AI reasoning is a necessity, NAND "cycles are longer and more stable"! JP Morgan: The main character in this round is eSSD, Kioxia has become the first choice

Don't just focus on HBM. JP Morgan predicts that the annual growth rate of the NAND market size will soar from the past 10% to 34% over the next three years, with prices expected to surge by 40% in 2026. The core logic is that AI inference makes enterprise-level SSDs "secondary memory," with a single AI server's storage demand reaching 70TB, while the supply of mechanical hard drives collapses, accelerating the replacement. NAND is transforming from a cyclical product into a core asset of AI infrastructure. Manufacturers like Kioxia are entering a golden era

Stop focusing on GPUs and HBM high-bandwidth memory; the wave of AI inference is allowing NAND flash memory to break free from the fate of being a "cyclical commodity" and evolve into a high-growth AI infrastructure asset.

According to news from the Chasing Wind Trading Desk, on January 23, JP Morgan's Asia-Pacific technology research team released an in-depth report titled "Semiconductors: NAND - A Longer and Stronger Upcycle," announcing that the NAND industry has entered a new super cycle driven by AI inference. Unlike previous cycles driven by smartphone and PC shipments, the core driving force of this cycle is enterprise SSD (eSSD).

JP Morgan believes that as AI workloads shift from training to inference, and with supply bottlenecks in HDD (hard disk drive) nearline storage, the NAND market is experiencing unprecedented structural growth. Moreover, investors have severely underestimated the strategic position of NAND in the era of AI inference.

Goodbye to the "Cyclical Curse": 10% Growth is History, Welcome 30% TAM Explosion

For a long time, the NAND industry has been viewed as a typical cyclical commodity: technological advancements lead to cost reductions, manufacturers ramp up production crazily, which then triggers price collapses.

But now, this logic has been broken.

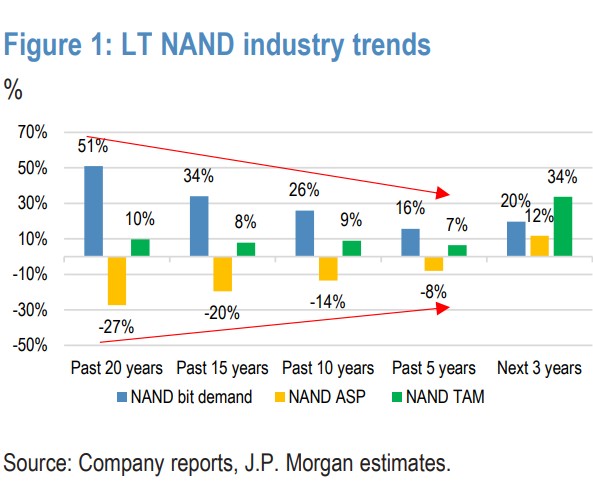

JP Morgan reviewed data from the past 25 years and found that, whether over the past 20 years, 15 years, or 5 years, the NAND industry's TAM (Total Addressable Market) annual compound growth rate (CAGR) has consistently hovered in the range of 7%-12%.

However, forecast data indicates that in the next three years (2025-2027), this figure will surge to 34%.

This leap in growth does not come from blind accumulation of shipments but rather from a rare resonance of "increased volume and price." The report points out that the past expansion of the NAND market mainly relied on high growth in bit shipments to offset the plummeting ASP (average selling price). However, in this cycle, ASP will become a positive driving force for growth.

JP Morgan predicts that the blended average selling price of the NAND industry will rise significantly by 40% year-on-year in 2026. More critically, this increase is not a fleeting moment; it is expected that prices will only slightly drop by 2% in 2027, maintaining high levels.

This change in fundamentals directly leads to a revaluation. The report indicates that the market's pricing of storage stocks is stripping away the pure "cyclical attributes" and instead assigning them "AI growth attributes."

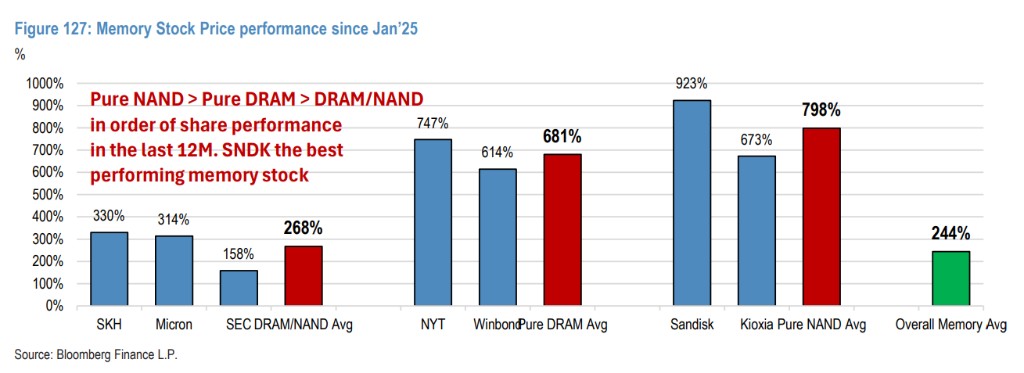

Since January 2025, the global storage sector's market value has surged by 242%, but JP Morgan believes that considering the irreplaceability of NAND in AI inference, this revaluation is far from over.

