Musk "designates" space photovoltaics: 100GW in 3 years, the optimal energy solution, 5 times the efficiency crushing

Elon Musk announced at the Davos Forum that SpaceX and Tesla will build 100GW of photovoltaic capacity in the United States, believing that photovoltaics is the best energy solution for space exploration, with an efficiency five times that of Earth. He predicts that space photovoltaics will become the main line of the future new energy power industry, emphasizing its uniqueness and urgency, and believes that photovoltaics is a reliable solution for long-term power supply for spacecraft

Elon Musk's speech at the Davos Forum ignited a surge in the domestic photovoltaic industry.

From the core highlights, why is photovoltaic the best energy solution for space exploration?

What are the necessary key links in the space photovoltaic industry worth studying?

Understand the vast ocean of space photovoltaics in one article.

1. What happened? Musk designates photovoltaic

Musk made an unexpected appearance at the Davos Forum, delivering a speech lasting over 30 minutes, rich in content, particularly his judgments and views on photovoltaics that shook the market. Musk's core viewpoints on photovoltaics are as follows:

① Photovoltaics are the optimal energy solution, and SpaceX will launch solar AI satellites in the future;

② SpaceX and Tesla will build 100GW of photovoltaic capacity in the United States; in the future, a space photovoltaic base should be established to deploy data centers; the teams at SpaceX and Tesla are working to establish an annual solar manufacturing capacity of 100 gigawatts in the U.S. within about three years.

③ The efficiency of solar panels in space is five times that on Earth due to continuous sunlight and no atmospheric interference. He predicts that "the cheapest place to deploy AI will be in space," which will be realized within two to three years;

④ Power supply remains a bottleneck for AI development; China's power system is truly impressive, and China's photovoltaics are indeed remarkable;

Musk stated that SpaceX hopes to achieve complete rocket reusability through Starship this year. This breakthrough will reduce the cost of access to space by 100 times, bringing it below $100 per pound.

Musk stated that SpaceX hopes to achieve complete rocket reusability through Starship this year. This breakthrough will reduce the cost of access to space by 100 times, bringing it below $100 per pound.

From the logic of the industrial chain, the future reduction in launch costs + the core challenge of power supply demand for space computing are the fundamental logic that the market is optimistic about "space photovoltaics" as the main line of the new energy power industry for a period of time.

① Uniqueness: Photovoltaics are the only feasible and reliable power supply solution for all spacecraft for long-term operation in orbit, with no alternative technical path;

② Urgency: The "first come, first served" rule established by the International Telecommunication Union (ITU) for near-Earth orbit and spectrum resources means that the number of satellite launches and deployment speed directly relate to national space strategic advantages and commercial initiative, driving the urgent demand in the satellite market for high cost-performance, lightweight space solar systems.

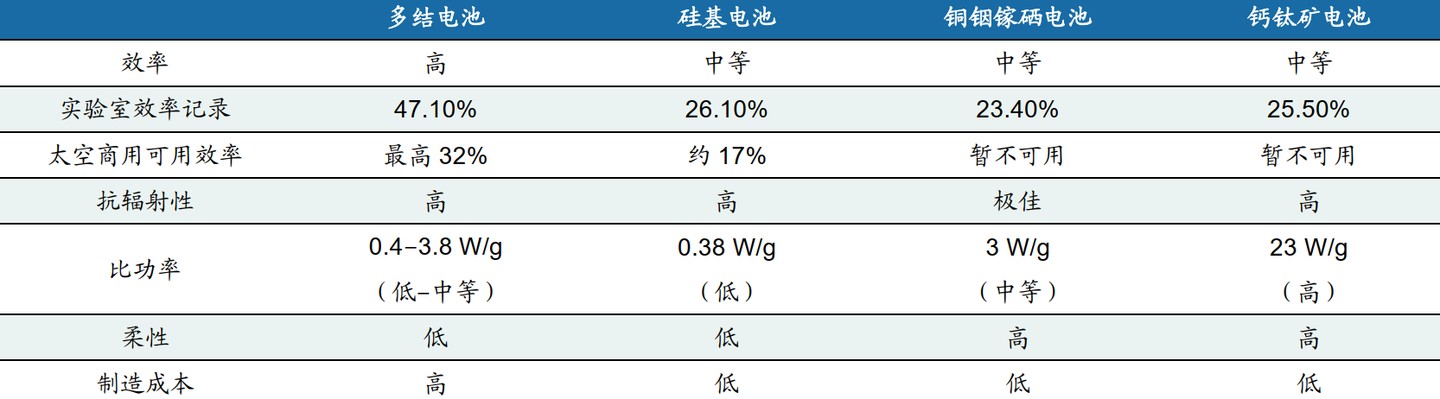

Space photovoltaics are the inevitable choice for space power supply: Solar energy is the only energy form that can achieve long-term, stable, and lightweight power supply. In extreme environments, photovoltaic technology can directly and continuously convert abundant solar energy into electricity, possessing characteristics such as "high efficiency, lightweight, low cost, flexibility, and resistance to extreme environments," meeting the deployment and design trends of large-scale, high-power satellites. The technological route of space photovoltaics will enter an iterative stage under the demand for high cost-performance, with crystalline silicon being a relatively mature and cost-effective technology in the short term, while perovskite tandem and multi-junction cells are expected to develop rapidly in the long term.  Source: Dongxing Securities

Source: Dongxing Securities

II. Why is it important? Strong industrial demand

Human exploration of the universe is officially transitioning from the "scientific research and exploration era" to the "commercial development era." As the "blood" of spacecraft, space photovoltaics are not only the only feasible energy solution for spacecraft operation in orbit but are also experiencing a leap from a marginal topic to a core focus under the multiple resonances of the explosion of commercial space, the rise of space computing power, and the networking of low Earth orbit satellites. The year 2026 will be a dual milestone for the iteration of space photovoltaic technology and the expansion of production capacity, as the industrial logic is undergoing a paradigm shift from "high cost, low output" to "high cost-performance ratio, large-scale." Its acceleration logic is built on three dimensions: economic improvement, technological paradigm reconstruction, and explosive demand scenarios.

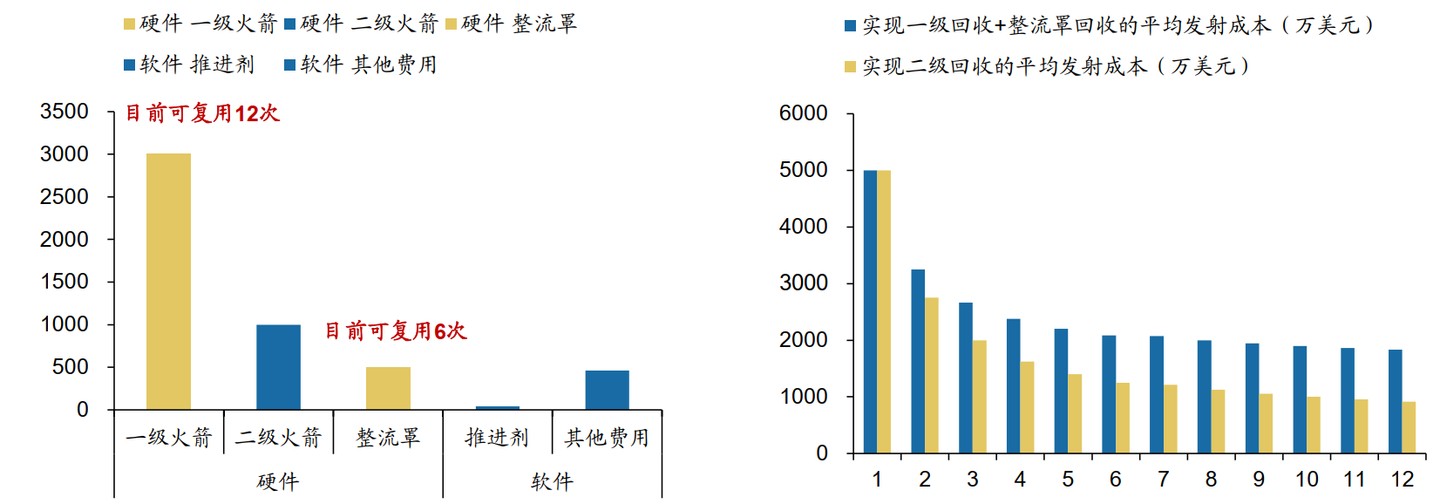

① The "cliff-like" drop in launch costs: The cornerstone of a closed commercial model

