What does the Federal Reserve's "dovish pause" mean? Morgan Stanley: The future path of interest rate cuts will be more driven by inflation

The Federal Reserve's January meeting implemented a "dovish pause." Morgan Stanley interprets that the future path of interest rate cuts has shifted from relying on a weak labor market to primarily depending on whether inflation data can decline as expected. The bank maintains its forecast that the Federal Reserve will cut interest rates in June and September, but warns of the upside risk of not cutting rates at all this year if economic momentum is exceptionally strong and the anti-inflation process is hindered

According to the latest research report released by Morgan Stanley, the Federal Reserve implemented a "dovish pause" at the January FOMC meeting. Although interest rates were kept unchanged, the signals released by the Federal Reserve indicate that the future path of rate cuts will change, no longer solely relying on weakness in the labor market, but rather more dependent on the performance of inflation data.

According to the Wind Trading Desk, on January 29, Morgan Stanley pointed out in its report that Federal Reserve Chairman Jerome Powell emphasized the strong performance of economic data and the "slight signs of stabilization" in the labor market during the meeting. Most critically, the Federal Reserve remains confident in its judgment that inflation caused by tariffs will be "transitory." Powell stated that the employment downside risks, which were previously cited as a reason for "risk management" rate cuts, have diminished, while the upside risks to inflation have also decreased.

This means that the Federal Reserve is not in a hurry to further loosen policies. Morgan Stanley's team of economists believes that the committee currently tends to lower the policy rate only after seeing clearer signs of a slowdown in inflation. Based on the expectation that anti-inflation evidence may emerge later this year, the bank maintains its outlook that the Federal Reserve will cut rates in June and September.

Although Powell did not make a clear commitment regarding the specific driving factors for future rate cuts, Morgan Stanley interprets that the Federal Reserve still holds a dovish inclination and views the current policy stance as "well-positioned." As long as the economic outlook develops as the Federal Reserve expects, the policy rate will be gradually lowered after evidence of a slowdown in inflation is established, while the current interest rate level is considered to be at the upper limit of the neutral range, suitable for guiding inflation downward.

Economic Resilience and Policy Shift Driven by Inflation

At this meeting, FOMC members showed greater consistency regarding the economic outlook. Powell pointed out that compared to the December meeting, the current economic outlook is stronger and maintains "robust" momentum as it enters 2026. Factors supporting this view include resilient consumer spending, expanding business investment, expectations of fiscal support, favorable financial conditions, and ongoing AI-related capital expenditures. The housing market is seen as the only weak area.

With the downside risks to employment diminishing, the logic for future rate cuts has fundamentally changed. Morgan Stanley analyzes that if the economic outlook meets expectations, future rate cuts will be "inflation-based." As evidence of anti-inflation may not emerge until the second half of this year, the Federal Reserve will remain patient. Powell reiterated the stance of making decisions "at successive meetings" during the press conference and hinted that under conditions of robust economic growth, a relatively stable unemployment rate, and slightly elevated inflation, the Federal Reserve is not in a hurry to act.

Risk Scenario: If Anti-Inflation Efforts Are Stalled, No Rate Cuts for the Year

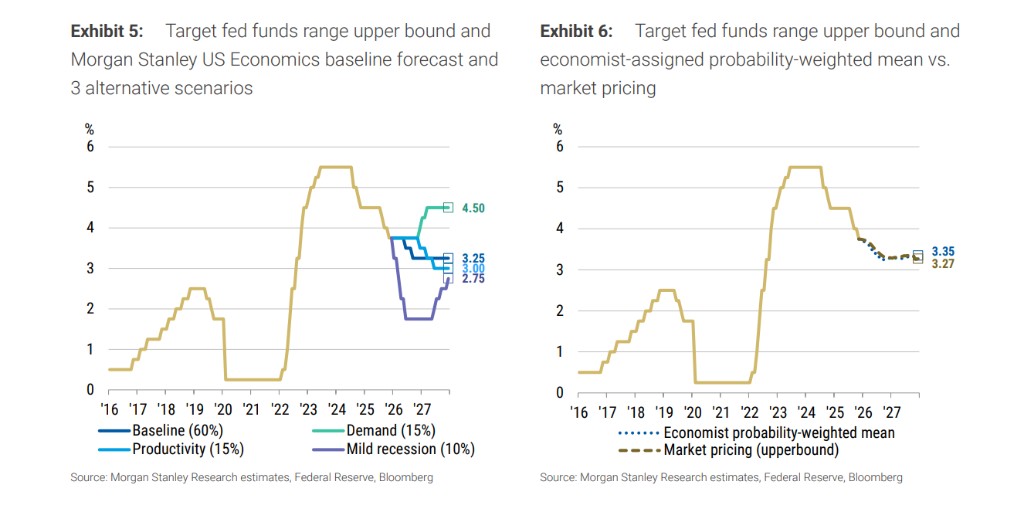

Although the baseline scenario is two rate cuts within the year, Morgan Stanley also highlighted the upside risk of "no rate cuts for the entire year of 2026." If the economy experiences the "animal spirits" inflation scenario described by the bank, where fiscal stimulus exceeds expectations and the policy backdrop triggers demand-side acceleration earlier and more strongly, then inflation may struggle to slow down In this context, as tariff pressures are expected to ease after the first quarter of 2026, if demand-side forces are too strong to hinder the decline in inflation, and monthly inflation data does not show substantial slowdown, the Federal Reserve may choose to remain on hold until the end of the year, rather than further pursue policy normalization through rate cuts.

The Productivity Puzzle and Data Noise

Regarding the relationship between productivity and AI, Powell holds a cautiously optimistic view. He hinted that the current productivity growth is above fundamentals, but did not directly attribute it to AI. Instead, he believes that robust economic growth accompanied by a sharp slowdown in hiring may be the main reason. Powell pointed out that if the economy remains strong, it will create some labor demand, thereby suppressing productivity growth. Morgan Stanley added that fluctuations in trade and inventory data may also play a role, and productivity growth is expected to slow in the coming quarters as these factors fade.

In terms of data quality, Powell is more optimistic about the assessment of the labor market and inflation, indicating that the committee is extracting signals from the recently noisy data. Regarding the issue of data distortion, Powell believes it is no longer a substantive barrier, merely "tweaks here and there."

Market Strategy: Maintain Neutrality and Focus on Swap Spreads

Based on the current policy outlook, Morgan Stanley's interest rate strategist Matthew Hornbach and his team recommend that investors maintain neutrality on the duration and curve of U.S. Treasuries, and continue to go long on the 2-year UST SOFR swap spread. Current market pricing shows that investors expect two more 25 basis point rate cuts, which is highly consistent with the probability-weighted forecasts of the bank's economists.

In the foreign exchange market, Morgan Stanley continues to predict a weakening dollar, but given that market pricing has fully reflected the Federal Reserve's policy outlook, the Fed's policy is unlikely to be the main driver of the dollar's decline. Market focus will shift more towards international monetary policy and related intervention risks.

For agency MBS (mortgage-backed securities), Morgan Stanley's strategist Jay Bacow maintains a neutral stance. Although a low volatility environment is favorable for MBS, the index OAS (option-adjusted spread) is close to its narrowest level in recent years, and there remains uncertainty in housing policy. Additionally, the Federal Reserve has confirmed that it will continue to increase the securities holdings in the SOMA portfolio by purchasing Treasury securities and will reinvest all principal payments from agency MBS into Treasury securities, keeping the balance sheet policy unchanged