The "Invisible Cornerstone" of AI Inference - Why eSSD?

There is a common misconception in the market: AI only benefits DRAM (especially HBM), and NAND is merely a supporting role. JP Morgan extensively corrects this view in the report: during the AI inference phase, the importance of eSSD (enterprise solid-state drive) is on par with HBM. **

The report clarifies the essential differences between training and inference:

-

Training Phase: The core is computing power and bandwidth. A large amount of data needs to be processed in parallel, with HBM being the absolute main player, while NAND mainly handles cold data storage, which has limited value.

-

Inference Phase: The core is latency and context. When a large model faces real-time questions from users, it needs to quickly retrieve and generate tokens from a vast number of parameters.

Secondly, KV Cache Offloading — a key technology has made breakthroughs.

As the context window of AI models continues to expand, the GPU memory (HBM) capacity is rapidly becoming insufficient. To address this bottleneck, the tech community has introduced KV Cache Offloading technology. Simply put, it offloads intermediate state data that originally had to be squeezed into expensive HBM to external storage.

This places extremely high demands on external storage: It must be fast enough and large enough.

JP Morgan specifically mentioned NVIDIA's ICMS (Inference Context Memory Storage) platform based on the BlueField-4 DPU, which was unveiled at CES 2026. This platform allows GPUs to bypass CPUs and access SSDs directly with extremely low latency. This transforms eSSD from merely a "hard drive" into a "secondary memory" within AI computing systems.

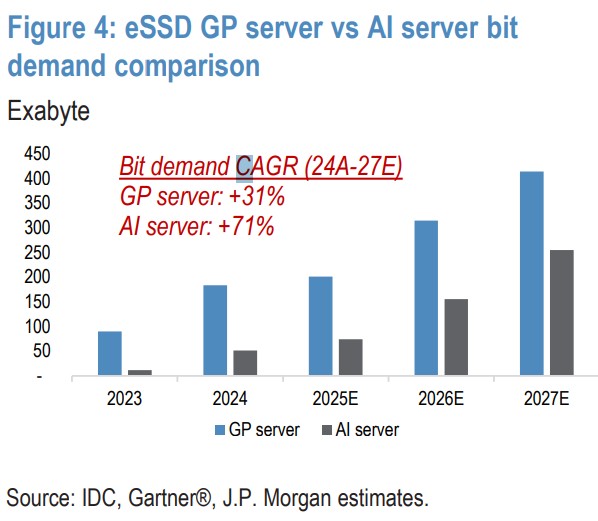

Feedback from the demand side is direct and aggressive. The report shows that the bit shipment volume of eSSD in 2024 has increased by an astonishing 86% year-on-year, a growth rate not seen since 2012.

Looking ahead, JP Morgan predicts that the storage capacity demand for AI servers will exceed 70TB per unit, more than three times that of general servers (approximately 20TB). By 2027, eSSD will account for 48% of global NAND bit demand, completely surpassing smartphones (30%) and PCs (22%), becoming the primary demand pillar in the NAND industry.

Perfect Storm — HDD Shortage and the Rise of QLC

The explosion of eSSD is not only due to the incremental demand from AI but also from the "forced replacement" in the existing market. The report reveals a supply chain crisis overlooked by the market: the collapse of mechanical hard drive (HDD) supply.

- The "Despair" of Mechanical Hard Drives Over the Past Two Years

Due to the sluggish storage market in recent years, HDD manufacturers (such as Seagate and Western Digital) have significantly reduced capital expenditures. When the data storage demand driven by AI suddenly surged, the HDD industry found itself unable to expand production in the short term.

JP Morgan cites data from TrendForce and Gartner, indicating that the delivery cycle for large-capacity nearline HDDs has now reached two years, with supply being extremely tight

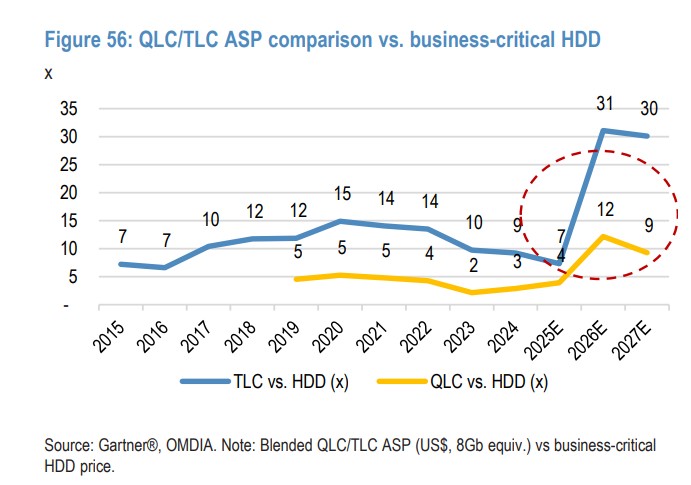

- The Cost-Effectiveness Moment of QLC

Faced with the shortage of HDDs, data center customers have no choice but to turn to NAND Flash. This has provided QLC (Quad-Level Cell) with an excellent opportunity.

Although the price of SSDs (even QLC) is still several times that of HDDs (currently about 6-8 times), in the race for AI infrastructure construction, the priority of "availability" and "performance" far outweighs "cheapness." In addition, the advantages of SSDs in energy consumption and space utilization also better meet the stringent requirements of AI data centers for power and heat dissipation.

The report specifically points out that the current penetration rate of SSDs in the "Business-Critical" storage sector is only 19%, which means there is huge potential for replacing HDDs in the future. JP Morgan estimates that for every 1 percentage point increase in SSD penetration, it will bring approximately $2 billion in incremental revenue to the NAND industry.

The "Understanding" on the Supply Side — Why Are Manufacturers No Longer Crazy About Expanding Production?

With such strong demand and enticing prices, historically, manufacturers should start buying equipment and building new factories like crazy. However, JP Morgan has observed the opposite situation: the supply side has shown unprecedented restraint.

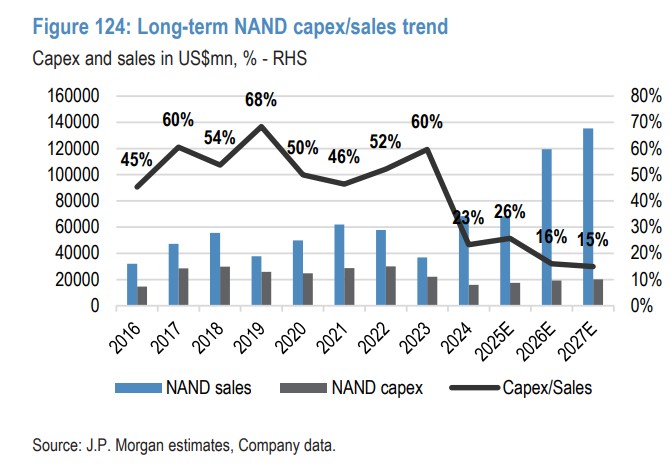

- Capital Expenditure Intensity Hits Historic Low

Data shows that in the next three years, the capital expenditure (Capex) of the NAND industry as a percentage of sales will drop to 15%-16%. In comparison, this ratio has remained at 30%-50% for the past decade, peaking at 68% in 2018.

JP Morgan analysts believe that this "low investment" is not temporary but structural.

Caption: The capital expenditure intensity (Capex/Sales) of the NAND industry is expected to remain low for a long time, which is the biggest difference between this cycle and previous ones, directly limiting future capacity release.

- Physical Constraints: The Limits of Stacking

Why not make money when there is an opportunity? Because it has become "unprofitable." The report delves into the technical bottlenecks:

-

Etching Difficulty Increases Exponentially: When the number of NAND stacking layers exceeds 300 or 400, it becomes extremely difficult to create uniform holes (Channel Holes) on a 30-micron thick stacking layer. High aspect ratio etching can lead to hole deformation, directly causing unit failure.

-

Wafer Warpage: Stacking hundreds of layers generates enormous mechanical stress, causing the wafer to bend by hundreds of microns, which is catastrophic during the manufacturing process

-

High Threshold of Hybrid Bonding: To address the above issues, manufacturers must adopt hybrid bonding technology, separating the production of logic chips and memory arrays before bonding them together. This not only requires extremely expensive ultra-high precision equipment but also suffers from overall output being dragged down by the yield issues of logic chips.