Elon Musk's prediction of a 100-fold reduction in future launch costs is not a fantasy. The maturity of SpaceX's reusable rocket technology and the mass production of domestic private rocket companies such as Blue Arrow Aerospace and Tianbing Technology have led to a reduction of about 60% in satellite launch prices (cost per kilogram) compared to three years ago. With further scaling and technological advancements, the future reduction in launch costs will break the economic bottleneck of space photovoltaic applications. Low-cost capacity allows satellites to carry larger, more redundant photovoltaic systems, thereby supporting more complex space operations.

② From "gallium arsenide" to "high cost-performance ratio": Technological paradigm reconstruction

The technological route of space photovoltaics is undergoing a revolution of "cost reduction and efficiency enhancement."

For a long time, high-orbit satellites predominantly used triple-junction gallium arsenide (GaAs) batteries, which, while having an efficiency exceeding 30%, are extremely costly and complex to manufacture, making it difficult to meet the scaling demands of a large satellite network.

Against the backdrop of the explosion of low Earth orbit (LEO) satellites, the market is transitioning to "high-efficiency crystalline silicon/perovskite tandem" or "ultra-thin flexible crystalline silicon." Perovskite multi-junction batteries, due to their excellent radiation resistance and lightweight potential, are entering a critical phase of on-orbit testing. The balance between this technological cost reduction (over 90% cost reduction) and efficiency improvement is the intrinsic driving force for the acceleration of industrialization in 2026.

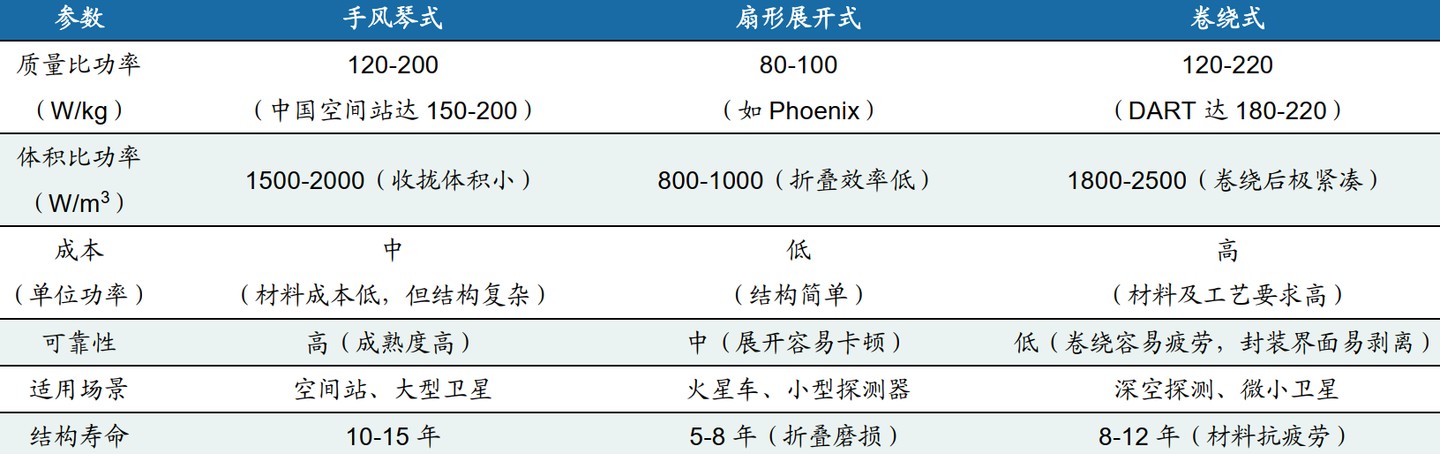

③ The comprehensive replacement of "flexible wings" for "rigid panels": A leap in specific power

The successful application of flexible solar wings in the Chinese space station has set a benchmark for the industry. By 2026, the new generation of commercial satellites will fully transition to flexible solar wings. The specific power (W/kg) of flexible solar wings has increased more than threefold compared to traditional rigid solar wings. This means that under the same payload limitations, satellites can obtain stronger energy support. For low Earth orbit communication and navigation satellites that pursue extreme lightweight and high power output, this form of transformation is an irreversible industrial accelerator.  In the past, satellite manufacturing had a strong "workshop" characteristic, with each satellite requiring customization. However, as China's satellite internet and G60 Starlink constellations enter a phase of intensive deployment, satellite manufacturing has entered the "assembly line" era. The production of space photovoltaic components has begun to introduce automated production lines similar to those for terrestrial components. The cost dilution brought about by economies of scale is expected to lead to an explosion in the ROE (Return on Equity) of related companies by 2026.

In the past, satellite manufacturing had a strong "workshop" characteristic, with each satellite requiring customization. However, as China's satellite internet and G60 Starlink constellations enter a phase of intensive deployment, satellite manufacturing has entered the "assembly line" era. The production of space photovoltaic components has begun to introduce automated production lines similar to those for terrestrial components. The cost dilution brought about by economies of scale is expected to lead to an explosion in the ROE (Return on Equity) of related companies by 2026.

III. What to Focus on Next? Understanding the Industry Chain Links

The space photovoltaic industry chain is long and has a very high technical threshold. Readers should pay attention to key links that possess "high entry barriers, high technological iteration space, and strong domestic substitution capabilities."

① Upstream: Core Equipment Suppliers

As the "water sellers" of the technology route, equipment manufacturers are the first to benefit with certainty. Regardless of whether HJT, perovskite, or tandem technology prevails, and regardless of who the battery manufacturers are, high-end photovoltaic equipment is an indispensable cornerstone. In the early stages of industrial technology exploration and capacity construction, equipment manufacturers will be the first to receive orders and revenue verification.

Leading HJT and perovskite/tandem equipment manufacturers: Maiwei Co., Ltd.: As the leader in HJT complete line equipment, it has actively extended into perovskite/tandem battery equipment, making it a core supplier for industrial technology upgrades. Jiejia Weichuang: Fully layout of multiple technology routes including TOPCon, HJT, and perovskite, its PVD and RPD equipment have won bids for leading perovskite projects, and its self-built pilot lines have gained industry recognition with deep technical reserves.

② Midstream: High-Efficiency Battery Cells and Flexible Solar Wing Components (Core Value Area)

-

Multi-junction battery cell manufacturing: Focus on enterprises with mass production capabilities for three-junction/four-junction gallium arsenide, particularly those with nuclear and aerospace backgrounds. For example, Junda Co., Ltd. has directly entered the research and development of perovskite space photovoltaics through investment and partnerships with the Chinese Academy of Sciences background company Xingyuxineng. Enterprises that can first pass aerospace-grade certification and obtain prototype orders or cooperation projects will establish extremely high entry barriers and first-mover advantages.

-

Silicon wafer and component equipment manufacturers: They will benefit from the growing demand for high-quality, ultra-thin silicon wafers in space photovoltaics.

-

Flexible solar wing structural components: Involves precision deployment mechanisms and ultra-light carbon fiber composite material frameworks. The ability to achieve "one roll, one unfold" with high reliability is the essence of the entire satellite energy system.

-

High-efficiency power management systems (PCDU): The current generated by space photovoltaics is extremely unstable and involves complex charging and discharging conversions. Designers of high-efficiency, long-life space-grade power management chips are the highest-margin and most invisible "shovel sellers" in the industry chain.

③ Downstream: Satellite Assembly and Space Energy Operators

- Satellite assembly (integrators): National teams and private unicorns with satellite design and mass production capabilities. They determine which photovoltaic solutions to adopt and are the source of orders in the industry chain.

Space photovoltaics are the intersection of the "energy revolution" and the "space revolution." By 2026, as low-orbit constellation construction enters a sprint phase, space photovoltaics will completely bid farewell to the "laboratory stage" and are expected to welcome the landing of orders worth billions. This is not only a technological game of the industry but also a deep layout concerning future space sovereignty

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at your own risk.