Merck's revenue for the full year 2025 is projected to be $65 billion, a 1% year-on-year increase. The revenue guidance for 2026 is between $65.5 billion and $67 billion, which is below expectations | Earnings report insights

Merck released its 2025 financial report, with annual revenue of $65 billion, a year-on-year increase of 1%. The revenue guidance for 2026 is expected to be between $65.5 billion and $67 billion, below market expectations. Earnings per share are $8.98, a year-on-year increase of 17%. Sales of the Gardasil vaccine face challenges, with sales in 2025 expected to be $5.233 billion, a year-on-year decrease of 39%. The company's CEO expressed concerns about the public health impact of changes in vaccination policies

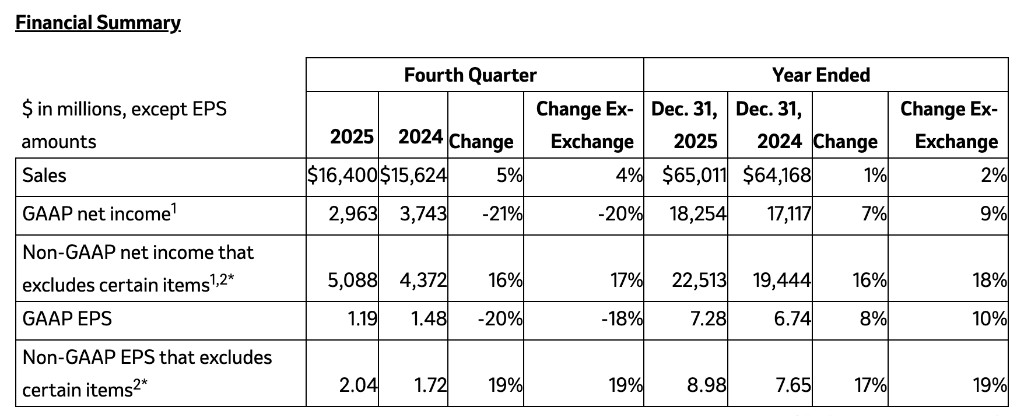

On February 3rd, Merck released its financial performance for the fourth quarter and the full year of 2025. Driven by the continued growth of Keytruda, increased contributions from new products such as Winrevair and Capvaxive, and robust performance in the animal health business, the company's total sales reached $65 billion, a year-on-year increase of 1%. The non-GAAP earnings per share were $8.98, a year-on-year increase of 17%.

Merck's performance in 2025 was solid, but the earnings forecast for 2026 is below market consensus. The company expects total sales for the year to be between $65.5 billion and $67 billion, with adjusted earnings per share of $5.00 to $5.15, both of which fall short of Wall Street's general expectations.

Due to one-time expenses related to the acquisition of Cidara Therapeutics, the adjusted earnings per share for 2026 include approximately $3.65 in acquisition-related costs, leading to a significant decline from $8.98 in 2025. Excluding the short-term merger impact, the company's core business is still expected to maintain a growth trend.

Gardasil Faces Global Sales Pressure

Gardasil, once Merck's second core product, is currently facing growth challenges in multiple global markets. In the fourth quarter of 2025, sales of the vaccine were $1.031 billion, a year-on-year decrease of 35%. Although this was slightly above analysts' previously conservative forecasts, it still shows a clear downward trend; total sales for the year were $5.233 billion, a significant year-on-year decline of 39%.

In some key international markets, demand for the vaccine has noticeably weakened. The growth momentum in major Asian markets, which previously performed well, has significantly slowed, facing increasingly fierce price and market share competition from local manufacturers. Additionally, the Japanese market has also seen a decline in subsequent demand due to the conclusion of the national catch-up immunization program.

Even in the U.S. market, Gardasil is encountering changes in the policy environment. In January of this year, U.S. health authorities updated vaccination guidelines, lowering the recommended dosage. The company's CEO Robert Davis previously stated that while the financial impact of this adjustment is "generally manageable," he is "more concerned about its potential impact on public health policy." Meanwhile, senior officials at the U.S. Department of Health and Human Services have recently been pushing for adjustments to the vaccine policy framework, bringing new uncertainties for vaccine companies like Merck.

Keytruda Growth Slows as Patent Expiration Approaches

Merck's core product Keytruda achieved sales of $8.4 billion in the fourth quarter, a year-on-year increase of 7%, exceeding market expectations. Total sales for the year surpassed the $30 billion mark for the first time, reaching $31.68 billion, a year-on-year increase of 7%, but the growth rate has shown signs of slowing, indicating that its growth is gradually approaching a plateau. **

The growth of the drug is primarily driven by global market demand for its early indications, covering areas such as triple-negative breast cancer, non-small cell lung cancer, renal cell carcinoma, cervical cancer, and head and neck cancer, while metastatic urothelial carcinoma, gastric cancer, and endometrial cancer also continue to contribute stable demand. Notably, the newly launched subcutaneous injection formulation Keytruda Qlex achieved sales of $35 million in the U.S. market in the fourth quarter.

As Keytruda's key patents are expected to gradually expire starting in 2028, the company's management faces pressure to introduce new growth drivers through strategic mergers and acquisitions. In January of this year, amid market rumors of Merck's intention to acquire Revolution Medicines Inc., CEO Robert Davis publicly stated that he had identified merger opportunities worth tens of billions of dollars. The subcutaneous formulation of Keytruda Qlex, approved last September, is one of the key business strategies the company has adopted to extend the product lifecycle of Keytruda.

Acceleration of New Product Portfolio Transformation

Merck is actively advancing its product portfolio transformation to address the impending patent expirations and generic competition pressures faced by several core products, including Keytruda. In addition to this star oncology drug, its diabetes treatment drug Januvia and surgical medication Bridion will also enter the competitive phase.

The company's new product lines are performing exceptionally well. The pulmonary arterial hypertension treatment drug Winrevair achieved annual sales of $1.443 billion, a significant leap from $419 million in 2024, quickly entering the ranks of blockbuster products, with growth primarily driven by demand in the U.S. market and early launches in some overseas markets. The 21-valent pneumococcal conjugate vaccine Capvaxive had annual sales of $759 million, showing rapid market penetration.

Additionally, the chronic obstructive pulmonary disease treatment drug Ohtuvayre, acquired from Verona Pharma, achieved sales of $178 million in the fourth quarter, exceeding market expectations. The company assesses that this drug has "billion-dollar level" commercial potential. The animal health business also maintained robust growth, with annual sales of $6.354 billion, a year-on-year increase of 8%.

2026 Outlook Includes Significant Acquisition Costs

Merck's 2026 performance guidance indicates that adjusted earnings per share are expected to be in the range of $5.00 to $5.15. This guidance includes approximately $9 billion in one-time costs associated with the acquisition of Cidara Therapeutics (approximately $3.65 per share), as well as related financing and operating costs (approximately $0.30 per share). In comparison, the company's adjusted earnings per share for 2025 are $8.98, which includes approximately $0.20 per share in one-time costs related to business development Mizuho healthcare industry analyst Jared Holz pointed out that although the market has anticipated that Merck will provide conservative guidance, the actual gap "may be slightly higher than investors previously estimated."

The company expects an adjusted gross margin of about 82% in 2026, with adjusted operating expenses between $35.9 billion and $36.9 billion, which includes one-time costs related to the aforementioned acquisition. The adjusted effective tax rate is expected to be between 23.5% and 24.5%. In addition, based on mid-January exchange rates, foreign exchange fluctuations are expected to bring about a 1% positive impact on annual sales, contributing approximately $0.10 to earnings per share.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk