Target price of $1,000! The institutions on Wall Street that are most optimistic about Sandisk have a valuation estimate with a PE multiple of only 11 times

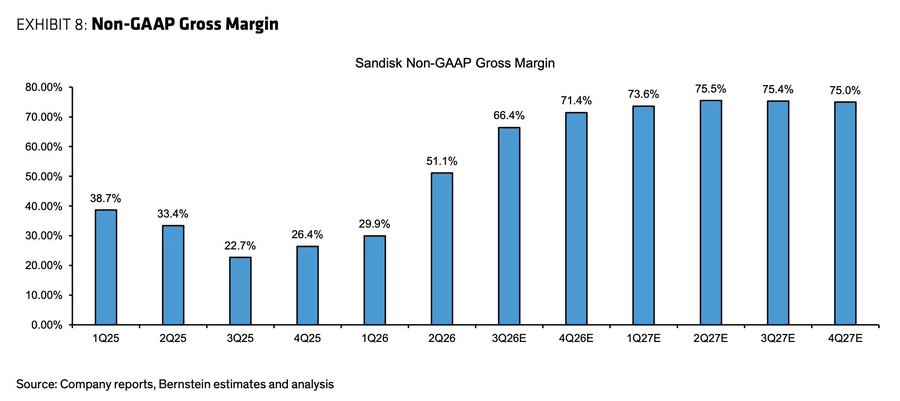

Bernstein raised the target price for Sandisk to $1,000, indicating an 85% upside from the current stock price, while the valuation is only 11 times the fiscal year 2027 PE. The key highlight is the explosive expansion of the company's gross margin— in the second quarter, the Non-GAAP gross margin reached 52.1%, far exceeding the market expectation of 42%, and the guidance for the third quarter is as high as 65-67%, which means the company is entering a super profit cycle

After a strong earnings report, Bernstein analyst Mark C. Newman significantly raised the target price for SanDisk from $580 to $1,000, an increase of 72%. This aggressive target price is based on the firm's forecast of $90.96 earnings per share for the fiscal year 2027, corresponding to a price-to-earnings ratio of only 11 times.

More notably, analysts expect the company's free cash flow for the fiscal year 2027 to reach $13.8 billion, corresponding to an EV/FCF valuation multiple of only 10.3 times, which is 195% higher than the market consensus expectation. For investors, the key highlight is the explosive expansion of the company's gross margin—Non-GAAP gross margin reached 52.1% in the second quarter, far exceeding the market expectation of 42%, while the third-quarter guidance is as high as 65-67%, indicating that the company is entering a super profit cycle.

Performance Significantly Exceeds Expectations, Gross Margin Expansion Becomes the Biggest Highlight

Analysts pointed out that SanDisk's performance in the second quarter of fiscal year 2026 significantly exceeded expectations. Revenue reached $3 billion, a year-on-year increase of 31%, surpassing the market consensus expectation of $2.673 billion by 13.2%. The driving factors include a low single-digit percentage increase in shipments, while the average selling price (ASP) surged over 35% quarter-on-quarter, far exceeding the market expectation of 16%.

The performance in terms of profit margins was particularly impressive. Non-GAAP gross margin expanded to 52.1%, exceeding the market expectation of 42% by 812 basis points, and a significant increase of 2,220 basis points from the previous quarter's 29.9%. Operating margin reached 37.5%, while the market expectation was only 24.4%, exceeding by 1,310 basis points. Non-GAAP earnings per share were $6.20, 77.4% higher than the market expectation of $3.49.

Analysts emphasize that the driving force behind margin expansion comes not only from the rise in ASP but also from significant cost reductions and product mix optimization. Unit costs decreased by about 9% in the second quarter, partly due to lower factory startup costs—this quarter's factory startup costs dropped to $24 million, down from $72 million in the previous quarter, and these costs are expected to be completely eliminated in the future.

Third-Quarter Guidance Becomes Stock Price Catalyst, Gross Margin Set to Exceed 65%

Bernstein analysts believe that the third-quarter guidance is the real catalyst for the stock price surge.

The company guides third-quarter revenue to be between $4.4 billion and $4.8 billion, a quarter-on-quarter growth of 53%, which means ASP will surge over 55% quarter-on-quarter. Even more astonishing, the Non-GAAP gross margin guidance is 65-67%, expanding by 1,490 basis points quarter-on-quarter. This will drive Non-GAAP earnings per share to reach $12-14, far exceeding the analyst's base case forecast of $6.5, and even surpassing the optimistic scenario forecast of $9.1. **

Analysts point out that the company currently has over 90% of its sales based on short-term contracts, but is evaluating a shift to long-term agreements to achieve higher and more sustainable pricing and fixed volumes. The company has signed a long-term agreement that includes prepayment terms, and multiple agreements are under negotiation.