Therefore, the current expansion of NAND is no longer a simple "buying equipment," but a difficult "technology migration." JP Morgan predicts that the year-on-year growth rate of global NAND wafer output will only be 3% in 2026, meaning that supply growth will almost entirely rely on technological upgrades (layer stacking) rather than new factory expansions. With a demand growth rate of 21%, this structural limitation on the supply side will lead to a year-round state of supply shortage, supporting a 40% surge in ASP.

Who are the Biggest Winners?

Based on the above logic, JP Morgan conducted a detailed competitiveness analysis of major global memory chip manufacturers and provided a clear investment ranking.

Top Pick in Asia: Kioxia

Kioxia is JP Morgan's top pick in this round of the NAND cycle.

-

Technological Uniqueness (CBA Architecture): The report highly praises Kioxia's unique CBA (CMOS Bonded Array) architecture. Unlike its competitors, Kioxia manufactures peripheral logic circuits (CMOS) and memory arrays on two separate wafers, then connects them through hybrid bonding. This approach allows the logic circuits to use more advanced processes (such as 28nm/14nm), achieving extremely high I/O speeds, perfectly aligning with the extreme pursuit of data throughput speed in AI inference.

-

Surge in Server Proportion: The report predicts that with the mass production of BiCS 8 technology, Kioxia's revenue share from server business will soar from 20% in 2023 to 61% in 2027. This structural change in customers will bring significant profit elasticity.

-

Purity and Valuation: As a pure NAND manufacturer, Kioxia can directly benefit from the rise in NAND prices, and compared to the already significantly increased SK Hynix, its valuation remains attractive.

Long-term Champion: SK Hynix

JP Morgan maintains a "long-term optimistic" view on SK Hynix, primarily based on the success of its subsidiary Solidigm.

-

Absolute Dominance in QLC: By acquiring Intel's NAND business (now Solidigm), SK Hynix inherited the advantages of floating gate technology in QLC. Currently, Solidigm has almost no competitors in the ultra-large capacity eSSD market of 30TB and 60TB, possessing strong pricing power.

-

Dual Driving Force: SK Hynix is the only manufacturer in the market that dominates both AI training (leading in HBM market share) and AI inference (leading in QLC eSSD) Short-term Rebound: Samsung Electronics

For the storage giant Samsung, JP Morgan's logic is "short-term rebound."

-

Flexibility of the Followers: Although Samsung started slightly later than SK Hynix in the QLC and eSSD fields, its massive production capacity cannot be ignored. The report points out that Samsung is accelerating the mass production of V9 QLC technology and is expected to regain some market share by 2026.

-

Valuation Repair: Considering that Samsung's stock price has significantly lagged behind SK Hynix and Micron, and its server business proportion is expected to increase from 29% in 2023 to 66% in 2027, it has a good trading cost-performance ratio in the short term.

Differentiated Competition: Micron Technology

Micron has adopted a differentiated competition strategy. The report analyzes that Micron launched the 6500 ION series eSSD, attempting to use 232-layer TLC technology to compete in the opponent's QLC market, emphasizing "TLC performance at QLC prices." JP Morgan believes Micron will continue to benefit from strong demand in domestic data centers in the United States, maintaining an "overweight" rating.

Caption: Since January 2025, although storage stocks have generally risen, the performance of pure DRAM and pure NAND targets has begun to diverge. JP Morgan believes that pure NAND targets (such as Kioxia) will show stronger resilience in the upcoming cycle.

Risks and Opportunities Coexist

Although the major cycle is establishing an upward trend, JP Morgan also highlighted potential risks at the end of the report.

The core concern comes from weak demand for consumer electronics (smartphones, PCs). Currently, the shipment growth of smartphones and PCs remains sluggish. If NAND prices rise too quickly, leading to a significant increase in BOM (Bill of Materials) costs, it may force terminal manufacturers to "downgrade" (for example, reducing from 512GB to 256GB) or further suppress consumers' desire to upgrade.

Report data shows that the cost of NAND is expected to rise from a low of 4.3% to over 10% of the laptop ASP, posing a huge challenge to PC manufacturers' profit margins.

However, JP Morgan's final conclusion is firm: This is a "super cycle" created by the structural explosion of AI-driven demand and structural contraction on the supply side. NAND is no longer an appendage to DRAM but an indispensable "hot data" reservoir in AI infrastructure. For investors, focusing on manufacturers with a high proportion of eSSD revenue and leading technology routes will be key to seizing this market opportunity.

The above content is from [Chasing Wind Trading Platform](https://mp.weixin.qq.com/s/uua05g5qk-N2J7h91pyqxQ)

For more detailed interpretations, including real-time analysis and frontline research, please join the【 [Chasing Wind Trading Platform ▪ Annual Membership](https://wallstreetcn.com/shop/item/1000309)】

[](https://wallstreetcn.com/shop/item/1000309)