As the cold wave hits, US natural gas prices soar by 50% in two days, with this week's increase set to break a 34-year record

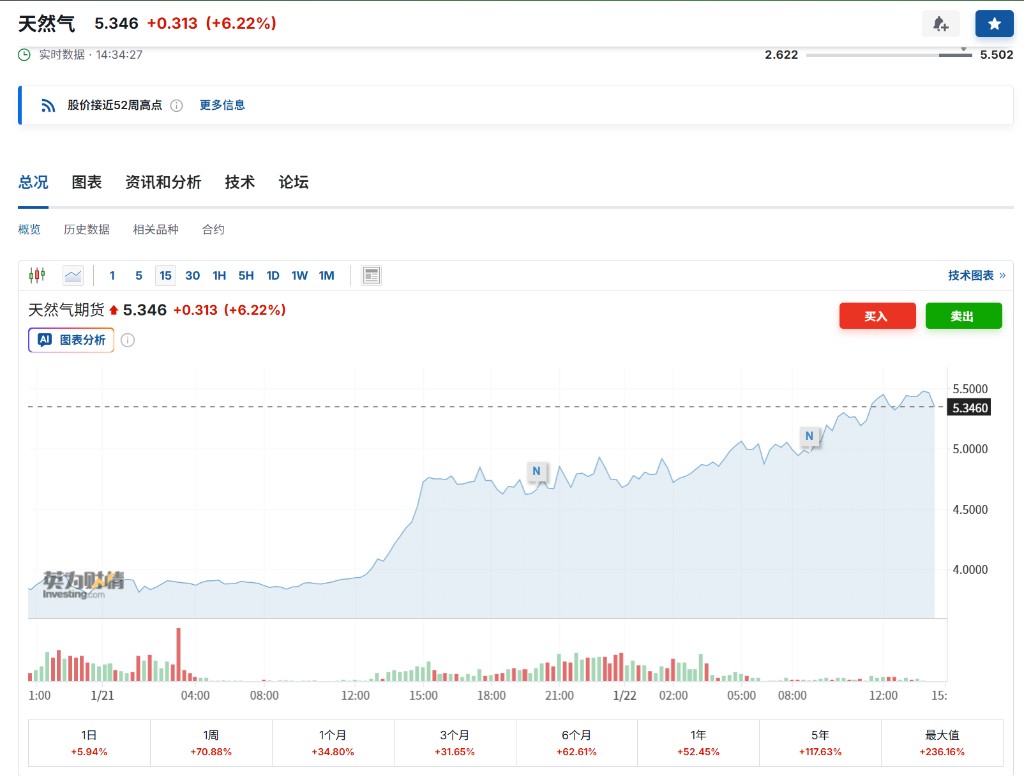

Driven by the intensifying supply-demand tension due to severe cold weather, U.S. natural gas futures prices surged by 13% at one point, reaching $5.502 per million British thermal units, the highest level since 2022. This price spike is attributed to the extreme cold weather potentially freezing pipelines, restricting supply, while simultaneously increasing heating demand

Driven by expectations of cold weather boosting supply-demand tension, U.S. natural gas futures prices have surged to their highest levels since 2022. As a key fuel for heating and power generation, natural gas faces potential supply disruption risks amid soaring demand, leading to significant market volatility.

According to the latest outlook from the National Oceanic and Atmospheric Administration (NOAA), recent weather forecasts indicate that temperatures in the U.S. are expected to drop significantly. It is anticipated that two-thirds of the country will likely experience temperatures below normal levels.

Affected by the cold wave, the near-month natural gas contract surged by 13% on Thursday, reaching $5.502 per million British thermal units. Prior to this, the contract had already risen by over 50% in the past two trading days. This rapid increase is expected to result in the largest single-week gain for natural gas prices in 34 years.

Market concerns are growing that extreme low temperatures could lead to "freezing" in the southern U.S.—where moisture in pipelines could freeze and block flow—thereby disrupting natural gas production and limiting supply, resulting in involuntary declines in output at critical times. Meanwhile, as cold weather intensifies, natural gas consumption is expected to rise significantly, accelerating inventory depletion.

This price surge not only affects the domestic U.S. market but also impacts the global energy landscape. Given that European and Asian markets heavily rely on U.S. liquefied natural gas (LNG) exports, any production disruptions in the U.S. could trigger a chain reaction in these regions.

Currently, both Europe and Asia are also experiencing cold waves. Driven by demand stimulated by low temperatures, European natural gas futures prices have surged over 18% in the past week.

At the same time, as a major energy-importing country, Japan's electricity prices reached a three-month high on Wednesday. This indicates that during the peak winter demand period, the global energy market is facing widespread supply tightness and upward price pressure.