Significant Upgrade to Earnings Forecast, FY27 EPS 188% Higher than Consensus

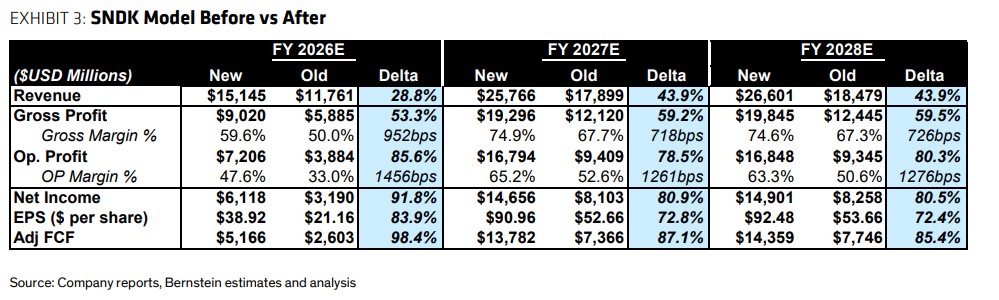

Based on strong performance, better-than-expected guidance, company comments, and an extremely strong pricing environment, analysts have once again significantly upgraded their earnings forecasts—primarily based on stronger pricing power in the short term. The earnings per share forecasts for fiscal years 2026 and 2027 have been raised to $38.92 and $90.96, respectively, with the latter being 188% higher than the market consensus of $31.59.

Specifically, the revenue forecast for fiscal year 2026 is $15.145 billion, up 28.8% from the previous forecast of $11.761 billion; the gross margin forecast is 59.6%, an increase of 952 basis points from the previous forecast of 50.0%; and the operating margin forecast is 47.6%, an increase of 1456 basis points from the previous forecast of 33.0%.

The forecast for fiscal year 2027 is even more aggressive: revenue of $25.766 billion, up 43.9% from the previous forecast; gross margin reaching 74.9%, an increase of 718 basis points from the previous forecast; and operating margin reaching 65.2%, an increase of 1261 basis points. Adjusted free cash flow is expected to reach $13.782 billion, an increase of 87.1% from the previous forecast.

Data Center Demand Explosion, AI-Driven Structural Improvement

Analysts emphasize that the company is strategically allocating constrained supply to end markets that prioritize supply security over price—specifically, data centers over PCs/mobile devices. Data centers are undoubtedly the fastest-growing segment this quarter, with a sequential growth of 64%, compared to 21% growth in edge computing and 39% growth in consumer segments. Data centers currently account for about 15% of total revenue, up from 12% last quarter.

Management has repeatedly raised its outlook for data center demand, from an initial growth of over 20%, to over 40%, and now up to over 60% EB (exabytes) growth by 2026. The company expects data centers to become the largest end market in the NAND industry by 2026, driven by AI workloads.

Analysts note that based on Jensen Huang's comments at CES regarding the new Vera Rubin configuration, management believes that the new AI system architecture could drive an additional 75-100 EB of NAND demand in 2027, potentially doubling by 2028, although this upside potential has not yet been included in guidance or growth rate estimates.

$1000 Price Target, Valuation Still Attractive

Analysts have raised the price target from $580 to $1000, still based on 11 times (unchanged) the fiscal year 2027 earnings per share. This implies an EV/FCF valuation multiple of 10.3 times, based on the analysts' expected $13.8 billion in free cash flow for fiscal year 2027, which is 195% higher than the market consensus.

Based on the closing price of $539.30 on January 29, the target price corresponds to an 85% upside potential. The current stock price corresponds to a price-to-earnings ratio of 13.9 times for fiscal year 2026 and only 5.9 times for fiscal year 2027, well below the average valuation level of technology stocks Analysts believe that considering the company is in a super profit cycle, and the gross margin is expected to reach around 75% in the fiscal year 2027, this valuation is significantly attractive.

It is worth noting that Sandisk's stock price has risen 127.2% year-to-date and over 1100% in the past 12 months, but analysts believe that based on the earnings growth potential over the next two years, there is still considerable upside in the current valuation.