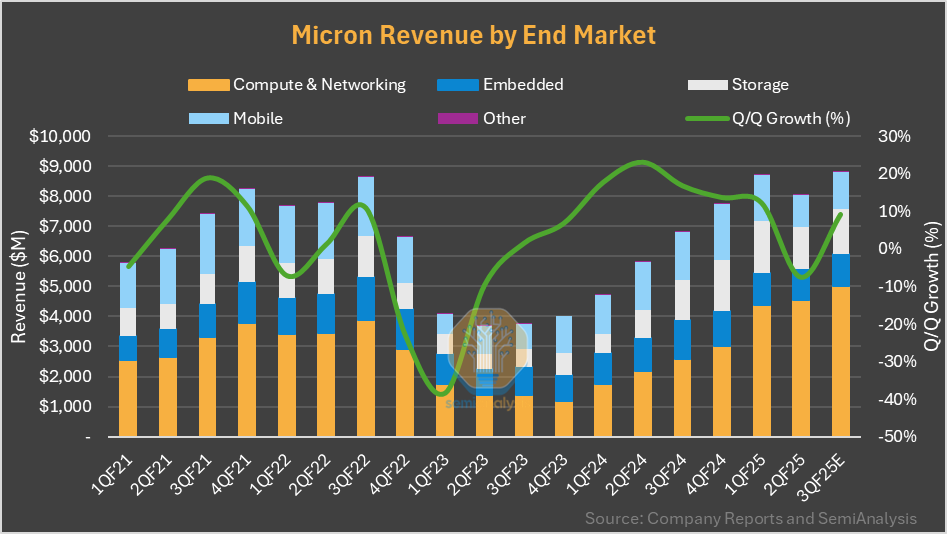

- Revenue down -8% q/q and up +38% y/y to $8.1B ; GM down by 160bps q/q (vs few 100 bps down guidance); GM to be down in 3Q but to be up somewhat in 4Q- HBM revenue up 50%+ to $1B+; on track to multiple billions in FY25- HBM growth momentum, strong position in high profit segments, process lead and manufacturing execution are key drivers- Persistent NAND weakness, GM pressure, non-HBM DRAM declines, HBM yield ramps remain challengesSource: Sravan Kundojjala

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.